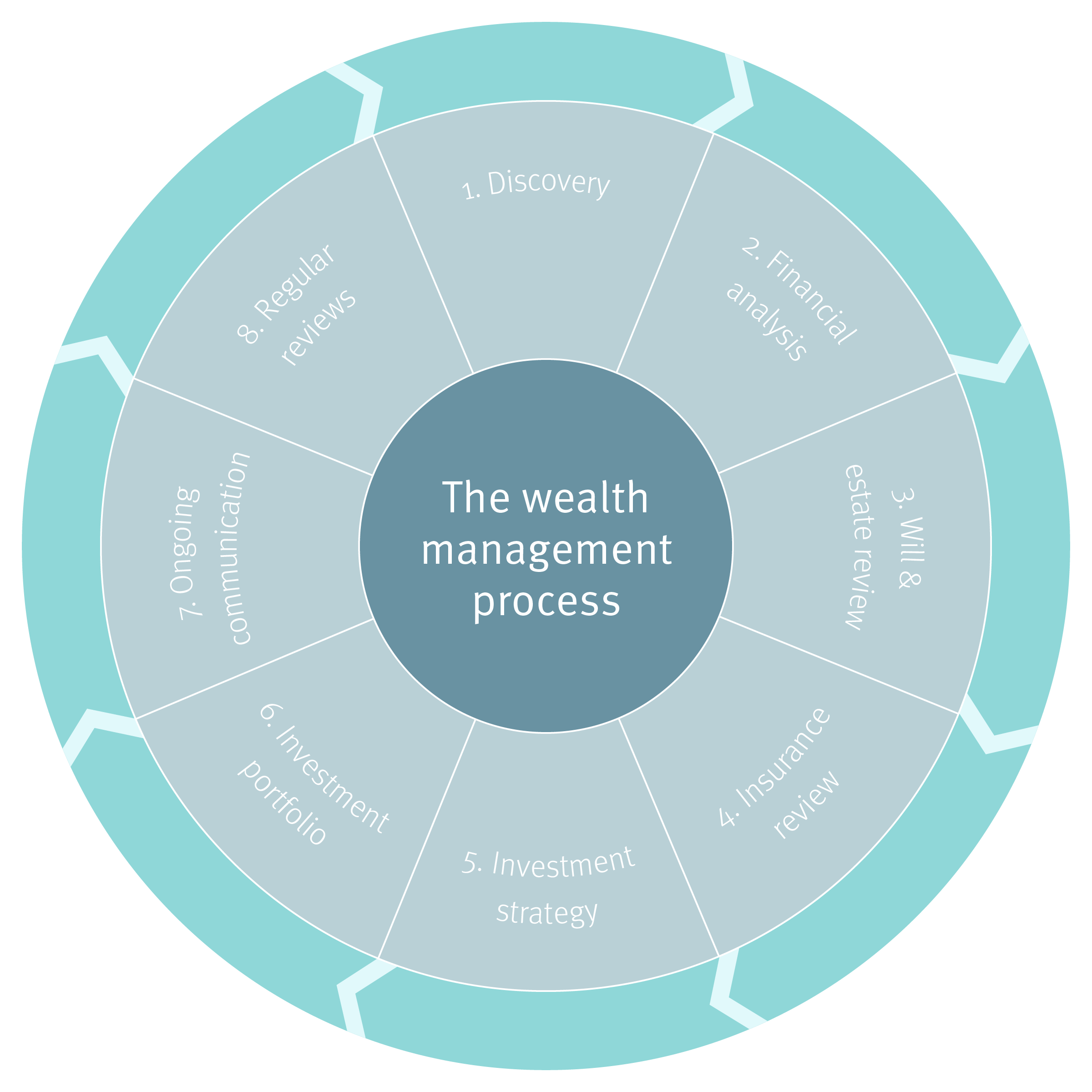

Discover Our Eight-Step Process

1. Discovery

First, we ask questions, listen to you and gather the necessary information to complete a detailed analysis of your financial situation. Through this analysis, we identify specific concerns important to you such as estate issues, U.S. residency issues, tax planning opportunities and so forth. With this complete, we are in a position to understand your unique needs and help you achieve your goals.

2. Financial Analysis

With our expert financial planners ready at hand, we will prepare a customized analysis of your financial situation that incorporates your financial goals, risk tolerance and long-range plans.

3. Will & Estate Review

Alongside our Will & Estate Consultants, we can help you address your various estate planning concerns and recommend the steps you need to take to achieve your goals.

4. Insurance Review

In company with our professional Estate Planning Specialists, we can help you protect everything you have worked to build through innovative insurance-based strategies.

5. Investment Policy Statement (IPS)

We formalize your goals by preparing an Investment Policy Statement (IPS) together. The IPS is a written expression of your investment goals, expectations and specific concerns. The IPS gives you the confidence of knowing that we know exactly what you expect from us in terms of how your money is to be managed. This is your life savings after all, so this should be a written document. It is signed by all parties and becomes the basis for the managed portfolio process.

6. Investment Portfolio

Your portfolios are constructed using our unique and time-tested portfolio management process. Your combination of high quality stocks and fixed income investments is professionally constructed to reduce risk and maximize after-tax cash flow in retirement, according to your retirement income plan. We will monitor your portfolio holdings to ensure they remain optimal.

7. Ongoing Communication

Our approach is open and flexible. As our clients, you are encouraged to contact us any time and we contact you proactively when needed. We will provide you with a service plan that meets your needs. There is no formula here - you let us know what works for you.

8. Regular Reviews

We review portfolios together formally whenever required - in person, over the phone or by mail, based on your individual needs and preferences. We also send you a quarterly consolidated report that shows net performance on a combined basis for the recent quarter, year to date, and since inception. We also provide annual and compound returns year-by-year.