Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2025 edition covers Market Review up to Q3 of 2025, the Artificial Intelligence (AI) boom and gold’s surge. Shiuman’s Corner is a about my cycling adventures for fund raising.

Markets

Market scorecard as of close on Friday November 21, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 30,161 | -0.5% | 22.0% |

| U.S. | S&P 500 | 6,603 | -1.9% | 12.3% |

| U.S. | NASDAQ | 22,273 | -2.7% | 15.3% |

| Europe/Asia | MSCI EAFE | 2,723 | -4.5% | 20.4% |

Source: FactSet

- TSX closed higher in Friday afternoon trading, bit off best levels. Most sectors higher. Canadian equities finished the week down 0.6%, way off worst levels.

- US equities finished higher in Friday trading, ending off best levels. Major indices were down for the week. Most-shorted, tariff-exposed, small-cap, and value names faring well. Big tech mostly higher.

Economy

Canada

- Canadian headline CPI growth slowed to 2.2% y/y in October, marginally above consensus expectations. Overall, October CPI data remained consistent with RBC Economics’ baseline expectation that the BoC is finished easing monetary policy for the time being and will keep rates steady for the foreseeable future.

- Prime Minister Mark Carney’s budget got the green light last week, as the BoC warned of a “systemic” productivity gap. The minority Liberal government’s proposed budget was accepted by a narrow vote of 170 to 168 in the House of Commons. The budget allocates tens of billions of dollars in investment toward trade infrastructure, defence, and housing, which may help address the country’s widening productivity gap.

U.S.

- Federal Reserve Chair Jerome Powell’s recent “driving in the fog” analogy reflects the Fed’s limited visibility following the 44-day government shutdown that delayed key reports on jobs, inflation, and consumer activity. According to the CME FedWatch tool, the odds of a December rate cut have fallen to approximately 40% as inflation remains sticky and above the Fed’s 2% target, complicating the policy outlook.

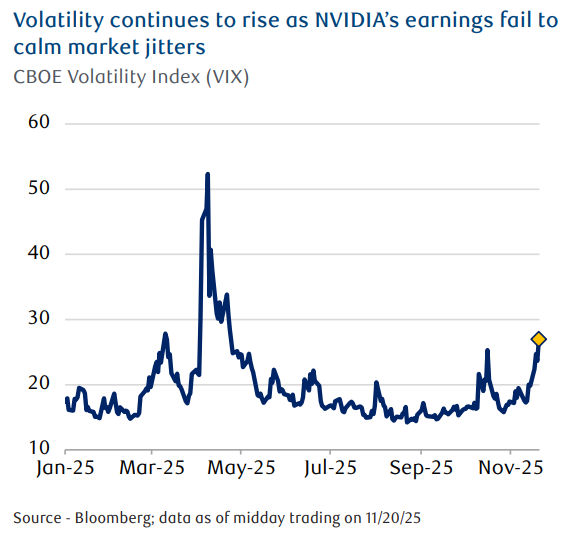

- The U.S.–China technology rift continues to pressure supply chains, exemplified by NVIDIA’s decision to exclude China data-center revenue from forward guidance. Meanwhile, enthusiasm around AI is increasingly tempered by practical realities. A recent MIT study found that many corporate AI initiatives fail to generate measurable financial returns, largely due to integration challenges, resource constraints, and uneven data quality.

- Further Afield

- In an effort to counter the structural weakness facing its industrial sector, the German coalition government has introduced a subsidized electricity price of €0.05 per kilowatt-hour (kWh) for energy-intensive industries. Elevated energy costs have been a major factor behind the loss of Germany’s industrial competitiveness against countries with lower power prices.

- On Nov. 20, markets reacted positively to a report that China is considering fresh stimulus measures to stabilize its property sector. The yuan and a basket of Chinese developer stocks reversed initial declines to close higher for the day. Policymakers are considering a slew of options such as providing new homebuyers mortgage subsidies and lowering transaction costs.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.