There’s nothing better than a sunrise

Sunsets get all the glory, and sure they're often brilliant, but there's something about the shift from darkness to dawn—that slight hint of light, then the breaking of the sun—that always gets my day off to the right start.

And there's nothing better than seeing it out the bow of your boat as you head out with rod in hand to chase fish up and down the shoreline. Something I haven't done nearly enough this summer.

This week we're seeing the first rays of sunshine showing in the COVID-19 story. The US is finally starting to see a break in their new COVID-19 cases, though test positivity levels are still entirely too high and their new case count (now down to +/-40,000 a day) is still 10x that of Canada on a population-adjusted basis. That said, Tennessee was the only state in the past week which had cases that rose over the week prior.

Here at home, we've signed deals with Novavax and Johnston & Johnston that will provide at least 88 million doses of vaccine once developed. Ottawa is also investing $126 million in a Montreal vaccine facility to bolster local production.

Listen to a replay of the Dr. Kennen Mackay discussion on the COVID-19 outlook►

Holy debts, Batman!

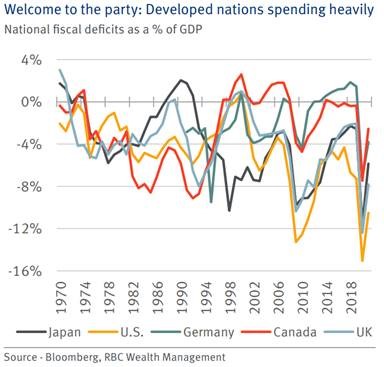

"This time is never different," except when it is, apparently. The COVID-19 response has been truly unprecedented, as governments around the world effectively put their economies into a medically-induced coma for a few months. In most of the world that was accompanied by massive government spending to stabilize individual and corporate incomes. As the chart above shows, we spent heartily over the past while. And someday, that spending will have to be accounted for (though, apparently, not yet). Obviously, taxation is a concern for many investors as we look to the future. There are really only three ways out of oversized spending: grow your way out, raise taxes, or lower spending. I think it highly unlikely that governments will have an easy time with austerity on the other side of COVID, so the most likely combination is to raise taxes and use some creatively optimistic growth projections to bury the rest of the debt.

While increasing the debt load of any individual country would typically be expected to weaken its currency, the picture is a little murkier when every single country does it on such a massive scale. Interesting to note, Canada had some of the lowest spending of major countries as a percentage of GDP, meaning that we might be able to sustain spending longer, or more easily reduce deficits in the future. Either way, high fiscal deficits and debt loads are more of a political issue than an economic one, especially with the cost of servicing that debt historically low. Until voters start to cry foul (and political parties start to complain about the incumbents' rampant spending) there really isn't much incentive for the government in power to jump the gun.

If we do see higher taxes in the future, the one concern I would have as an investor in Canada would be a higher capital gains inclusion. The Liberals and M. Trudeau have long called for increasing the rate from the current 50% to either 66.7% or 75% (the rate was 75% between 1990 and 2000). The NDP has also called for this, so if deficits become a campaign issue, both parties might be tempted to "tax the rich" to pay down the debt, ignoring the fact that 77% of Canadians have investments, and that doesn't include pension assets. Keep in mind, however, that "the rich" tend to hold much more stocks than "the rest" (see above, from the US) and it's not inconceivable that taxing investments would be feasible politically given the right spin.

Loan losses at the Canadian banks

Source: Thomson Reuters

The Canadian banks reported their third-quarter results this week for the period ending in July. As we suspected, some of the banks set aside smaller reserves for future loan losses than they did earlier this year. These reserves are used to help absorb future loan losses. Up until recently, the banks had been increasing these accounts by billions of dollars in anticipation of future delinquencies, mainly from COVID-related defaults as well as oil-sector losses. This quarter, some set aside less, which may be taken as a sign that they feel adequately prepared for any challenges to come. If true, this would be a very good sign for the stock prices of those banks.

Importantly, none of the banks have experienced any outsized loan losses to date despite the millions of jobs lost and business disruptions as the government aid, income support measures, and the banks’ loan deferral programs have delivered on their objectives. This development is positive, but not surprising. Investor anxiety with respect to the sector may fade in the near-term as there may be a greater conviction in the ability of the banks to continue to successfully navigate through this challenging period. We'll be keeping a close eye on it, though, since if the economic recovery falters as we head through the fall and into 2021, questions will arise as to whether more reserves will need to be set aside.

Cloud computing basics and benefits

We have a new post up on the blog from our Portfolio Advisory Group explaining why cloud computing has become so important so quickly.

“We’ve seen two years’ worth of digital transformation in two months…from remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security."

“We’ve seen two years’ worth of digital transformation in two months…from remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security."

Satya Nadella, CEO of Microsoft Corporation

Financial planning tip: Gradually unlocking your life income fund (LIF)

For those already retired, here is a strategy that may help you to gradually unlock your LIF on a tax-deferred basis. This could provide additional flexibility should you ever require cash from your LIF in excess of your annual maximum payment amount. The basic strategy involves moving the difference between the minimum and maximum amount every year from your LIF to your RRSP or RIF (without paying tax for the transfer).

Click here to read the full article► or just email me

Marginalia from around the web

Water, Water, Everywhere — And Now Scientists Know Where It Came From

Because of its proximity to the sun, it has always seemed that it was too hot for water to form on Earth, and it must have been seeded with it later on. But maybe that's all wrong. This is a short but interesting read if you're curious about our origins. Link►

Going all-in on remote work: The technical and cultural changes

If you own a business or manage a team, this is a must read. It's comprehensive, and includes opportunities and risks, a list of supplies to make sure your remote workers have, defining the corporate culture, and steps to prepare for a mixed workforce. Link►

Judged for what he wore: A first-time author writes about class and clothing

Aveeve sent me this brilliantly written and wonderfully candid piece on what our clothing telegraphs (true or not) to others about us, and making conscious choices about how we chose to present ourselves to the world (while being true to ourselves). Link►

5 habits of people who are especially productive working from home

Now that it seems that work-from-home is becoming the default and may be for some time, I’ve found myself trying to get a handle on staying productive in the much less stimulating environment of my home office. I have been trying over the past week or so to incorporate these five tips into my own day (to varying degrees of effectiveness). Link►