The Role of Artificial Intelligence

How will it change our lives?

Market Review: 2024 Q1

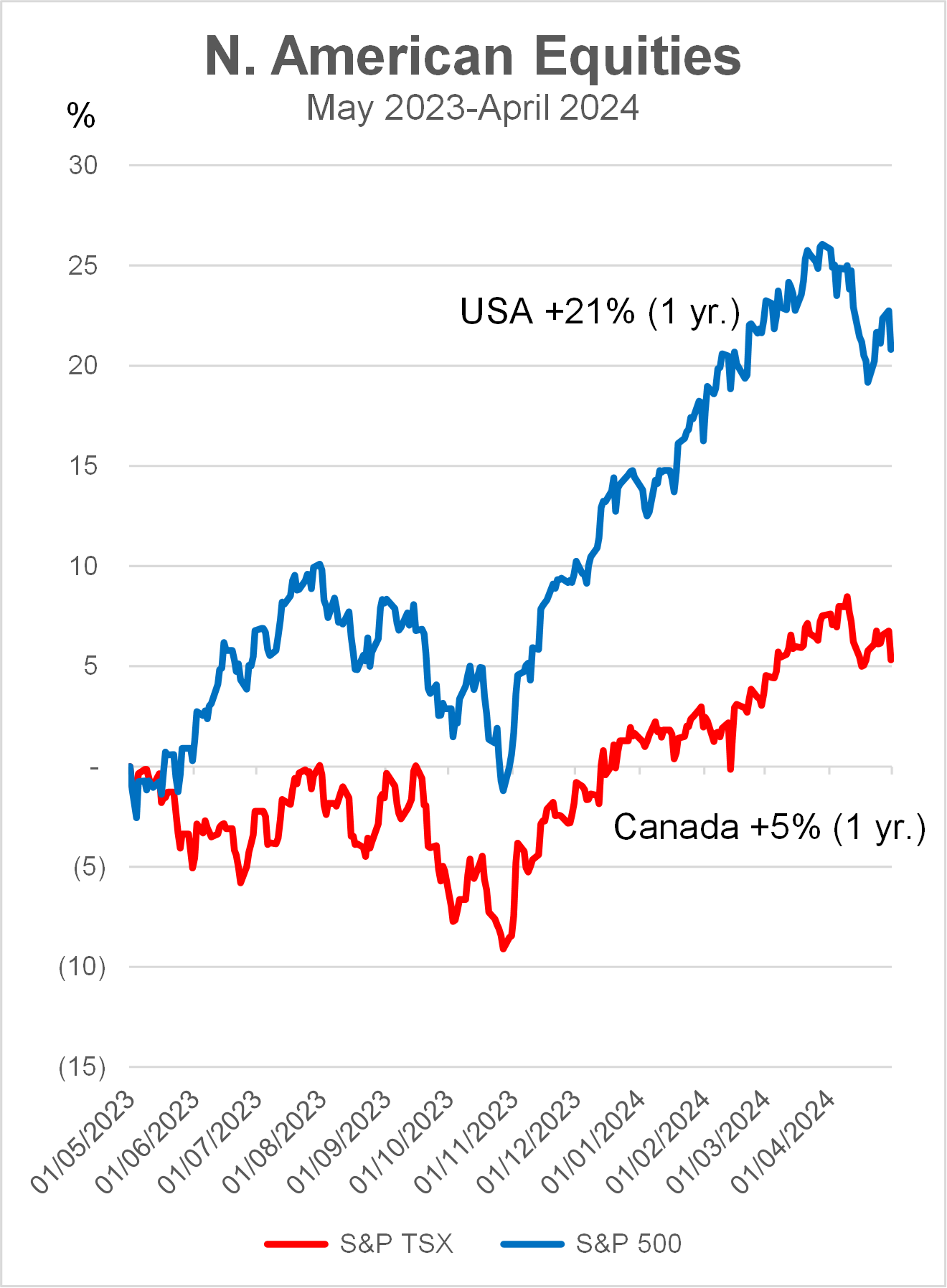

The S&P/TSX Composite Index (TSX) traded mostly in positive territory in early 2024, and was up 3.5% by April 30th (see red line in chart below) The S&P 500 Index (S&P 500) rallied in Q1, setting a record high before settling up 5.3% at the end of April – see the blue line in the chart below.

Source: FactSet April 30, 2024

If we extend the chart back one year to May 2023, you can see that the U.S. market (in blue) clearly outperformed the Canadian equities market – the S&P 500 was up 21% compared with 5% for the TSX. This can be explained by the concentration of mega-cap technology companies in the S&P 500 Index having an outsized influence on the U.S. benchmark. See concentration of returns in Smart Investor 2024 Q1.

Interest rates expectations

The year began with the market expecting the Federal Reserve to cut rates aggressively. The futures market was pricing in up to six rate cuts in 2024. However, with each meeting of the Federal Open Market Committee (FOMC) it became clear that rate cuts would depend on how fast inflation comes down and stays down for a period. As we move into the second quarter, the market is less sanguine, now believing that there may be only one or two cuts later in the year.

The expectations of lower rates has been one of the main factors driving the stock market. On the other hand, the bond market has been giving investors a return based mainly on the coupon. Once rates start to fall, bond investors will reap the benefit of higher bond prices (bond price and yield move in opposite directions). As I have been advising my clients, as long-term investors, we should not try to predict when the rate cuts will come, but simply need to understand the direction of rate movement and position the portfolio accordingly.

Artificial Intelligence

On November 30, 2022 Open AI, a research organization in artificial intelligence (AI) released its latest AI-based chatbot –ChatGPT– that uses conversational language as interface. Rather than type in a series of keywords in a search engine, users can ask questions in everyday language, and it will come back with answers in complete sentences, paragraphs (or even longer responses) rather than just pages of links on the web.

If you recall, equities, especially in the technology sector languished for most of 2022. However, after the release of ChatGPT, technology stocks started to reverse their fortune and headed upwards. Much of this movement was based on ChatGPT.

A quick history

AI has been around for years. Apple’s virtual assistant Siri has for years been able to answer user questions such as “what is the weather in New York tomorrow?” Google and Amazon have similar devices. ChatGPT represents the start of a new revolution because of its ability to process a huge amount of information, then generate a coherent answer (though not always correct) in complete sentences. It is able to “learn” from every byte of new data it is fed. Imagine if you can read every book and research paper ever published and be able to recall and apply the information perfectly.

What this means

If we consider the business world, there are three main groups of companies that will play a part and benefit from this development.

Foundation – these companies make the equipment and components that enable AI models to operate. Nvidia is regarded as the most advanced designer of graphics processing units (GPUs) that can process vast amounts of data. Then we have companies such as Amazon and Microsoft that provide cloud computing and storage of an ever- growing mountain of data.

Producers – the likes of Google and Microsoft have invested heavily in AI. Microsoft is a major investor in Open AI which developed ChatGPT, and the company is integrating AI in its search engine Bing. The aim of these search engine companies is to provide better search experience and sell more advertising. Interestingly Open AI is a not-for-profit organization but ChatGPT has a premium version (by subscription) that offers richer features, which is their way to monetize this service.

Applicators – these represent all the rest. Tesla is using AI to harness the data gathered from millions of users and their driving history to “teach” its self-driving software. In healthcare, AI can be used in different areas including patient diagnosis, development of a new drug or robotic surgery. In financial services AI can enhance productivity or efficacy in fraud detection, customer service or portfolio management, just to name a few functions.

The future for humans

“Will AI replace humans?” What better way to find out than to ask ChatGPT, to which it answered, with a degree of humility, “Rather than replacing humans entirely, AI is more likely to augment human capabilities, free up time for more meaningful and high-value activities.” Phew! Just like robots replaces some jobs that are repetitive, tiresome and dangerous, AI will likely displace some positions that don’t necessarily require higher order thinking, such as translation. Witness the ubiquity of Google Translate, imperfect though it is for now. Once auto manufacturers develop a safe system for self-driving, it could free up hours for many millions of commuters each day, and make roads safer. AI has the potential to transform commerce and the way we live, but I personally have faith in the ingenuity of the human race to adapt to a new reality.

Some implications

AI presents a new factor to consider when evaluating investment oppor-tunities. How will AI benefit or negatively impact its business? Will it help cut cost or boost revenues? How can it spur innovation and drive new opportunities? The commercialization of AI is still in its infancy. We need to look for companies that have the potential to harness AI to accelerate its growth or profitability. In my work I hope there will be AI driven tools to help me do a better job for clients in portfolio management or retirement planning. The day my clients prefer to interact with an AI driven robotic advisor than to deal with me, will be when it’s time to call it a day. Hopefully that will be some years off.

Shiuman’s Corner

Spring Break in Japan

Photo: Sakura season in Shikoku

This spring a few friends combined our shared passion of cycling and the spirit of adventure in a cycling tour of Shikoku, fourth largest of thousands of islands that make up Japan. Shikoku is roughly twice the size of Greater Toronto Area, but as an island that has experienced much volcanic activity it is mountainous. When travelling to Japan, most visitors think of cities such as Tokyo, Osaka or Kyoto, but Shikoku was a hidden gem. It’s somewhat off the beaten track so we didn’t come across many tourists, and enjoyed riding on many quiet backroads. Climbing hills was hard work, but we took some scenic routes including through bamboo forests, and were always rewarded by breath taking views at the top. A real bonus was to see cherry blossoms (Sakura) in bloom, thanks to it being delayed. We could not have picked a better time, even for the favourable exchange rate. Each night for one week we stayed at a different traditional inn or hotel. Some of them were devoid of furniture and clutter; the bed was a futon on the tatami mat. There were natural hot springs “onsen” to soothe aching muscles at the end of each day, and a traditional multi-course meal (lots of fish and pickled vegetables) to nourish the body. After a week my body began to feel fatigue set in, but my spirit was revived. It was the perfect spring break.