Planning and saving for your future might feel overwhelming, especially when we see headlines about needing $1.7 million to retire comfortably, in Canada, at age 65. There are a lot of factors that can cause this number to be higher or lower, but for Gen Z and Millennials $1.7 million is thought to be what the average household will need to retire. That number may seem intimidating, but with the right plan, tax-efficient growth, and consistent investing - financial freedom is achievable.

Our four-step plan breaks down how to save for your retirement, how much you might need, and smart strategies to grow your wealth over time.

Step 1: Invest – Don’t Just Save

While saving is important… investing those savings is what actually builds your long-term wealth. With today’s interest rates, a traditional savings account just won’t keep pace with inflation – meaning your purchasing power will decline over time. Instead, focus on investing in high quality investments that are designed to produce consistent long-term growth, and income.

Step 2: Consistency – Start Investing Early and Often

When it comes to retirement savings, consistency matters more than perfection. The longer you wait to save for retirement, the harder it gets.

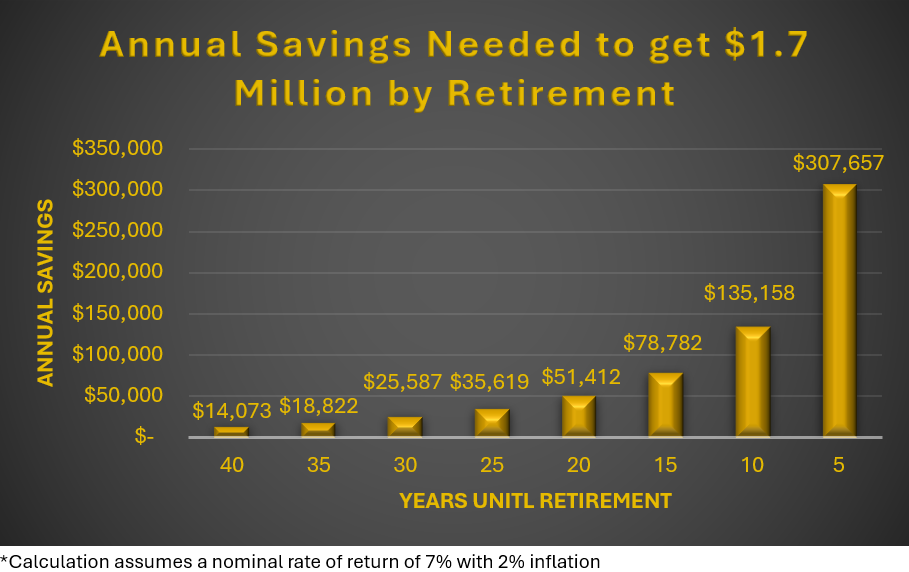

It’s not about ‘timing’ the market – it’s about ‘time in’ the market. The earlier you begin, the more years your investments have to compound. Missing even a few early years can make a massive difference. In the chart below, we calculated how much you would need to save annually, depending on the number of years you have, until retirement, to reach a $1.7 million portfolio value.

This chart shows that someone wishing to retire in 40 years, would need to invest $14,073 every year (growing it at an average return of 7% annually), to reach a target of $1.7 million. With every year you wait to invest, your retirement goals get more ambitious to save for.

Step 3: Use Tax-Advantaged Accounts

Canadians have two major saving tools designed specifically for retirement: the Registered Retirement Savings Program (RRSP) and the Tax-Free Savings Account (TFSA). Using both effectively can help you keep more of your money and grow your investments faster. RRSP contributions are tax-deductible, reducing your income tax, and invested funds within your RRSP grow tax-free. TFSA investments grow tax-free and you can later withdraw your funds completely tax-free.

Step 4: Adjust Your Plan With Time

Retirement planning isn’t “set it and forget it.” As life changes, your financial plan should change as well. It is important to regularly review your portfolio to ensure it continues to meet your financial goals. Consider your investment mix, or asset allocation, and shifting it to being more conservative as you near retirement. Track your annual savings to ensure your goals continue to be within reach. Keeping on top of your financial plan will help make sure there are no big surprises down the road.

The Bottom Line

Saving for retirement in Canada doesn’t have to be complicated or intimidating. The sooner you start, the more control you’ll have over your financial future and the easier it will be to enjoy the retirement you have worked hard for. No matter what your goals are, if you follow the plan, financial freedom and retirement is often more attainable than you think.

P.S. – One of the top ‘wealth killers’ is a new car payment. The average new car payment is $1,022, or $12,264 annually. Buying a used car could be the difference between being a millionaire or not, if you invest it right.

Trent Nicolay, CFP

Associate Wealth Advisor

Weatherill Wealth

RBC Dominion Securities Inc.

Phone (403) 341-8872

300, 4900 50 St. I Red Deer, AB I T4N 1X7