2024 May Be A Turning Point

Inflation showing signs of abating

Market Review: 2023

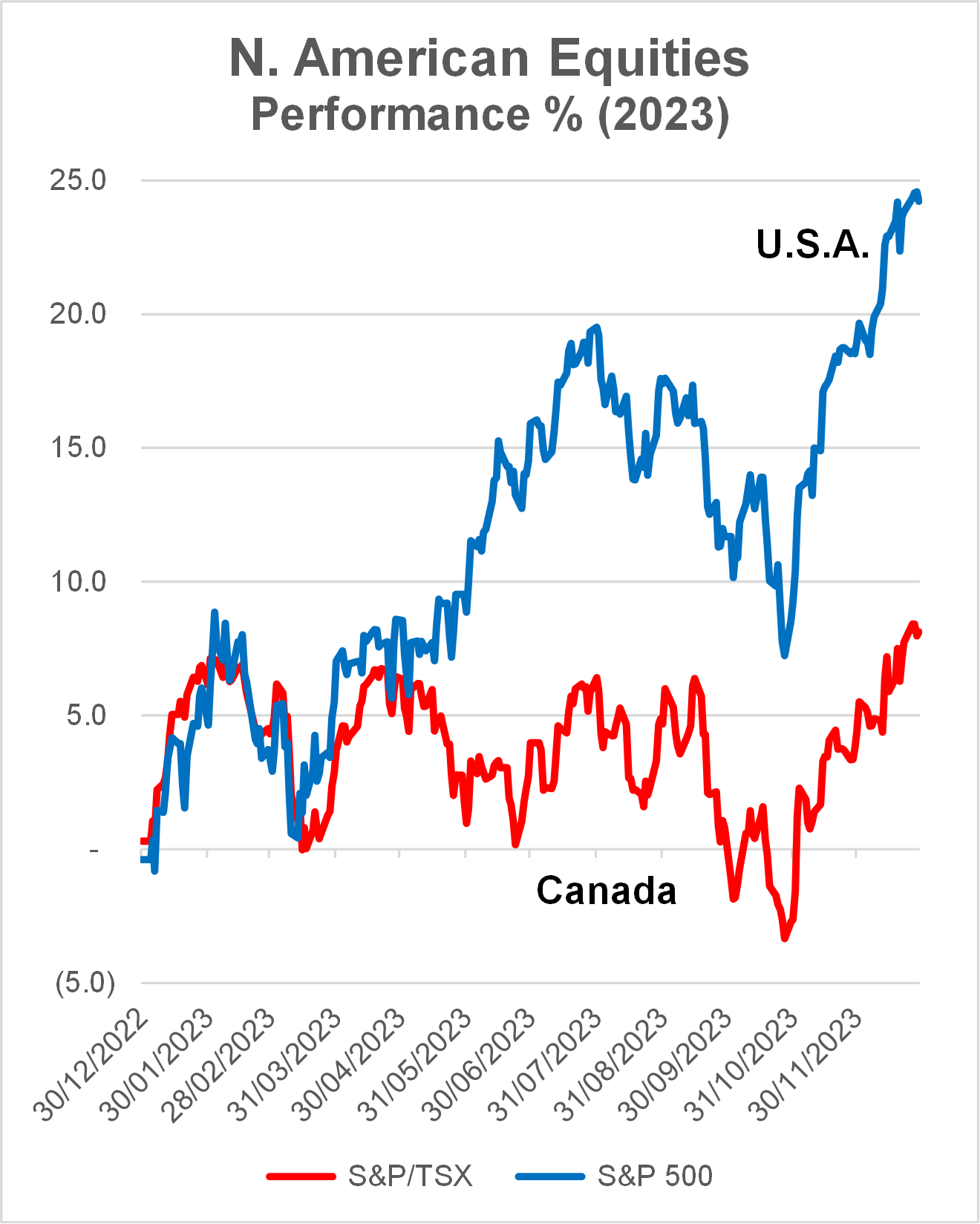

The S&P/TSX Composite Index (TSX) representing the Canadian stock market traded within a range from January to September this year, dipping into negative territory in Q3 before recovering in Q4 – see the red line in the chart below. TSX finished the year up 11.8%. The S&P 500 Index (S&P 500) rallied for the first seven months but took a turn in August and September, giving up some earlier gains. The S&P 500 then rallied in Q4 to finish with a 26.3% gain – see the blue line in the chart below.

Source: FactSet December 31, 2023

Stock price movements were affected by Bank of Canada (BoC) and Federal Reserve (Fed) interest rate policies to a large extent. In the last months of 2023 market sentiment turned more optimistic that the Fed’s tightening cycle had likely come to a natural conclusion, and that some analysts even started to predict rate cuts in 2024. It’s the prospect of lower interest rates that added momentum to the market in the last two months of the year.

Concentration of returns

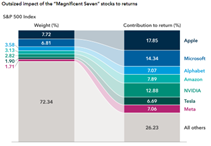

After a steep drop in 2022, large Technology companies in the U.S. staged an impressive rebound in 2023. Seven of the largest companies, known as the Magnificent Seven, led by Apple, Microsoft and Nvidia now represent some 26 percent of the S&P 500, and three quarters of its return in 2023.

Source: FactSet, Capital Group (returns Jan 2 to June 30, 2023)

The chart above shows these seven companies’ market capitalization weights (left) and their outsized contri-bution to returns of the S&P 500 for the first half of 2023. While the S&P 500 gained 26.3% in 2023, the Index excluding the Magnificent Seven was 14.7%, though still very respectable.

Turning Point

Higher for longer

The year began with inflation much higher than the BoC or Fed target of 2 percent. Central bankers continued their tough talk of tackling inflation with higher interest rates. Having rates “higher for longer” became a mantra, as they did not want to risk inflation staying at elevated levels, or worse, go up further.

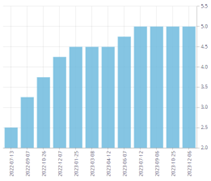

BoC Policy Rate

Source: Bank of Canada

Rates at plateau

Above is a chart showing the BoC policy rate, which has been held at 5% since the last hike in July. That month also marked the last time the Fed raised its rate (it is held at 5.25%).

What happens next?

In the last issue of Smart Investor I noted the decline in inflation. Canada’s economy has also shown signs of weakness, although the U.S. consumer has been holding up relatively well. The difference is that on average Canadian households are more indebted, and are now having to pay more on interests on mortgages, car loans and credit cards. This limits their capacity to spend. Although central bankers still talk about the dangers of re-inflation, their tone has softened leading to most economists and analysts to start forecasting cuts starting in 2024. In their last meeting in December 2023, the Fed projected a number of rate cuts in 2024.

Interest in Bond

After the steep drop in bond pricing due to the sharp rise in interest rates (bond prices and rates move in opposite directions) in 2022, Smart Investor started to advocate increasing allocation to bonds in April 2023.

Regular income

One of the key reasons of owning bonds is the regular income they pay investors. For many years this income was meagre, but many investment-grade corporate bonds pay 5 percent a year or more now, above the rate of inflation.

Risk and Return

There is a risk (though small) that if interest rates go up from here bond prices will suffer. In this interest environment, for a bond with a duration of five years, if interest rates go up 1% the bond price will lose 5% in value. This will be offset by the income from the bond over one year. However, all signs are that interest rates are likely to fall, in which case the investor will enjoy a capital gain as well as collect the income – ideal scenario. This is one of those rare moments in time when the risk to reward ratio is in the investor’s favour, thanks to the high interest rates you can lock in today, which also provides a buffer should the price drop.

What about GICs?

With the stock and bond markets being volatile in the past year, some may have found refuge in guaranteed investment certificates (GICs). Some were able to lock in interest rates over 5% for up to five years. However, rates have already started to ease lately, and at maturity prevailing rates are likely to be lower than what they are today. Unlike bonds whose price can fluctuate depending on interest rates, GIC principal is constant. That’s a good feature when bond prices are in decline. However, should rates drop in the next couple of years, GIC investors will not see any capital gains, unlike bond investors.

Bond duration

Duration is a measure of a bond’s sensitivity to interest rate changes, and is mostly related to its length in years to maturity. “After spending three years sheltering in short-duration securities while the BoC rolled out nearly 500 basis points worth of interest rate increases, it is now reasonable, in our view, to consider lengthening duration in portfolios.” – Global Insight 2024 Outlook, RBC Wealth Management. The case for longer duration is compelling, although timing it perfectly will be hard.

Shiuman’s Corner

What I read in 2023

Photo: Fiction on left, non-fiction on right

For some reason I read fewer books in 2023 than in 2022. One novel (Fayne) and a biography (Code Breaker) were thick enough to be door-stoppers. The only work-related book was Fed Up, which explained the workings of the Federal Reserve from the point of view of someone who used to work there. That was very helpful during a year in which Fed policy had a big impact on financial markets. Two books covering the business world (Empire of Pain and Flying High) were accounts of corporate failings and gives one pause on unfettered capitalism. I bought some books based on book reviews that I trust, or friends’ recommendations. There were also those I discovered by browsing in independent bookstores, one of my favourite pastimes. If you have followed my book lists in previous years then you might have gathered that I am partial to the spy genre; each year I seem to discover new authors that I will add to the roster. This year it was Charlotte Philby who is the grand-daughter of the infamous English double agent who spied for Moscow. On the non-fiction side, I have found Walter Issacson to be a biographer who can consistently paint an insider’s picture of his subject. His account of Jennifer Doudna was no exception. For this year I have started on his biography of Elon Musk, but you’ll have to wait until next year to read my account of it. I hope you will be able to pick a couple of titles from my list that interests you. See Addendum for my complete list.