I’m typing this from the cottage right now as the sky blues above me following the brief hailstorm that just passed through. The mercurial nature of cottage weather is one of my favourite parts of the summer. I spent the past couple of weeks on a light working schedule from the lake, taking frequent work breaks to swim with Leila, take boat rides, and just enjoy the glorious weather we have been having this summer.

Global equity markets crept higher this week despite the lack of progress on a U.S. stimulus package. I argue that while the U.S. has been one of the best performing markets so far during this pandemic, the market dominance has been almost exclusive to the multinational tech businesses. A further U.S. stimulus package is less valuable to them than general global pandemic recovery would be. This week, I’ll address the dichotomy that has emerged on the virus front between the U.S. and much of the rest of the world, and the implications of the upcoming U.S. elections now that Senator Kamala Harris has been announced as the running mate alongside Joe Biden on the Democratic ticket. I’ll also touch on some reflections on the market’s resilience of late.

But, before I do anything else: this, from the brilliantly funny XKCD (link)…

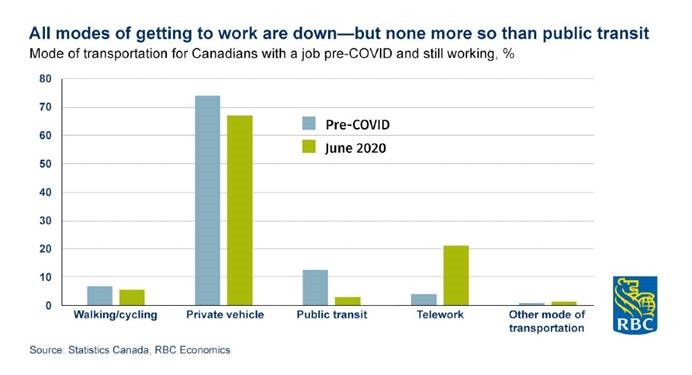

How are we all getting to work?

Here’s a study from Stats Canada showing the pre- and post- COVID transportation, and as you can see, all methods of getting to work have dropped off—which seems obvious. Telework has skyrocketed, as any of the professionals you know will likely attest (from their home offices, as I am). I actually find surprising that public transit has dropped as much as it has. As a long-time avid bus rider, it’s true that I haven’t taken the bus since April, but I would have assumed that the workers in jobs where face-to-face work is a requirement (retail, hospitality) as well as on-site work (construction, manufacturing, food processing) would have been over-represented on public transit. The easy replacement for public transit would be walking, and yet that doesn’t seem to have taken place.

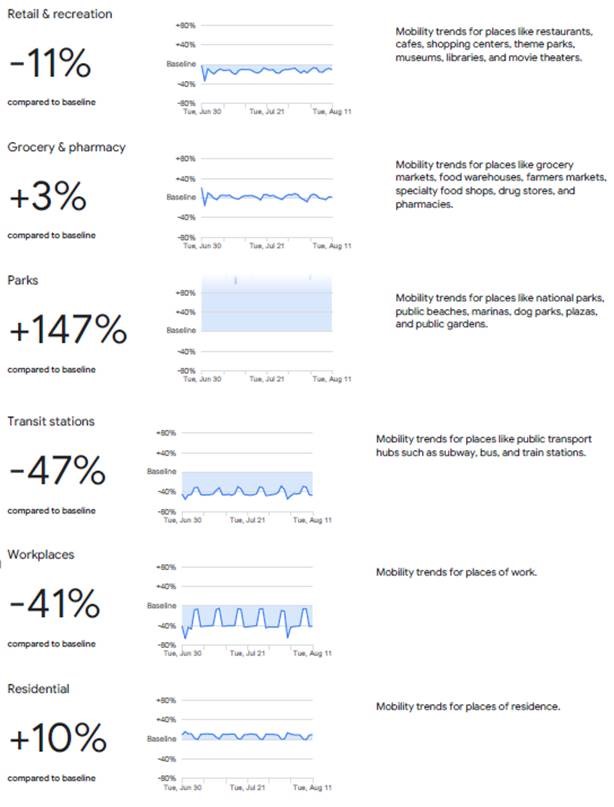

On the topic of what we’re doing during COVID-19, Google has a “Community Mobility Report” that tracks anonymous data on where its phones are moving around to in the world. You can look up the report for any country on Earth. I found the following few stats particularly revealing, and wonder what changes in society will become habits before the pandemic is a memory. Look, for example, how our retail is down -13%, grocery down -3%, but public parks are up a whopping 190% compared to the baseline usage! It plain to see when you’re out these days, and I love the troupes of bikers and walkers out at all hours of the day enjoying the world. I had a series of back-to-back conference calls / Zoom meetings the other day, none of which required me to be at a my office computer. I literally spent the whole day instead walking around the city, and Google would have found my phone in more than a few parks.

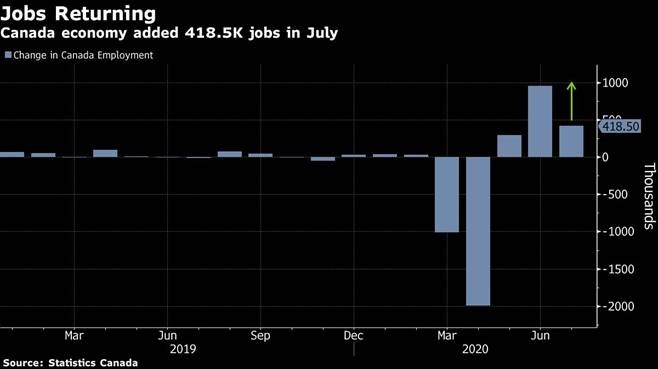

Employment Gains

Canada is far from “back,” but we’ve seen unprecedented job gains over the past few months as provinces have begun to open back up. After losing 3 million jobs in March and April, Canada added back 1.7 million in May, June, and July, including the just-printed 418,500 last month. That is 55% of the jobs lost, a far faster recovery than the U.S. so far seen (adding back only 42% over the same period). This doesn’t mean the recovery in jobs will proceed apace, and the argument can certainly be made that there will be diminishing returns as the remaining lost jobs are concentrated in industries still reeling from the effects of COVID-19.

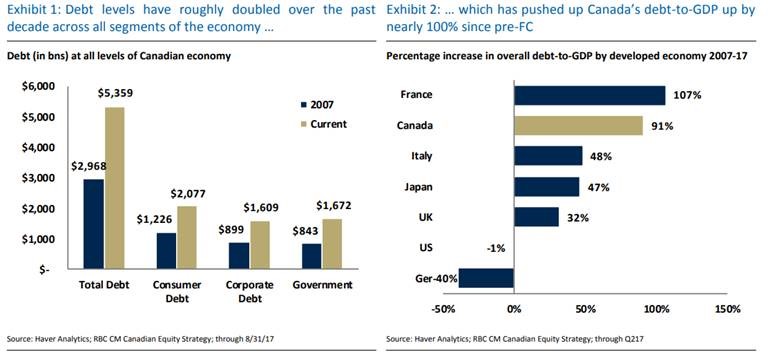

Bill Morneau, Canada’s Minister of Finance, presented a fiscal and economic snapshot of Canada last Wednesday, sharing that the estimated federal deficit for 2020-2021 will be a staggering $343.2 billion. This marks a sharp deterioration from last December’s expectation of a $28.1 billion deficit. The government expects Canada’s GDP to plunge 6.8% in 2020 followed by a reasonable recovery of 5.5% growth in 2021.

The announced deficit is driven by many factors. Stimulus is a key contributor, with total announced stimulus spending for 2020 totaling nearly $230 billion. Lower revenues and higher expenses are also meaningful contributors, both brought on by the economic disruption from COVID-19. Alternatively, lower interest costs on public debt from interest rates that have fallen sharply, will lead to savings of approximately $4 billion.

Now, this is fairly manageable in a world in which interest rates remain low and indeed, while the absolute debt levels have risen dramatically, the cost of servicing these debts has barely moved. However, each dollar of debt buys a lot less in terms of growth than it used to and given the high absolute levels of indebtedness, there simply may at some point be a tipping point at which the ability to pile on new debt becomes limited.

Morneau made it clear in his update that there remains a high degree of uncertainty around the economic recovery – both the speed and the degree to which it will occur. At the current juncture, the Federal government is relying heavily on public debt to cover spending, but they will need to be careful in managing this over the months to come. While the snapshot helped provide some clarity on Canada’s current economic and fiscal situation, we would like to see more actionable guidance from the Federal government regarding how they plan to manage stimulus/aid programs in concert with the compromised fiscal position.

Despite worrisome trends in the pandemic’s resurgence in the U.S. and elsewhere in the world, economic data releases this week continue to point towards recovering activity. The U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), initial and continuing jobless claims, Eurozone retail sales, and the Canadian Ivey PMI all came in better than expected.

The improving tone to the economic data, together with cautious optimism surrounding the progress of developing a vaccine, remain key pillars supporting the “risk on” sentiment in financial markets. While markets have exhibited resilience in recent weeks, we remain conscious of several risks that could keep volatility elevated in the months ahead.

COVID-19 update

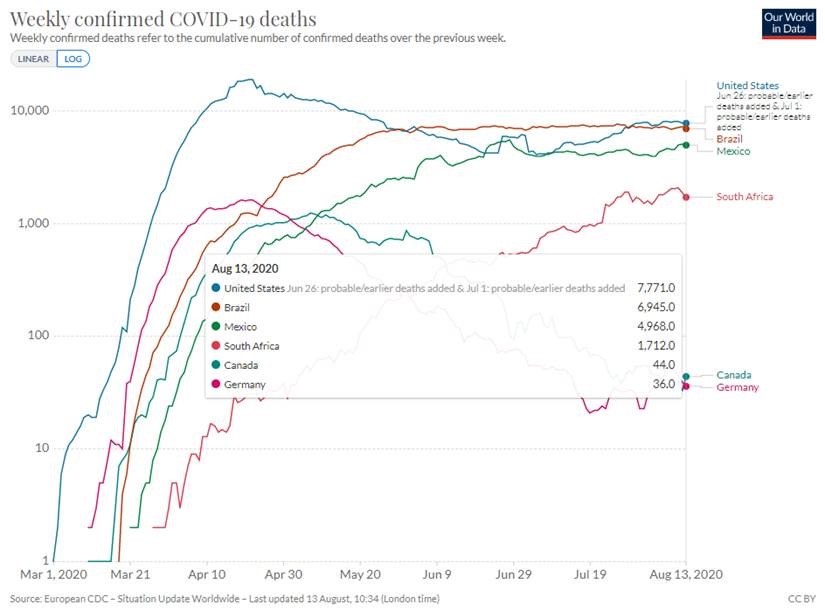

The United States sadly has re-taken the lead in COVID-19 deaths globally. Their weekly confirmed deaths were 7,771, beating out Brazil (though Brazil has 210 million people, so their per-capita weekly death toll was 40% higher than the U.S.). Compare that to Canada, with 44 deaths over the same week. If Canada had the same population as the States, we would have had only 380 deaths to their 7,771; if Germany were the same size, they would have had only 142 deaths. All positive news around novel therapies or vaccine developments, this is something that the U.S. is going to have to grapple with on the other side of whatever COVID-19 looks like from here on out. Hopefully, they are finally starting to turn things around down South: the U.S. has seen its number of new daily infections slow, particularly in states like Florida and Texas. Hospitalization admissions have followed suit and alleviated the pressure on the health care system. To be clear, the figure remains elevated, averaging more than 50,000 new cases daily. And there are states seeing increases. But, the national trend is heading in the right direction – lower - and suggests containment measures are working.

The trend elsewhere is arguably worse than it was a few weeks ago. Hotspots including most of Central and South America, India, South Africa, the Philippines and Indonesia have yet to see meaningful declines in new daily cases. Meanwhile, countries like Australia and Hong Kong have fortunately seen some stability in their recent outbreaks, though a trend lower has yet to materialize. More worrying is the resurgence of the virus in Japan and European countries such as Spain and France where new daily cases are trending higher.

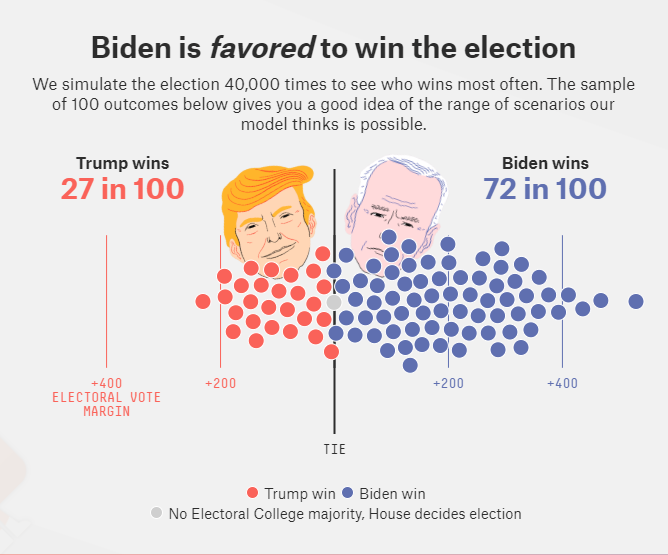

The U.S. election is coming up fast. There’s no sure information, but 538 just posted their election outcome forecast.

Source: fivethirtyeight.com

The U.S. elections are now just a few months away and the rhetoric will undoubtedly pick up sharply in the weeks to come. This week, Democratic presidential nominee Joe Biden announced that California Senator Kamala Harris will be his running mate. Vice President picks rarely influence election outcomes. While there may be some incremental impacts at the margin from this week’s news, we don’t expect it to shift the narrative much.

The race for the presidency understandably gets most of the attention. But, the legislative branches of the U.S. government will also be elected in November. The U.S. Congress is made up of the Senate (currently controlled by Republicans) and the House of Representatives (currently controlled by Democrats). Within Congress, there are certain rules that require enough bipartisan support for a law to be passed. This important division of power acts as a guardrail of sorts, and ensures that any sweeping policy changes have enough support from both Democrats and Republicans. In other words, there are checks and balances in the U.S. political system that ensure a President alone cannot drive policy.

With respect to election outcomes, we see three plausible scenarios: 1) status quo; 2) Joe Biden as President while the House and Senate stay unchanged; and 3) sweeping victory for the Democrats (President, Senate, and House). This latter scenario may pose the most uncertainty for the market as it could increase the odds of higher taxes and more restrictive regulation in the future among other things. Nevertheless, we think the elections are unlikely to alter the course of fiscal policy in the intermediate term as both Democrats and Republicans are incentivized to help their constituencies through this period of economic malaise. Furthermore, accommodative monetary policy, which has helped ignite the economic and market recovery is unlikely to change any time soon regardless of election results.

Market resilience

Many investors remain concerned about the current backdrop. After all, we remain in the midst of a global pandemic, with an economy that is recovering after a multi-month period of forced shut down. Much uncertainty remains. Nevertheless, global markets have been resilient in recent months. The widely followed S&P 500, an index representing the U.S. equity market, is higher today than it was at the beginning of the year. Elsewhere, markets continue to claw back much of their losses, though they still remain below breakeven on the year. While this may seem incomprehensible, there are some justifiable reasons for the resilience. More specifically:

- We are learning how to keep an economy functioning with the virus lurking in the background.

- Containment measures, assuming they are followed – mask wearing and physical distancing – have proven to be an effective way of limiting the spread.

- Health care providers have learned how to better treat patients.

- Governments continue to buy time for more healing through substantial aid to businesses and consumers.

- Central banks have aggressively lowered interest rates, incentivizing borrowers to refinance or borrow for new spending or investment. Moreover, they have ensured the proper functioning of credit markets.

- The scientific community is closer today to finding a vaccine, though this cannot be guaranteed.

- Economic momentum is improving, rather than deteriorating.

We have been impressed with the recovery, but remain vigilant given the elevated level of uncertainty. As always, we don’t know what will transpire in the weeks and months to come but will remain focused on ensuring that our investment plan can deliver the required outcomes of our clients.

Have an excellent week,

Sam