Global stock markets had an impressive November and a decent-enough December, but as the New Year dawns that euphoria is starting to wear off. Despite major central banks announcing rate hikes, investors are still optimistic they're near the end of their tightening cycles. At the same time though, tighter financial conditions may soon start to hurt economic demand and growth.

Below, I'll quickly recap some of the main points from our firm's flagship investment publication, The Global Insight 2023 Outlook (which, by the way, is always worth a read). We've got stellar insights from our top notch research and investment experts from all corners of the globe.

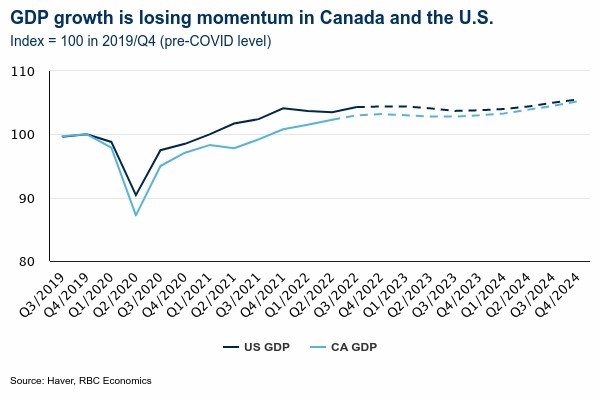

RBC currently believes that the U.S. (and the world) is almost certainly headed for a recession, just as has happened in the past when interest rates are very high. There are certainly still routes to a soft landing, but they are closing quickly. If we do get a recession, we believe it's likely to start in the middle of the year, and key leading economic indicators confirm this. Although it's difficult to predict precisely when the recession will arrive, RBC is confident that it will be sometime in the next twelve months. One of those indicators, GDP growth, while still positive is deteriorating in both Canada and the US. The high rate of GDP growth was one of the factors that could have "grown the economy" into the inflationary prices we've seen, so its slowing is disappointing.

As we look ahead, there are some key lessons to be taken into account. In the short-term, it is common for economic downturns, especially those in the U.S., to be accompanied by bear markets. Therefore, it is likely that investors will experience further stock market volatility in the upcoming year. Furthermore, this type of environment can be characterized by overwhelming negative news and a sense of uncertainty. To successfully navigate through such a period, one must demonstrate a high degree of self-control and maintain a long-term perspective.

Fortunately, there are a few crucial lessons to be learned from the economic recessions that have occurred throughout history. Generally speaking, these recessions tend to not last for an extensive period of time, and the expectation of an eventual recovery is often enough to spark the start of a new bull market. Furthermore, as time goes by, any downturns caused by recessionary periods are usually dwarfed by the substantial gains that are usually achieved in the future. Ultimately, while recessions can cause temporary dips, they have typically proven to be minor setbacks on the overall upward trajectory of the stock market.

Though recent bond returns have been weak, a ray of hope shines in the fixed income market. Yields are now at their highest levels in over 10 years, making the expected returns from these investments significantly higher than what they have been in the past. Moreover, their diversification advantages and ability to stabilize portfolios could become a great asset when any economic downturn arrives.

The year ahead will likely present its own unique set of difficulties. Nevertheless, we remain confident in our portfolio management process which involves adhering to an asset allocation that is in line with your financial goals, reallocating as necessary, and regularly examining all investments to evaluate their worth and suitability. Furthermore, we anticipate that income will be a major contributor to returns in the coming year, and will thus strive to look for prospects in areas such as fixed income and dividend-focused stocks.

We hope that 2023 brings you nothing but good things, and we are excited to keep sharing our insights with you.

She came! Meet Esme Rose McLaughlin

Our newest addition arrived on time on November 23rd. She's absolutely wonderful, and even though she's not quite letting her parents sleep uninterrupted for more than a couple of hours at a time, we're all madly in love with her. Leila has proven to be a fantastic big sister, and our biggest concern is her harassing her little sister with too much unsolicited "help" (see below).

| Maximize your RRSP contributions

| The RRSP contribution limit for 2022 is $29,210 and $30,780 for 2023. You may contribute 18% of your earned income up to the maximum for the year. Contributions may be made until March 1st to "count" for the year prior, and reduce your taxable income by the amount of the contribution.

|

| Contribute to your TFSA | TFSAs are flexible savings vehicles for both medium- and long-term goals, as well as being excellent estate vehicles. Contributions to TFSAs are done with tax-paid dollars, but all growth and income within the TFSA is tax-free, and withdrawals are not taxable. The new contribution room for 2023 has risen to $6500, and the cumulative room is now $88,000. |

| Contribute to RESPs for kids and grandkids | RESP contribution amounts roll over on January 1st. Contributions to RESPs provide tax-sheltered investment to fund post-secondary education at accredited institutions. The Canadian Education Savings Grant adds 20% to contributions up to $500 per child (20% of a $2500 contribution). There is a lifetime maximum grant of $7200. We employ a couple of strategies to help parents to maximize the benefit for their children and would be happy to provide them to you. |

| Pay prescribed rate loan interest | For spousal loans, family trusts, and other investments that employ a prescribed rate loan, the loan interest is due to be paid by January 30th. The prescribed rate for new loans has doubled recently from 1% to 2%, but fortunately any loans already in place keep their original rate for the lifetime of the loan. |

| Review your wealth planning and financial projections | Given the rise in costs that took place in 2022, it is prudent that you review your financial planning to make sure that the assumptions that were made about your costs, incomes, and taxes are still current and adjust as needed. Opportunities and risks should be evaluated, and in some cases there may be fine-tuning needed to investment strategies to account for any changes |

| Check in on your insurance coverage and opportunities | The rise in rates has hurt current bond portfolios, but it has brought with it opportunities in the insurance space. In particular, clients with surplus wealth should explore whole-life insurance as a way to reduce their estate tax burden and transfer wealth efficiently to the next generation. Even more so those who have corporate structures, where there are additional benefits to whole-life policies. Younger clients may want to examine their term insurance coverage to make sure that it is still current with their risk-mitigation |

Sam McLaughlin, CIM, FCSI, FEA

Senior Portfolio Manager & Wealth Advisor