By their very nature, financial markets move fast and often. To achieve long-term financial success, it is not important to be right every time…It is important to be right over time.

With this prudent investment philosophy, Portfolio Manager Brian Davenport has helped investors, families and foundations build wealth with real results while managing market risk for over 25 years.

The Investment Philosophy

Tactical Asset Management

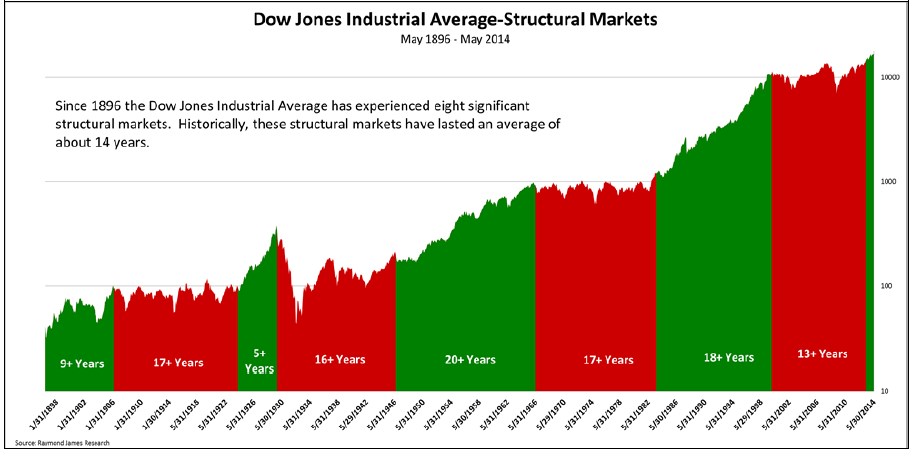

Long-term trends have shown that equity markets are cyclical: lengthy periods of upward momentum are followed by periods of stagnation or generally lower market values. Since 1896, the Dow Jones Industrial Average has experienced eight such alternating cycles, each averaging 14 years in duration.

Investors who want to come out ahead in these markets need a strategy that is effective during both spectrums of the cycle. One methodology that has proven effective in both rising ("bull") and falling ("bear") markets since the late 1800s is the Point & Figure methodology, which uses the fundamental supply and demand relationship as the basis to buying and selling investments.

At the core of the Point & Figure methodology is a logical, organized means for recording the supply and demand relationship of an investment vehicle. By charting price action in an organized manner, we develop the ability to evaluate changes in the market and therefore have taken the first step towards a response to the bull or bear market period.

Broadening Your Investment Scope

Asset Class Investing

While stocks may be synonymous to investing, investing by asset classes gives you a broader investment spectrum to find quality and value for your portfolio. Traditionally only available to large institutional investors, asset class investing has become more widely available to the individual private investor over the last decade. With asset class investing, you now have greater flexibility and choice to invest in Canadian stocks, U.S. stocks, international stocks, commodities, foreign currency, fixed income or cash.

As illustrated by the graphic, asset classes tend to rotate in and out of the top performance spot. Over the last 10 years, no asset class has held the top spot for performance consistently every year so it is important to keep an open mind and be willing to shift the focus of your portfolio based on a disciplined and proven asset selection approach.

Putting Strategy Into Practice

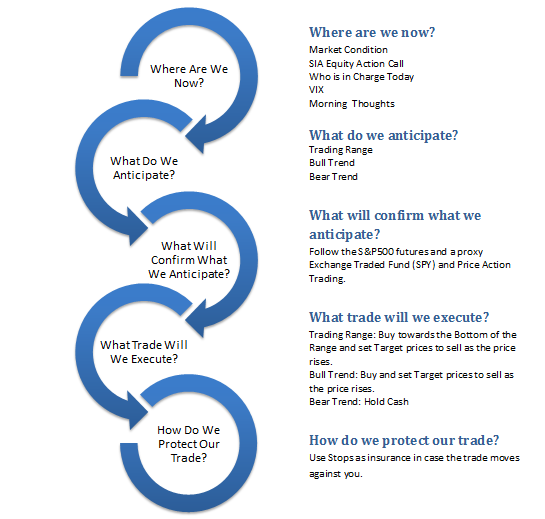

We use that information to answer the following 5 Daily Questions:

As a result, our clients have comfort that they are well invested for the future.

We recognize our clients are in pursuit of absolute returns. Our process uses several techniques that address capital preservation. This does not mean that your capital won't decrease in value. It does mean that each of our clients can calibrate their tolerance for risk in relation to their need/want for return.

Our processes evolve as markets evolve, and we use technology to manage it.

In Summary

This proven selection approach combines the best of both worlds: a thorough and complex selection process and a simple execution strategy. Through this disciplined approach, you can expect to have a portfolio comprised of quality companies that have met our in-depth research and evaluation requirements and fit our economic outlook.

For more information on this process, and to determine if it is right for your portfolio, please contact us today.