Missives and Marginalia

Rise of the meme economy—tendies edition

The only thing that seems to be coming across my various social media accounts these days, as well as my professional trading wire services, internal emails, and everything else that inundates me, has been the current “best thinking” and random commentary around shares of GameStop, a failing mall business that sells new and traded video games. They have had shrinking sale and net income losses in 7 of the last 10 years, culminating in a massive negative earnings of $5.38 per share in 2020 (on a stock that traded at an average price of $7.14 per share that year).

Then, near the end of 2020, something happened. An anonymous user on the social media site Reddit forum r/wallstreetbets named “DeepF***ingValue” [I’ve sanitized the name] started to post about his trading of GameStop stock and making the case that other users do the same in an attempt to effect a “short squeeze” on some hedge funds that had sold shares of GameStop short (other names such as Blackberry and AMC were added, as well). And they did. A lot. Acting together, they were able to buy vast amounts of shares and options in these stocks, bidding up the prices and forcing some of the institutions to unwind their “short” positions, which then exacerbated the upside pressure creating a sort of feedback loop. As of writing, from their 2020 low of $2.57, GameStop is up a whopping 13,000% to $335. All of this will likely bring down a hedge fund or two, make several retail clients millionaires, and hurt those who hold on too long and are left holding the bag when the water goes out and fundamentals inevitably take over from irrational exuberance (to mix a couple of metaphors with an aphorism or two).

The story gets a lot more complicated from here, so I have compiled a couple of links to good explainers of various parts of the story:

- What happened with GameStop? (Alexis Goldstein, Markets Weekly). Fair warning this is a long read, but it is the best explainer of a complicated topic I’ve yet seen.

- Game. Stop. (Ranjan Roy, Margins). Another long-form piece (no easy explainers here, sorry) that remind us that “hedge funds” are not a singular entity, and that there’s money on both sides of this trade. It also gives a good explanation of the hazards of this type of investing and what to watch out for.

- Infinite leverage explained (thicc_dads_club, Reddit – wallstreetbets). The most fascinating thing about writing about this, and something that news networks have to grapple with, is the usernames. This post has nothing to do with GameStop directly, but is a humorous explainer on abusing leverage, something that plays into the GameStop shorting story. Warning: lots of bad language.

This story is interesting because of the fact that it was fueled by some degree of coordination among retail investors socializing online. It is a demonstration of how things are fundamentally changing in the world, and how Millennials and their Gen-Z younger siblings are starting to exert control just as they stand to take economic reigns from the Gen-X and Boomer generations before them. And while it has limited implications for the outlook for the economy and markets today, it highlights the growing force of a retail investor base that is willing to increasingly collaborate. However, we can’t help but wonder how many of these investors are motivated by the potential for gains they perceive to be quick, extreme, and easy.

Ok. Enough on GameStop. And apparently the meme economy is moving on—they just can’t decide whether to bump up dogecoin (a joke bitcoin alternative with a shiba mascot) or to start to plan a run on silver. Seriously.

COVID update

On the COVID-19 front, the peak of the second wave of the virus in Canada – and third in the U.S. – appears to be behind us. Canada’s 7-day average rate of new daily infections fell again this past week, at just over 5000 versus the 6000 from a week ago. Once again, all provinces saw declines, with Ontario, Quebec, and Alberta leading the way. New Brunswick, which had seen a spike in recent weeks, saw a fall in its average. Meanwhile, the northern territory of Nunavut has seen no new cases in recent days, which is reassuring given a significant one day jump in new infections nearly a week ago. The U.S. also saw another week of notable progress. Its 7-day average rate of new daily infections fell below 150,000, versus the nearly 180,000 from a week ago.

A number of regions around the world – Malaysia, Peru, Brazil for example - haven’t seen the same kind of progress witnessed in North America of late. But, there may be more help on the way. U.S. biotechnology company Novavax released data from two clinical trials in recent days. Its vaccine candidate demonstrated an efficacy rate of 89% in the U.K., and showed it protected against the U.K. variant of the virus. Meanwhile, in South Africa, where another variant is prevalent, Phase 2 trial results demonstrated an efficacy rate of 60% in people without HIV. Moreover, Johnson & Johnson is expected to reveal results of its trials in the coming weeks. We see high odds of more vaccines being approved in the months to come.

Global Insight Weekly

While I’m busy repurposing other people’s good work, the Global Insight Weekly this week has a piece on a topic I had been planning to cover that is better illustrated than I would have been able to do it. The first article—exploring whether the stock market is overpriced and what to do if it is—is quite good. Their thesis: yes, it’s expensive, but not in a crazy way, and they think continue to advocate for an outsized position in stocks over bonds and cash.

Find it here: Global Insight Weekly

Whither inflation?

One issue that bears monitoring as we transition through the year is the likelihood of upward pressure on the prices of goods and services.

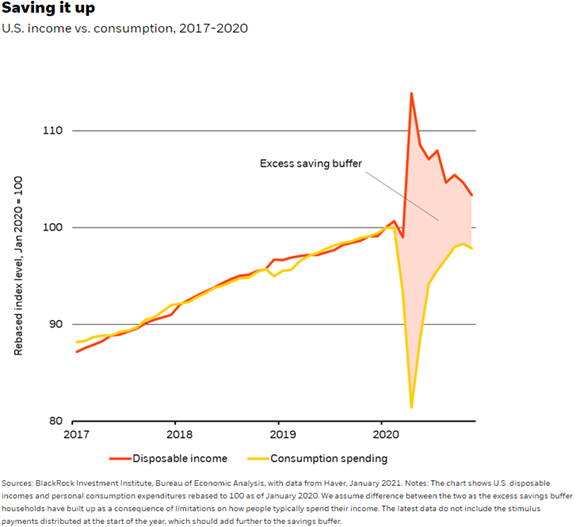

Inflation is most commonly measured by the year over year change in prices for goods and services. In 2020, the rate of inflation, particularly for services, fell precipitously at the onset of the pandemic. In the year ahead, we see potential for the economy to move from partially open to nearly fully open. That transition should translate into a meaningful acceleration in growth and consumption. Moreover, despite unemployment that remains elevated, there is a substantial amount of savings that consumers have accumulated following the actions taken by governments. All of this could stimulate an environment characterized by higher prices for goods and services this year. Look, for example, at this chart by Blackrock of the consumption and savings in the US. When that money comes back into the retail economy, we could see heavy spending in all categories.

A jump in inflation is normally a cause for concern. Anyone who lived through the early 1980s knows it wasn’t a fun time. First, it leads to higher input costs for companies, presenting an overhang to margins and earnings growth. In addition, central banks typically raise interest rates in an effort to curb price pressures. This has a tendency of acting as a headwind to growth. Moreover, the valuations of most assets – stocks and bonds – are heavily dependent on interest rates. Generally speaking, higher rates can lead to lower valuations.

This time isn’t different, but it’s not normal, either. And as a result, the increase in inflation this year may prove to be temporary. That was the view expressed by the U.S. Federal Reserve this past week. They believe the output gap, high unemployment, and longer-term pressures such as technological advancements among other things will impede inflation from permanently rising. They also reminded investors that they are prepared to have inflation run higher than their long-term target for some time before considering any change in its interest rate policy. This shift in their approach was announced last year as they admitted that inflation has more often than not fallen short of their long-term target.

I tend to agree with the approach and comments from the U.S. central bank. The global economy remains relatively fragile, and it is sensible to ensure the economy is on a sustainable path higher before becoming too preoccupied with rising inflation. Nevertheless, I wouldn’t be surprised to see the bond and equity markets wobble at some point this year as they adjust to a more inflationary environment where investors are likely to debate whether the pressures are transitory or more durable in nature.

Have an excellent weekend,

Sam