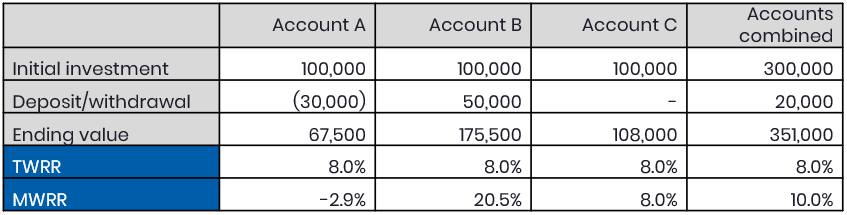

There are several ways to calculate an investment rate of return. We leverage the Time-Weighted Rate of Return (TWRR) and the Money-Weighted Rate of Return (MWRR) method for performance reporting in our quarterly client reporting. The major distinction between the two is how they treat amounts added to or taken out of the portfolio. TWRR excludes them from the rate of return calculation whereas MWRR includes them. For example: An investor has three separate investment accounts (A, B and C). At the beginning of the year, the investor invests $100,000 into each account and makes the exact same investment in each account. In the first 6 months the underlying investment loses 20% and in the final 6 months of the year the underlying investment rises by 35%. The investor decides to withdraw $30,000 from the first account and deposit $50,000 into the second account immediately after the first 6 months.

The TWRR is the same regardless of the deposits or withdrawals because it measures the underlying investment’s return. The MWRR measures the investor’s performance. and is heavily influenced by the dollar amount and timing of the deposits or withdrawals. Look at Account B. It had a significant deposit right before the investment rebounded, so it had more money benefiting from the rebound. The opposite occurred in Account A. Finally, with no deposits or withdrawals the MWRR for Account C was identical to the TWRR. When using MWRR, it is more difficult to compare the performance of various accounts.