Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Friday March 8, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,738 | 0.9% | 3.7% |

| U.S. | S&P 500 | 5,124 | -0.3% | 7.4% |

| U.S. | NASDAQ | 16,085 | -1.2% | 7.2% |

| Europe/Asia | MSCI EAFE | 2,358 | 2.3% | 5.4% |

Source: FactSet

-

TSX finished lower in Friday afternoon trading, off worst levels. Most sectors lower. Canadian equites rose 0.9% on a weekly basis.

-

US equities were mostly lower in Friday trading as the S&P 500 and Nasdaq both ended a bit off worst levels. Stocks were weaker with some focus on stretched positioning/sentiment, as well as potential for further hawkish repricing of Fed pivot expectations, lagged effects of Fed tightening, dampened pricing power and geopolitics. Friday’s pullback came despite employment data (and revisions) largely supportive of firmer growth backdrop, labor market normalization and disinflation narrative.

-

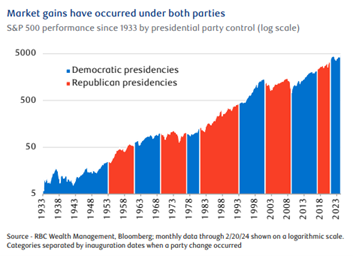

This month’s Global Insight published by RBC Wealth Management covers four key things to know about U.S. elections – “the market has performed well under various combinations of party control – including both controversial and plain vanilla presidencies.” To view full article, click here.

Economy

Canada

-

The Bank of Canada (BoC) held the overnight rate unchanged for a fifth consecutive meeting, extending a pause that started after the last hike in July last year. BoC’s key messaging remains that we’re on the right path to target inflation, but just not there yet. RBC Economics expects the BoC to start gradually lowering the policy rate by mid-year, after allowing for clearer signs of easing in core inflation readings to come through.

-

Employment rose by another 41k in February but that was, again, not enough to keep up with rising population (+83k) growth so the unemployment rate also edged higher. The unemployment rate ticked up to 5.8% after edging down to 5.7% (the first decline in a year) in January and is up 0.7 ppts from a year ago.

U.S.

-

In Congressional testimony this week, Fed Chair Jerome Powell returned to the same themes policymakers have been emphasizing for months. He acknowledged progress in bringing inflation down, but highlighted strong labor markets and a robust economy as reasons to delay rate cuts until there is greater certainty the Fed will achieve its longer-term goal of 2% inflation.

-

Payroll employment rose 275k in February, building on downwardly revised but still large gains in the prior months to suggest persistently robust hiring activity in the U.S. Unemployment from the separately released household survey ticked higher to 3.9% from 3.7% in January, with the increase entirely accounted for by rising youth unemployment.

Further Afield

-

As widely expected, the European Central Bank kept the deposit rate unchanged at 4% at its March meeting. Even though it kept some optionality, stressing data dependency and a focus on incoming wage data, markets are now pricing in an 80% probability of a June cut.

-

The National People’s Congress (NPC), China’s highest legislative body, commenced its annual session on Tuesday. The seven-day event is pivotal for setting China’s economic growth target and policy direction for the year ahead. The NPC set a GDP growth target of “around 5%” in 2024, maintaining the same target as last year and aligning with market expectations.

Notes About Companies in Model Portfolio

-

Costco Wholesale Corporation (COST) Thursday announced its operating results for the second quarter (twelve weeks) and the first 24 weeks of fiscal 2024, ended February 18, 2024. Net sales for the quarter increased 5.7 percent, to $57.33 billion, from $54.24 billion last year. Net income for the quarter was $1,743 million, $3.92 per diluted share, compared to $1,466 million, $3.30 per diluted share, last year.

-

UnitedHealth Group (UNH) provided update on cyberattack; gives timeline to restore Change Healthcare systems. The company continues to make substantial progress in mitigating the impact to consumers and care providers of the unprecedented cyberattack on the U.S. health system and the Change Healthcare claims and payment infrastructure. Based on its ongoing investigation, there is no indication that any other UnitedHealth Group systems have been affected by this attack.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman