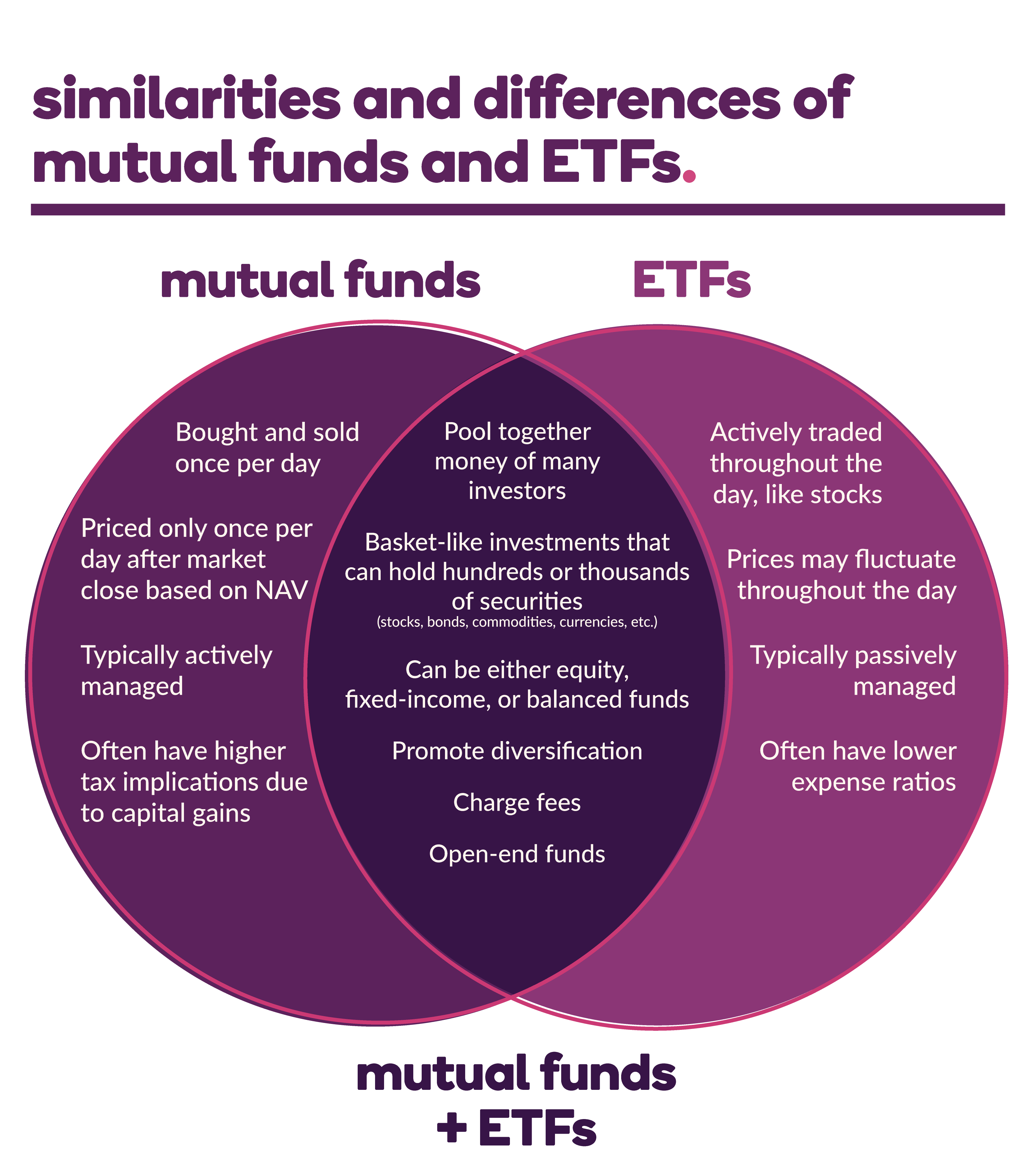

I mentioned last week that there are good investment options other than buying individual stocks and bonds. In fact, depending on the size of your portfolio, buying stocks and bonds individually could get very expensive because of transaction costs. With that in mind, let’s look at two other options - mutual funds and exchange traded funds.

A mutual fund is just a bunch of stocks or bonds that a Portfolio Manager selects to be in his or her fund. The fund is then given a name that should give you an idea or basic description of what is in the fund (ie. Canadian equity (stock) fund, Global bond fund, etc.). The nice thing about mutual funds is that you don’t have to pick the stocks or bonds in the fund: it’s the Portfolio Manager’s job to decide when to buy and when to sell. All you have to do is buy as much of the fund as you would like and hold it. Pretty easy…

Financial journalists have recently aimed a lot of criticism at Canadian mutual funds because of their high fees. I have two comments on that. One, you need to know what the fees are before buying the fund. The fee will be expressed as a percentage and called a Management Expense Ratio (MER). You can go online and find a profile for any mutual fund in Canada so check out what the MER is. If the MER is 2% and you invest $10,000 in the fund, that means that you are paying $200 a year for them to manage it for you. If the fund goes up in value then the amount you pay will go up and vice versa.

Second, I believe you always have to look at the value you are getting for the fee. The old cost/benefit idea… I know that a cafe latte at Starbucks is not cheap at $5. But I may decide to buy that yummy latte anyway because I really love their coffee, or because I decided that $5 is worth it to spend half an hour sitting in their store chatting with a friend (pre-covid). Similarly, if a fund’s fee is 2.3% but the fund returned 20% in one year then I would consider that good value. On my $10,000 investment I paid $230, but I made $2000 (returns are usually expressed after the fee has been taken off). But if I paid 2.3% and the fund made 3%, then I would have to look at how other funds in the same category performed. The market doesn’t go up every year and a good manager who can protect the downside is also worth a lot to me. The good news for you is the mutual fund industry is incredibly competitive, so there are lots of funds to choose from. Even better, all of their track records, holdings, fees and other information are readily available to you online.

While mutual funds have been getting bad press, exchange traded funds have been gaining in popularity. So what’s the difference? Remember the discussion about indexes back in blog #2? Exchange traded funds, (ETFs as they are referred to), are basically like indexes that trade on the market. So, they are a sample of stocks that replicate the broader market and trade on the market under a trading name. For example, if you want to buy the Canadian market you could buy the TSX 60 index and it would hold 60 Canadian stocks that represent the broader Canadian market. So what’s the big deal? Because the stocks are selected based on a set criteria (in this case Canadian market) there is no manager that selects them. No manager means no big management fee to pay so the fees on ETFs are much lower than mutual funds which have a manager. Make sense? Another interesting fact about ETFs is that, as they have gained popularity, more and more have come onto the market, so there are thousands to choose from and you can get very specific in your choice. For example, just in bonds, you can buy long bond ETFs, short bond ETFs, government bond ETFs, corporate bond, Canadian short bond ETFs... I think you get the idea. Basically, if you can think of a selection of stocks or bonds that you might want to invest in there is probably an exchange traded fund available.

Apart from the management fees, the other big difference between mutual funds and ETFs is that mutual funds don’t trade on the market while ETFs do. Just like I can go and see what Apple stock is trading at during the day, I can go and see what an ETF is trading at if I know its trading symbol (all stocks trade under a symbol). For example, Apple’s trading symbol is AAPL, and TSX 60 ETF’s symbol is XIU. While the individual stocks or bonds in a mutual fund trade on the market, think of the fund as a vehicle that holds them and the value of that vehicle only gets updated at the end of the day once the market is closed.

When It Comes to ETFs vs. Mutual Funds, There’s No Favorite Child. (December 2, 2019). Alley. Retrieved from https://www.ally.com/do-it-right/investing/etf-vs-mutual-fund-whats-the-difference/

So what’s better you ask? Mutual funds or ETFs? A couple things to consider. While ETFs have lower ongoing management fees, you will have to pay a transaction fee when you buy or sell them (just like you do when you buy individual stocks). I don’t think you should ever pay for someone to buy or sell you a mutual fund. (A topic of a future blog on fees). People in the mutual fund business argue that mutual funds are better because you get active management. You are paying for a manager who will buy and sell the holdings he or she has selected based on his or her experience and expertise. With ETFs there is no analysis done on each holding so you could have stocks or bonds included in the ETF that you wouldn’t buy individually. Interestingly, there are now actively managed ETFs on the market that are still very competitively priced compared to mutual funds. So how do you decide between the two?

I would first do my homework as there is a ton of information online about mutual funds and ETFs. Look at the fees and the historical performances of ones you find interesting, and then remember what I said about value in the paragraph above.