Getting Ready for Retirement

Let’s Answer a Few Common Questions

Market Review: 2024 Q2

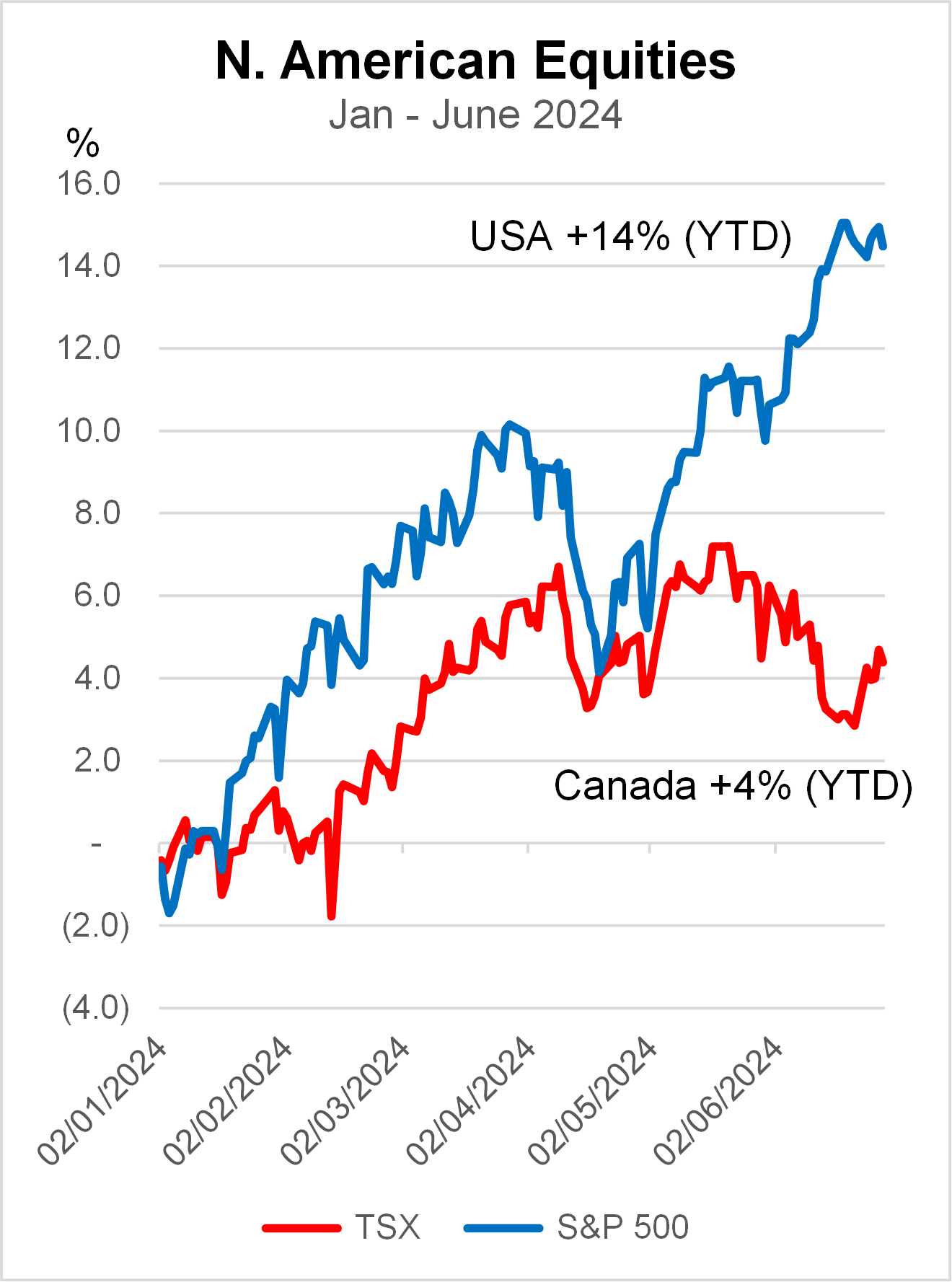

North American stock markets had a positive first half of the year. Both U.S. and Canada had a good start in Q1 then started to wobble in April as a result of uncertainty on interest rates. The U.S. recovered strongly since May with the S&P 500 Index up 14% by June 30, 2024. See blue line in the chart below.

Source: FactSet June 30, 2024

The Canadian stock market lacked direction in Q2 and gave up some gains from Q1. The S&P/TSX Composite Index finished at +4% by June 30, 2024.

Concentrated Returns in the U.S.

The gain in the S&P 500 so far this year has outstripped the average annual return in the past 40 years by almost 1.5 times. However, just eight stocks represented 71% of the index’s return, seven of which are related to artificial intelligence (AI). A third of the S&P’s returns can be attributed to just one company, Nvidia which makes highly sought-after silicon chips that power AI engines. It’s also not surprising that the valuation of the so-called Magnificent Seven stocks are somewhat elevated compared with the rest of the market. If earnings growth does not keep up with such lofty valuations then the stock prices may be vulnerable to correction. In the Global Insight 2024 Midyear Outlook, RBC Wealth Management does not call for an end to the bull market, but cautions investors of possible increased volatility ahead.

Ready for Retirement?

In his commencement speech to graduates at Dartmouth College this year, tennis legend Roger Federer referred to his retirement from professional tennis as a graduation. He said he was moving to the next stage of his life. While we may not be as successful as Mr. Federer, there are steps we can take to prepare for this “graduation”. Below are some questions all of us need to answer.

Will I, or Do I have enough?

This is probably the question clients have at the top of their mind, whether they are planning for retirement or already retired. To answer this question there are just a few key variables – expenditures to support lifestyle, the amount of savings accumulated, the performance of the portfolio as well as the number of years left for saving. I would take all the inputs and feed them into the planning software that can make a projection on how the portfolio would grow during the savings years, and after the client starts to draw on it during retirement. Below is a sample chart from the software called myGPS, showing a projection of future net worth.

Projected Net Worth on myGPS

We update the projection whenever there has been a change in the assumptions, so it’s a dynamic and on-going process.

When do I take government benefits?

If you have contributed to the Canada Pension Plan (CPP) during your work life, you will be eligible to receive a lifetime pension at age 65. Some may choose to delay taking CPP; the benefit is that the amount increases by 8.4% for every year you defer it up to 42% by age 70. For those still working or have other sources of income it is a good way to boost retirement income.

What about my RRSP?

If you are one of the fortunate ones to have a defined-benefit pension plan, then due to the pension adjustment you are likely to have only a small RRSP account. Otherwise, the RRSP forms the bulk of most Canadians’ retirement savings. You can contribute to your Registered Retirement Savings Plan (RRSP) as long as you have earned income up to the age of 71, at which time the RRSP is converted to a Registered Retirement Income Fund (RRIF). At that point there is a minimum amount you must withdraw each year from your RRIF, a percentage that grows from around 5% from age 71 to 7% at age 81. All your investments in your RRSP can roll over in-kind to the RRIF without being sold.

What are the key tax considerations?

Contributing to the RRSP allows you a tax deduction, and any income and gains inside the plan is not taxed. If you convert the RRSP to a RRIF at age 71 and withdraw from it, any amount taken out is considered income for that year. For most clients their tax rate in retirement is lower due to reduced income. The logic is that you can save taxes during years of relatively high earnings, and pay taxes when your tax rate is expected to be lower.

Tax-Free Savings Account

The TFSA can be part of your retirement savings. Although there is no tax deduction when you contribute, there is also no tax when you withdraw. It is the most flexible of all the registered plan. For anyone who came of age before 2009, the cumulative contribution limit is $95,000. For retirees who are receiving CPP and payments from RRIF, their unspent cash can continue to be saved in their TFSA.

How do I invest in retirement?

When my clients and I discuss their investment horizon, they realize that it doesn’t stop at retirement. They invest for the rest of their lives. With life expectancy increasing we will need to continue to invest so that the portfolio can sustain us for the rest of our days. What I will do is to adjust the client’s asset allocation to reflect their evolving risk tolerance – usually we would lower the allocation to equities and increase their allocation to fixed income correspondingly. This tends to lower the volatility of the portfolio.

What will I do on Day 1?

As the old joke goes, your spouse might ask you on your first day of retirement, “don’t you have some place to be?” A study over decades have dubbed certain places to be in the Blue Zone – areas with a high propensity for living beyond 100 years of age. This is well beyond my areas of expertise, but I did watch a series on Netflix on it! Amongst the various factors, having a close-knit community around you, and regular physical activity tend to contribute to having a long and healthy life. Many of the people featured have developed lifelong habits of eating, sleeping and moving well, not just after they retired. While we cannot tell how long we will live, we can all aspire to living a healthy life for as long as we can.

Shiuman’s Corner

The age of podcasts

Photo by J. Velasquez (Unsplash)

Some years ago I used to think that podcasts were just a gimmick favoured by technology types, but did not serve a wider purpose. Concurrently audio books became available and some magazines offered audio version – they were good for the visually challenged or those who spent a lot of time commuting. From being a skeptic, I have been converted into this medium of consuming content. Whether it is Apple of other platforms, you will find a plethora of subjects from which to choose your podcasts. I gravitate towards those that provide news or commentary on current affairs (Intelligence from the Economist and the Journal from Wall Street Journal are part of my daily commute). It’s useful to hear more in-depth reporting than what is generally on the radio. There’s also the obvious advantage of being able to listen at a time that’s convenient rather than follow a schedule. Masters in Business (Bloomberg) offers hour-long interviews with the top figures in finance. I was recently introduced to Founders, which is a monologue by a host who has read multiple biographies of successful entrepreneurs, then talks about what he’s learnt. It may not sound like your idea of fun, but I have found this to be truly illuminating and educational. There is more content than I have time for, so I tend to rotate in and out of a longer list. Perhaps when we are retired we’d have more time for podcasts, along with pickle ball, to keep our minds and bodies active.