Whither the world? As clients would know, I started laying out a picture of the recovery economy starting early last year. Derailed somewhat by Delta and then Omicron shut-downs (thank god for flexible and responsive strategies), the picture was just starting to resolve as 2021 turned into 2022. In fact, I was able to use the following slide in client reviews from about October to February with not a single amendment (clients who saw me over those 5 months, feel free to fact-check me):

What we think drives 2022

- Currencies more unsure, especially USD/CAD

- Fixed Income returns to be determined largely by central bank actions and inflation concerns

- Equity market returns to remain positive, though more muted

- Transition to New Industrial Revolution to intensify as supply chains re-orient

- Growing emphasis on AI automation and robotics

- New materials sciences to accelerate

- Biosciences to deliver new drugs, building on successes from the pandemic (see: new HIV, malaria, and influenza drugs announced)

- Energy transition to renewables to continue at-pace

- Increased share of new companies being held privately for longer that they would traditionally be held, with IPOs happening much later in the corporate life-cycle

- Technology dominance to shift from low-capital to high-capital business models

- ‘Epicenter’ business to regain a foothold – travel & leisure, exporters, consumer discretionary, office REITs

- Crypto assets may become prime-time (and we're still not buying them)

We made a number of changes to portfolios themselves over this period to keep up with the evolving economy, re-opening, and re-inflation of trade (along with inflation more generally), but for the most part we were able to stay the course. Now we have to ask ourselves: has the Russian invasion of Ukraine caused a pause in the economic march forward, has it shifted the vector but left the terminus unchanged, or has it so changed the picture that a complete re-evaluation of our picture of the future needs to be re-examined?

Instructive might be remembering where we found ourselves two years ago, pre-pandemic. At the time, we were telling people that the future looked bright. We had a 5-10 year timeline of a slow walk into a New Industrial Revolution. Our thesis then involved a gradual transition of the global economy as a number of previously laboratory-only technologies started to be brought off the bench-top and into the real world. We were looking at everything from the rise of AI to the new "collaborative" industrial robots from companies like Comau. Moderna and their mRNA platform were already on my radar, as biotechnology started to look more like bio-engineering. And nanomaterials started to see themselves in even consumer products as varied as golf clubs, car batteries, and clothing. Then Covid hit. This past week marked the two-year anniversary of the bottom of the market. Here's where we were then:

And now, two years later, we've actually seen the market higher off not just those lows, but off the highs that preceded them. Not because of a simple return to the mean. Not because of the governments' recovery funds (though, admittedly, not in spite of them). But because of the one good thing to come out of Covid: an incredible leap forward in those emergent technologies. One thing that rolling lockdowns brought was a need to innovate. And, coincidently or not, those very technologies were just the tools needed by companies to weather Covid.

It might be overly optimistic of me, but the one thing that Covid has so far left broken—global trade and global logistics—might be, in a Nietzschean way, made stronger for its adversity. I doubt purchasing managers at companies will ever again succumb to the siren song of China-only one-stop manufacturing. Supply chains will be rebuilt (not a process without some disruption along the way) as more resilient and likely more efficient. In the same vein the Ukraine-Russia conflict, and the massive human toll that Russia is inflicting with its petro-dollars, will almost certainly bring with it a re-evaluation of our energy priorities.

With everything going on in the world today, surprisingly, the risk of recession has probably fallen. In the cruel irony that sometimes bad news is good news, developed markets are likely to remain hawkish but move carefully. JP Morgan's inflation risk model is currently suggesting an 8% risk of recession within the next year; importantly, its risk of recession over the next three years has been brought over 50%.

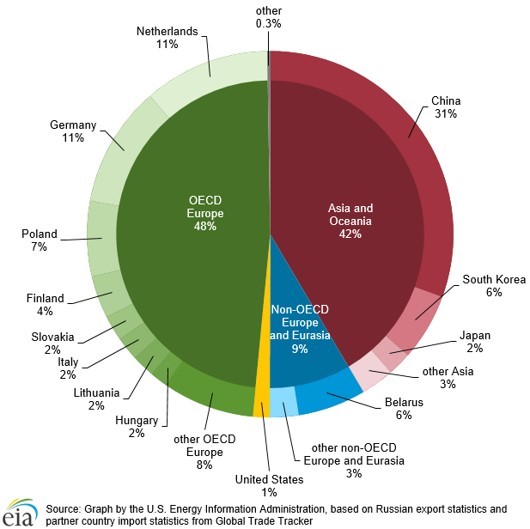

One thing suggested as the biggest Ukraine-Russia risk to disrupting the previous march forward: the price of oil, driven quickly higher by the loss of supply of Russian oil. This affects Europe and China directly (US traditionally only takes 1% of Russian oil production, and Canada doesn't even make the chart), but in the modern world commodity pricing is globalized, hence those eye-watering trips to the pump of late.

And it's not just oil. Russia is a huge producer of other key commodities. With about 17% of global natural gas production, 11% of wheat, and—important to the so-called energy revolution—a staggering 14% and 44% of platinum and palladium production, respectively, both integral for advanced battery production.

And given its much smaller size, Ukraine is no slouch in the commodities department (it's also no slouch in the "fighting off Russian invaders" department, it would seem).

A quick note about these numbers. You can see big slices of commodities here. Amazingly big slices. How, you might ask, will the world ever replace the missing supply? It's a valid question, and one you see ominously hinted at in new media all the time. But notice the difference in titling between the Russia table and the Ukraine pie charts: "global production" vs. "global exports." And that's an important distinction. You'll see things written like, "Ukraine and Russia together are responsible for 25% of the world's wheat exports." and that's true. But the truth is that, for example, the estimated wheat export shortfall from the Russian invasion is only 7 million tonnes. How? Because most wheat is used in whatever country it's produced in, Russia included. They may have the most surplus to sell, but that doesn't mean not selling it will take 25% out of the global supply. Credit to crop scientist Dr. Sarah Taber for first pointing that out.

What all this does mean is that pricing of a number of commodities will likely be disrupted, but that sooner or later we will be on the other side of all this disruption. So what does this all mean for stocks and bonds? As we have been counselling throughout the past six months or so, a lot of volatility is likely in both assets.

The pain will probably continue for most bond markets for a while to come as inflation concerns force central banks' hands on raising interest rates. The news won't be all bad: as we've just recently seen in the US, sometimes bad news that isn't as bad as it might have been is actually good news. The US Federal Reserve raised rates 0.25%, but expectations were for a 0.50% raise. This "bad but not that bad" news was treated as a sign that the bankers would be less hawkish at future meetings, and both bond and stock markets rallied.

Equities are a mixed bag, but most are currently fairly valued: any valuation premia was likely removed as stocks fell from December to March. Those with better balance sheets (the biggest companies, often), more stable business structures (in many cases, less consumer focus and less recurring subscription requirements), stickier customer bases (such as SaaS businesses), and especially those who stand to benefit from rising interest rates (the "inflation sensitive" businesses like insurance companies) are in good shape. Those with unsustainable debt loads, those with overly optimistic sales growth expectations, and those directly hurt by either interest rates or geopolitical realities may be on shakier footings.

For now we continue to focus on the fundamentals (both figuratively and literally), to structure bond and stock portfolios to both weather continued uncertainty well and to benefit from the changes ahead, and to be responsive to opportunities as they arise. The key to successful investing is—as it has always been—to look as far down the road as possible, and to already be wherever the change is moving eventually.

RBC Articles

| Global Insight Weekly: Risks become realities: Consequences of Russia’s strikes on Ukraine Global Portfolio Advisory Committee rbcinsight.com | The “looming” geopolitical threat has become a reality, cascading uncertainty over markets. While the situation is fluid, history shows the equity market impact could play out in short order even if the conflict lingers. We look at what the real risks to the market are, and what investors should be alert to as events unfold. |

| Market Update: The Price of Success Global Portfolio Advisory Group rbcinsight.com | Rising inflationary pressures have once again put the Federal Reserve under the microscope as markets look for the Fed to act more aggressively, sparking the most volatile start to the year for global fixed income markets we have seen in decades. |

Ukraine Russia

| The Darkness Noah Smith Noahpinion Blog | This was a depressingly well written piece by Noah Smith, a sometimes-Bloomberg opinion writer with a keen eye. Highlighting the march of illiberalism across the world, it provides a valuable insight into how we found ourselves here (he places it at the Iraq War). |

| Arnold Schwarzenegger addresses the Russian people @Schwarzenegger Twitter | There is no chance that 19 year-old me would have ever believed that 39 year-old me would have so much respect for Arnold "I'll Be Back" Schwarzenegger, not as a movie star, but as a statesman and an orator. |

| Conversations to the Tune of Air-Raid Sirens: Odesa Writers on Literature in Wartime Ilya Kaminsky The Paris Review | "You can resolve to live your life with integrity. Let your credo be this: Let the lie come into the world, let it even triumph. But not through me." Alexander Solzhenitsyn, a Russian writer persecuted by Stalin wrote this. What amazing art must be being created in Odessa, Mariupol', and Lviv right now. |

| How Zelensky Met the Moment What's Next Podcast slate.com | This was the most honest accounting of Volodymyr Zelensky's history and rise to the moment I heard in the past while, and the political situation Ukraine was in leading into the war. An excellent listen. |

| Yuval Noah Harari Conversation with Masha Gessen Yuval Noah Harari Getting Interviewed Podcast Spreaker | Masha Gessen, now staying in Poland, is a Russian-American journalist and activist. They've been longtime vocal critics of Putin from inside Russia, and provide a crucial voice of the current state of affairs in the Kremlin and on the streets of Moscow. |