ESG and responsible investing

Our values are at the core of every choice we make. Making decisions with greater purpose helps the world become a better place.

More and more people are turning to responsible investing— an umbrella term encompassing the approaches used to deliberately incorporate environmental, social and governance (ESG) considerations into your investment portfolio.

Download the latest newsletter

Download the latest newsletter

Insights into responsible investing

A growing trend

As companies continue to innovate and strive for positive impacts, responsible investing opportunities continue to increase.

Like many of our clients, RBC Wealth Management focuses on community involvement, diversity and inclusion and environmental responsibility to support both current and future generations. To help you create a positive social and environmental impact, we offer a broad range of solutions designed to align with your values and financial goals.

Responsible investing

We can help you invest with purpose and apply responsible investing approaches to your wealth plan, including ESG integration, ESG screening & exclusion, Thematic ESG investing, and Impact investing.

These approaches are not mutually exclusive; multiple approaches can be applied simultaneously within the investment process. We believe there are four main applications of this data:

- Materiality

- No Constraints

- Personal Values

- Positive/Negative Screens

- A particular Environmental/ Social Theme or Issue

- Generate a Measurable Positive Impact

ESG integration

Systematically incorporating material ESG factors into investment decision making to identify potential risks and opportunities and help improve long-term, risk-adjusted returns.

ESG integration happens at the same time as traditional financial analysis. ESG integration is about understanding the material factors that are important to a company as it helps create a clearer picture in order to better understand the potential impacts to long term value. A few examples of ESG factors include:

Environmental concerns — Climate change, natural resources conservation, pollution and waste management, and water scarcity

Social issues — Data privacy and security, community and government relations, workplace health and safety, human rights and diversity

Governance topics — Accounting practices, board accountability and structure, disclosure practices, executive compensation, corporate ethics, regulatory compliance and transparency

ESG screening & exclusion

Applying positive or negative screens to include or exclude assets from the investment universe.

This is often referred to as investing in line with values or values alignment. ESG exclusions and screening can include positive/negative screening, socially responsible investing (SRI), inclusions/exclusions, ethical, faith, and norms-based investing, best-in-class, and seeking leaders’ strategies.

Negative screening

Positive screening

Thematic ESG investing

Investing in assets involved in a particular ESG-related theme or seeking to address a specific social or environmental issue. With thematic investing, there is an intentional allocation of capital to a specific investment theme (e.g. climate change, gender equity, sustainability-related categories).

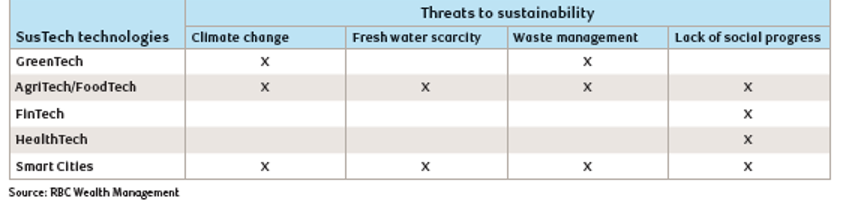

There is significant investment into technologies that alleviate the threats to sustainability. At RBC Wealth Management, we call the technologies that help tackle the threats to sustainability “SusTech”—Sustainability through Technology. These include:

Impact investing

Investing in assets that intend to generate a measurable positive social or environmental impact. Impact is the third dimension of performance, alongside traditional financial risk and return. Impact investors want a return on their investment, but may also be willing to take a capital loss as long as there are tangible results for the investment. In that way, it is essential to measure the impact of this investment.

A third dimension of performance

Invest with a greater purpose

RBC Wealth Management can help you integrate responsible investing into your portfolio. Contact us today to learn more.

Required disclosures

Research resources

The strategies, advice and technical content in this publication are provided for the general information only and benefit of our clients. This publication is not intended to provide specific financial, investment, tax, legal, accounting or other advice for you, and should not be relied upon in that regard. Readers should consult their own professional advisor when planning to implement a strategy to ensure that individual circumstances have been considered properly and it is based on the latest available information.

Like any type of investing, ESG and responsible investing involves risks, including possible loss of principal. Past performance is no guarantee of future results. This material has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. All opinions and estimates constitute the author’s judgment as of the date of this publication, are subject to change without notice and are provided in good faith but without legal responsibility. It is not possible to invest directly in an index. Nothing in this communication constitutes legal, accounting or tax advice or individually tailored investment advice. RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your independent tax or legal advisor. The information contained herein has been derived from sources believed to be reliable, but no representation or warranty, express or implied, is made by RBC Wealth Management, its affiliates or any other person as to its accuracy, completeness or correctness.

â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada. 2022. All rights reserved.