Well, folks. Trade policy has once again become the elephant in the room: loud, disruptive, and impossible to ignore. With economist Stephen Miran now at the wheel of President Trump's Council of Economic Advisers and known for advocating protectionist tariffs, the United States is charging headfirst into protectionist territory. Miran’s big idea—aggressive tariffs as both economic shields and bargaining chips—looks like it’ll be a major player on the global stage. Given how tightly woven Canada’s economy is with the U.S., this is something we should all have on our radar.

Here’s Miran’s original paper if you want a deeper dive. Spoiler alert: it’s a long read, and his assumptions are wrong for a wide variety of reasons, not least of which he completely ignores retaliation of any kind in his analysis. But he’s the one with Trump’s ear, and he’s saying what Trump wants to hear, so expect his opinion carries a lot of weight. Read Stephen Miran’s paper here

The Return of Tariffs and Trump’s Latest Gambit

Just when you thought we’d put tariffs behind us, they’re back—bigly. Trump’s administration has started rolling out import tariffs between 10% and 25%, and Canada, Mexico, and China were first in line. After a brief reprieve, as of today there will now be a 25% tariff on products from Canada, except for energy products at 10%. Additionally, as of March 12, 2025, the U.S. plans to reinstate 25% tariffs on steel and aluminum imports from all countries, so far with no exemptions. These have also announced to be cumulative, which would mean a 50% tariff on Canadian steel.

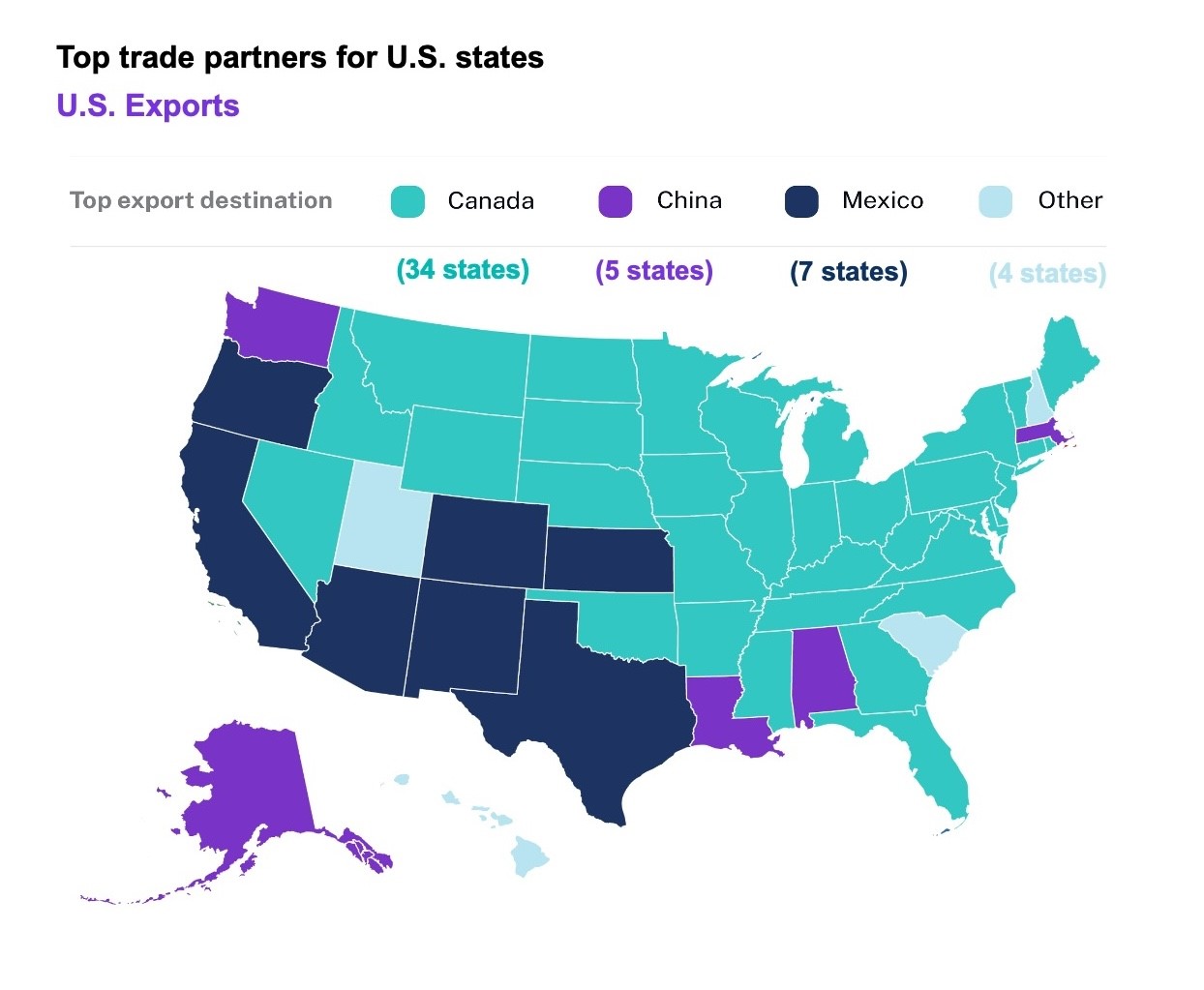

Canada and Mexico didn’t take kindly to this (and why would we?), and Canada just announced 25% retaliatory tariffs targeting $155 billion in U.S. goods, particularly those produced in key Republican states. Other countries would be expected to do similarly if the U.S. goes ahead with its global tariff plans on April 2. If history is a guide, that will mean trouble for everyone involved.

Beyond just rhetoric, this sets the stage for heightened volatility across global markets. Supply chains are tense, investors are jittery, and companies are dusting off their trade war playbooks. Add to this that the Atlanta Federal Reserve just put out its Q1 2025 growth estimate at a whopping minus -2.8% yesterday--a shocking reversal from the +3.9% is was forecasting prior to the tariff talks. The Volatility Index (“the VIX”), a measure of the ups-and-downs of the market, is up 54% since it bottomed just two weeks ago.

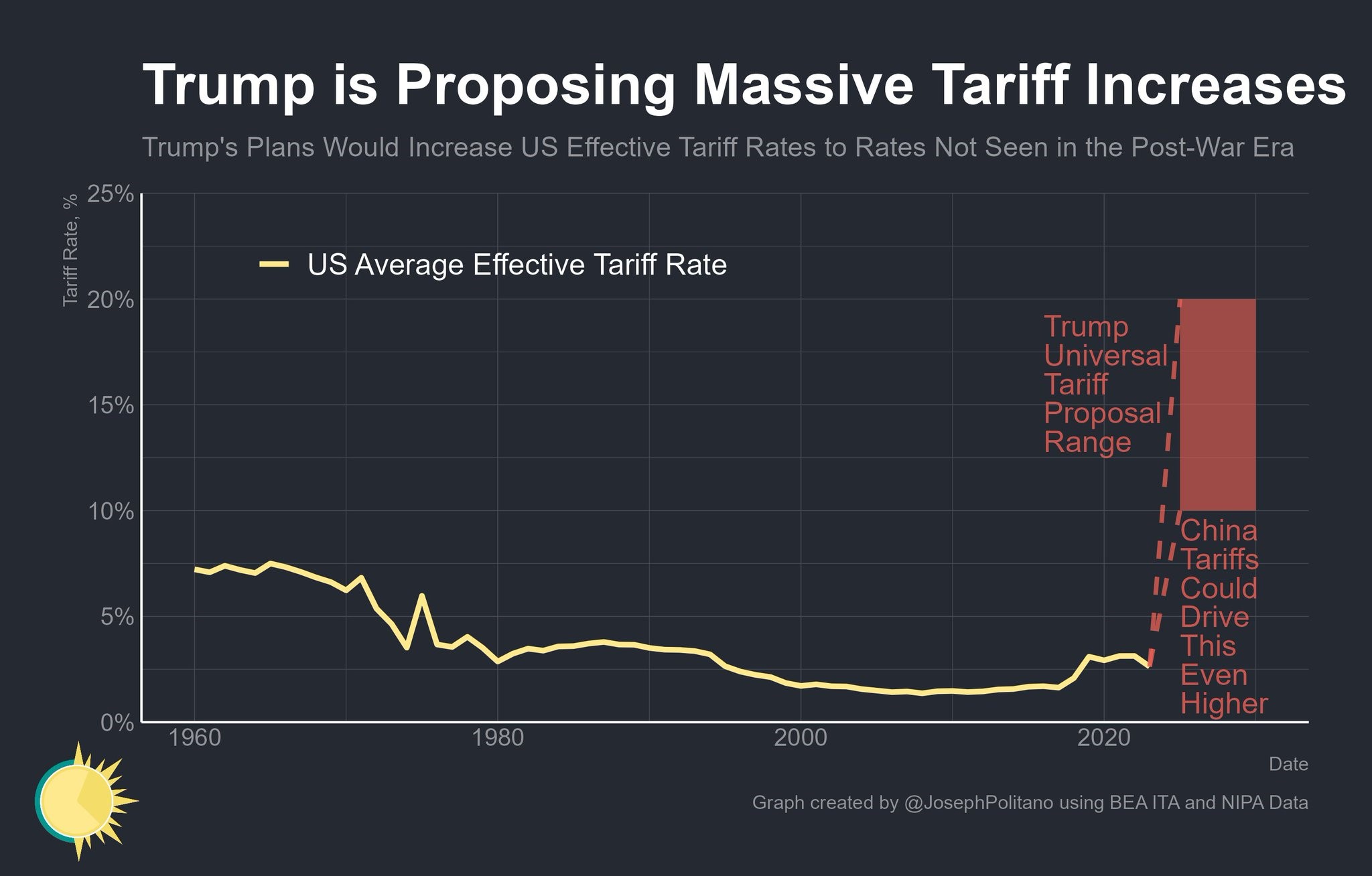

To this point, I had been telling clients and friends alike (sorry if you’ve heard this already) that it felt like the market was discounting too much that the tariffs would be delayed again, negotiated down, or be targeted in a way that they wouldn’t be widely felt. If there’s anything that Donald Trump actually believes, it’s that tariffs are the way to American prosperity. It’s not a cynical populist gesture to his base: he’s been saying it since at least the 1990s. Come April, the U.S. average effective tariff rate is set to rise to between 15% and 25%, levels not seen since…well, since the 1930s. For reference, the average effective tariff rate in Canada (pre- trade war) is approximately 1.5%.

Source: Apricitas Economics (Substack) with BEITA and NIPA data

Why Canadians Should Care—a Lot

I get it. Canadians do care. Supermarkets full of shoppers checking “Made in Canada” content (wow, that was swift re-labeling, by the way), the resurgence of Canadian flags everywhere, “Buy Canada” websites and apps, along with some great skits and memes are all testaments to that. But we can’t downplay how much Canada’s economic reliance on the U.S. market means we’re squarely in the line of fire. Automakers, already juggling supply-chain acrobatics, could see costs spike and production timelines stretched. And our energy sector? It’s nervously eyeing the border, wondering if Trump’s trade crusade might indirectly impact oil and gas exports.

In the worst case, Canada might face serious economic pain, especially in manufacturing-heavy regions (sorry, Ontario). Supply-chain snarls, job losses, rising costs, and even a nasty mix of inflation-plus-recession—the dreaded “stagflation”—could rear its ugly head. Despite the rhetoric from our government (and candidates, and some premiers), Canada won’t “win” a trade war with the U.S.. In basically every scenario, Canadian consumers get hurt more than Americans do. And as cathartic as they are, threats to “turn off the power” to the U.S. are puerile—they’ll just turn off the internet.

But let’s not panic just yet. Canada has some leverage here, and truth is on our side—this is a bad idea. Updated trade terms could help ease tensions. Governors and senators have to face their constituents eventually. This might even push a much-needed rethink on how and where we produce goods here at home. Could this be the moment when "friend-shoring"—shifting manufacturing to more stable and cooperative trade partners—actually takes off? Stranger things have happened.

Source: BDL's Partners in Prosperity report.

Meanwhile, South of the Border…

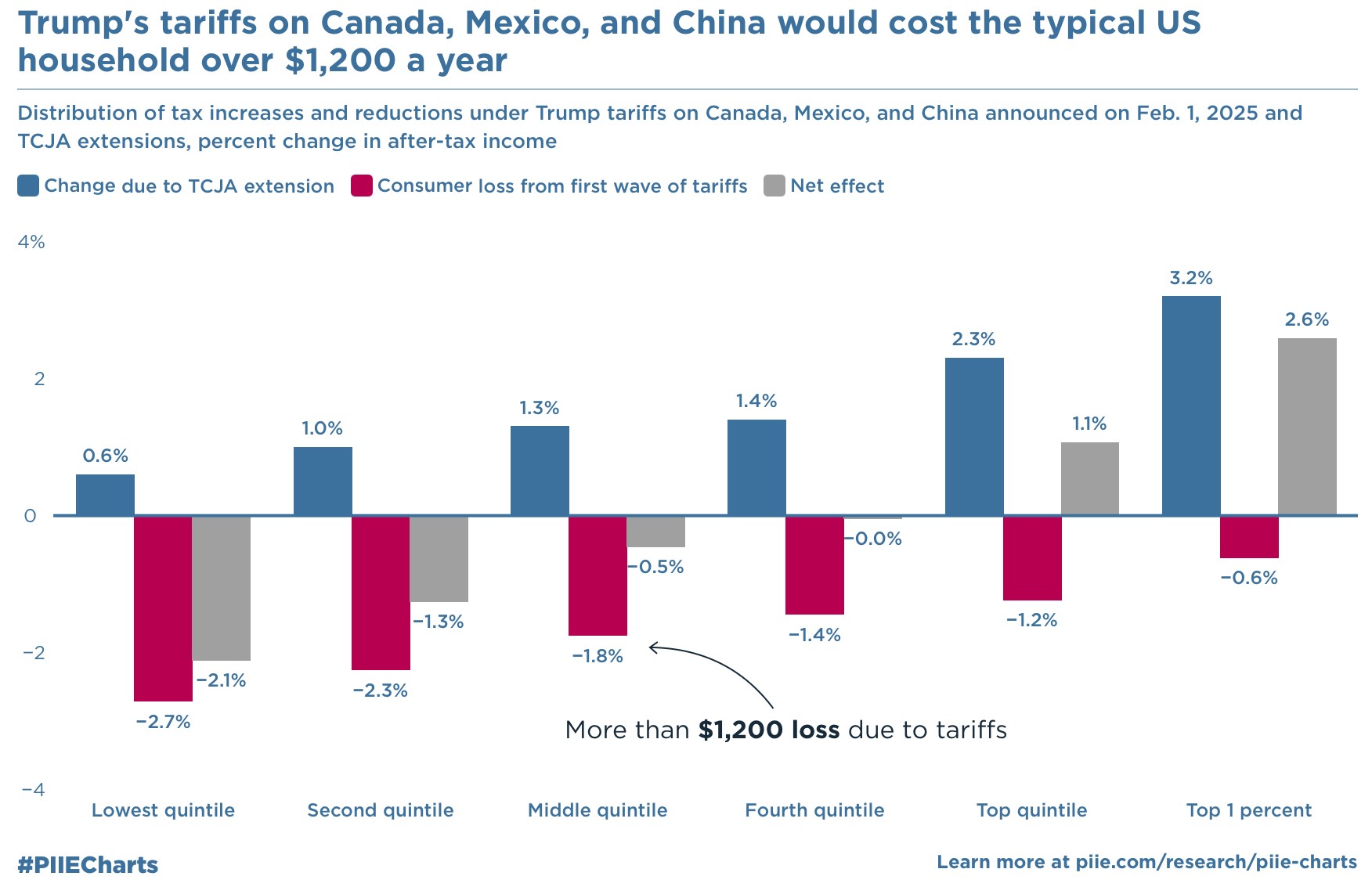

In the U.S., these tariffs are shaping up as a double-edged sword. Yes, some industries (steelmakers, domestic solar manufacturers) might cheer a little protection from foreign competition, but higher costs could quickly bite consumers and businesses elsewhere. Retailers, tech firms, and manufacturers reliant on global supply chains could face price hikes and profit squeezes. Not to mention consumers. The Peterson Institute has researched the expected effect of today’s tariffs on U.S. consumers, and it’s not a pretty picture, costing a middle quintile family an extra $1,200 per year.

Also: Read this CATO Institute piece on the cost of Canada and Mexico tariffs on the U.S. economy.

The Federal Reserve is stuck playing referee, balancing the risk of tariff-fueled inflation with the possibility of slower economic growth. Investors, understandably, are not thrilled by this uncertainty. Speaking of the Federal Reserve, these tariffs aren’t Stephen Miran’s only…interesting idea. He’d also like to start charging “fees” on foreign holders of U.S. Treasuries (read: paying them less than the interest that they are owed). The Financial Times doesn’t mince words on how silly an idea that would be. It also includes maybe my favourite infographic of all time, detailing how whether they think T-Bill fees are a good idea:

Final Thoughts (and maybe a deep breath)

Yes, trade tensions are nerve-wracking, but they're not new, and they're not insurmountable. Historical evidence strongly suggests that tariffs typically result in higher costs for consumers and economic disruptions without meaningfully addressing trade imbalances. Prudent investors should look past short-term volatility, instead focusing on resilient, diversified strategies. Smart companies and countries will adapt, just as they've done before. We'll keep you well informed, and we continue to adjust client strategies thoughtfully as events unfold.

If all this talk of trade wars, tariffs and tantrums sparks questions—or if you just want to chat through your portfolio or your planning—please don’t hesitate to reach out. We’ll be navigating all of this right alongside you, and we’ll all just keep calm, and invest on. As always, we're here for you.

Warmly,

Sam

Addendum, for the wonks

If you’re interested in digging deeper into the nuances of tariffs, trade deficits, and their economic impacts, below are some valuable resources to explore.

- Separating Tariff Facts from Tariff Fictions | Cato Institute | A concise analysis debunking common misconceptions about tariffs, emphasizing their hidden costs and economic inefficiencies. Of particular interest was the 8-layer flow chart describing how tariffs were actually paid. | Read More

- The Impact of Tariffs on Inflation | Federal Reserve Bank of Boston | An official Federal Reserve analysis highlighting how tariffs directly translate into higher consumer prices. This is a wonderful illustration of what economists think of the plans and the net effects of the tariffs from a U.S. perspective, including their contribution to inflation, and backed by real-world data. | Read More

- Trump Tariffs: Tracking the Economic Impact of the Trump Trade War | Tax Foundation | A comprehensive report quantifying the broader economic costs associated with recent tariff policies. Definitely for the data nerds in the audience, this skews heavily to extended tables of numbers. | Read More