Lower Interest Rates are Here

What This Means for Investors

Market Review: 2024 Q3

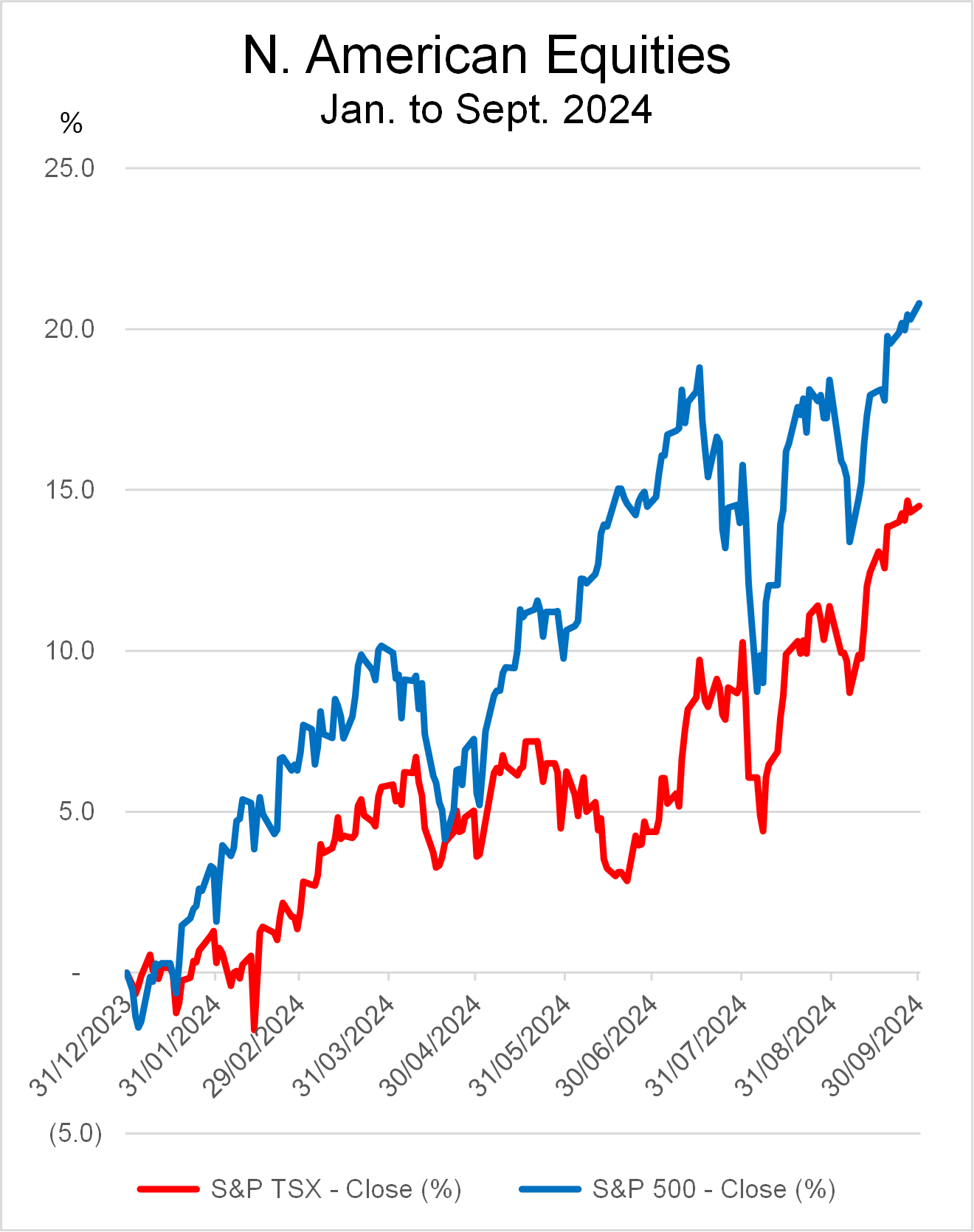

The U.S. stock market as measured by the S&P 500 Index finished up 20.3% for the first nine months of the year. After a brief wobble in July and August it regained its upward trajectory and set new highs. Similarly, the S&P/TSX Composite Index (TSX) for Canada was up 14.3% during the same period, also setting new highs.

Source: FactSet Sept. 30, 2024

The Canadian stock market’s performance was led by the resource sectors. Rate cuts have also helped interest-sensitive sectors such as Real Estate.

Change in leadership

In the third quarter of 2024 there appeared to be a change in leadership in the U.S. stock market. The group of mega technology stocks collectively known as the Magnificent Seven that had led the advance in the previous quarters started to lose steam. In Q3 there has been a gradual shift to more value-oriented such as Industrials and Utilities.

Rates Heading Lower

The role of the Bank of Canada (BoC) and the Federal Reserve (“Fed”) in the U.S. is to set policy interest rates, which in turn impacts bond yields as well as bank lending and deposit rates.

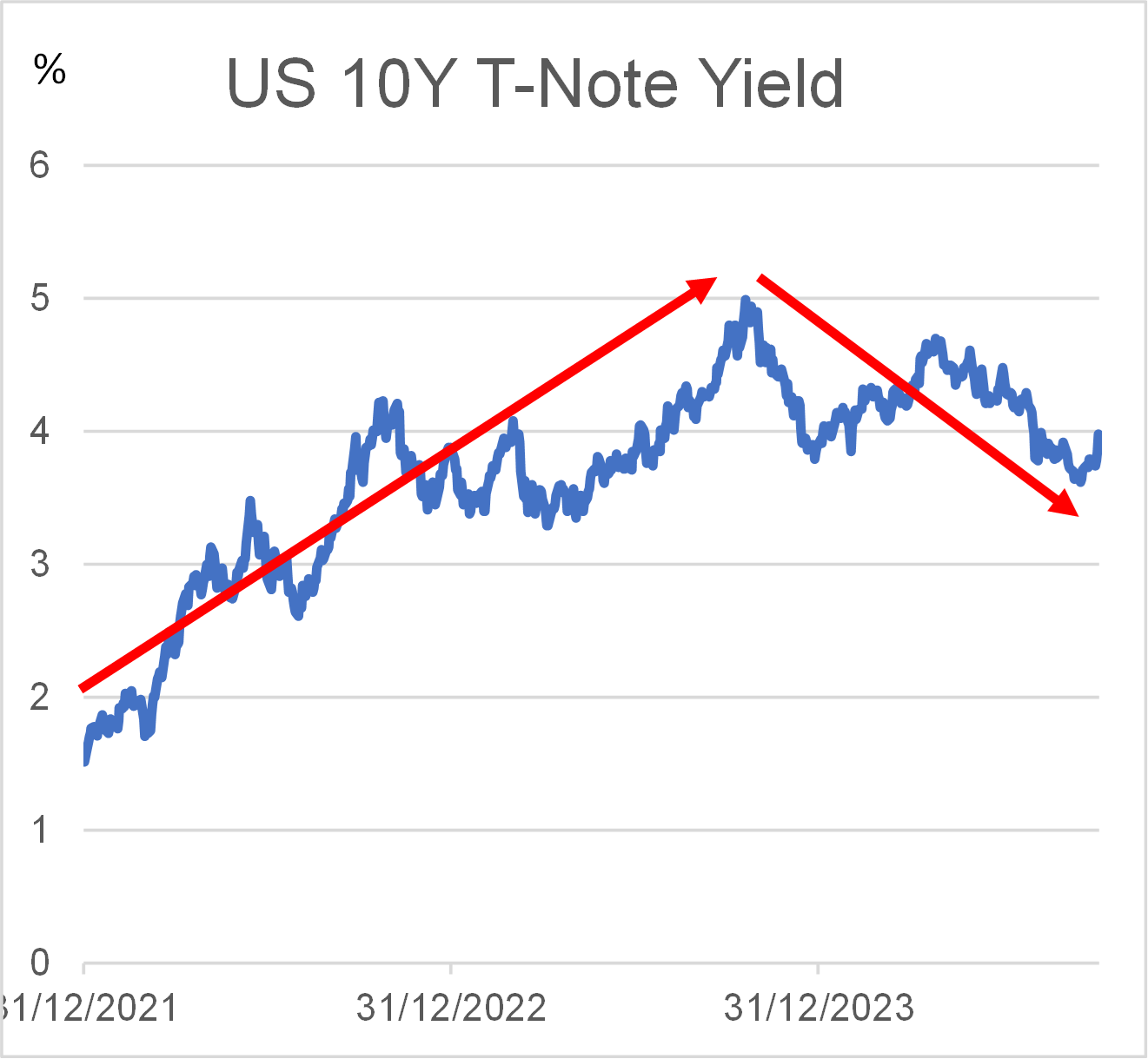

Source: FactSet Sept. 30, 2024

The above chart shows the 10-year U.S. government bond yield climbing steeply in 2022 reaching a peak just under 5% in 2023. This was in line with the Fed policy rate increase. Bond yields have since started to recede as the market anticipated future rate cuts.

Bank of Canada ahead of the Fed

The Canadian economy has been weaker and more vulnerable during the post-pandemic period of high inflation than the U.S. economy. As a result, the BoC started cutting interest rates earlier in 2024; the U.S. Fed had its first rate cut in September. Market pundits and the financial media offer up frequent updates of when they think the next cut will happen, and by how much. My advice to clients is always to ignore such prognostications. It is good to know the direction of interest rates, but the exact timing and magnitude of change is of less importance to the long-term investor who thinks strategically.

Uphill since 2022

You may recall that when inflation reached 8% in 2022, the BoC started to hike interest rates rapidly in order to reduce demand on goods and services. Imagine that you are riding a bicycle up a steep hill, you would be huffing and puffing all the way to the top. That was what it was like for consumers who suffered from paying more for essentials such as groceries or gasoline, or had increased monthly payments when renewing their mortgage. Businesses had to pay higher wages or cost of material inputs as well as for loans.

Downhill is easier

The BoC has been signaling that the Canadian economy has been slowing and unemployment ticking up. Inflation has also come under control. They have started to cut rates in order to stimulate the economy and prevent a recession. With lower interest rates, mortgage burden will start to ease. However, that takes time to work its way through the economy. Also, prices may be rising more slowly now than two years ago, but they are not falling. At least we are not pedaling uphill.

Race to White House

No clear winner for stock market

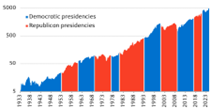

With the approach of the U.S. presidential election, I have been fielding questions about its possible impact on financial markets. The answer is somewhat surprising – since 1933 the U.S. stock market has performed well irrespective of who is in the White House. The following chart shows the S&P 500 through nine decades, with Democratic (blue) and Republican (red) presidents. There is no clear pattern. Other factors such as which party controls the House or the Senate play a role in what policies are enacted.

S&P 500 performance since 1933 by party control

Source: RBC Wealth Management, Bloomberg monthly data (August 31, 2024)

Taxes and Regulations

Republicans tend to favour lower taxes and less regulation. The tax cuts enacted by the Trump administration gave the stock market a lift in 2016-2017. However, there were also some counter intuitive surprises. Despite having fewer restrictions on drilling which favoured the oil and gas industries, the energy sector fell 56% during Trump’s term. On the other hand, Energy outperformed under President Biden. While certain industries may seem to be in or out of favour by the government of the day, the outcome in the stock market is far from certain. There is another surprise in the number of regulations introduced by each president. Every president has introduced more regulation in office. Trump introduced more in his four years than under Obama’s first term. But Biden has outstripped all previous occupants of the White House with his new regulations. That has not dampened the stock markets which have set new highs recently.

Focus on long term

For long-term investors it is important to identify businesses that can generate consistent and growing profits under a wide range of conditions. Many other factors are at play including where we are in the economic cycle, industry innovation, monetary policy or geopolitics. If you are interested to learn more on this subject, please read the article “Harris and Trump on the Issues” in the September issue of Global Insight by RBC Wealth Management. The link is to my website.

Shiuman’s Corner

New cycling milestone

Photo: Marathon Photos

If you have been reading Smart Investor for a few years, then you will know that cycling is a passion of mine. Each year I log several thousand kilometres on the road and trails on two wheels. I have participated in the Tour de Cure six times to raise money for BC Cancer Foundation, which is a 200km ride through the Fraser Valley. The RBC Granfondo Whistler has always been too intimidating for me to contemplate. This year, a colleague persuaded me to register. The idea of riding 122km from Vancouver to Whistler felt audacious. Not to mention the 2,000 metres of climbing. Through the riding season I trained hard on and off the bike to prepare for the event. On race day I rode with a few of my friends in Team RBC, nervous with anticipation. Our group was not there to race, but to enjoy the scenery on the Sea to Sky highway and soak in the atmosphere of North America’s largest grandfondo with 5,000 riders. We lucked out with the fine weather. There were moments of suffering, but mostly it was enjoyable. It was hard to describe the feeling of accomplishment and camaraderie as we crossed the finish line together in Whistler Village. And I survived to tell the tale!