In the August edition of RBC's Global Monthly Insight, the Portfolio Advisory Committee highlight the following:

Political reality checks

As the U.S. elections approach, RBC looks at how the candidates’ policy prescriptions could play out under the most plausible election outcome scenarios, and discuss the checks and balances that could limit the impact of politics on financial markets.

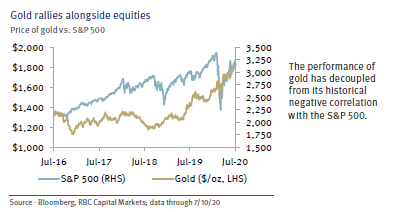

How good is gold?

Against a backdrop of investor uncertainty, market volatility, and central bank stimulus, the price of gold has reached new heights in 2020. RBC Capital Markets, LLC Commodity Strategist Christopher Louney discusses gold’s prospects in the second half of the year and beyond, and the precious metal’s relationship to macro trends.

Global equity: A long and winding road

RBC has pushed back the timing for full economic recovery by major economies, and would not rule out some GDP potholes along the way. But they believe the recovery is happening, with Europe’s pandemic response particularly encouraging. Jim Allworth, RBC Portfolio Strategist, brings insight to the bottom of the waterfall decline in late March. Jim explains stocks were being valued as if the COVID-19 pandemic was going to be followed by many years of unusually weak economic and earnings growth. But the strong rally from March into July has left most markets trading at valuations that imply the global economy will resume growing at its long-term potential rate once the pandemic has passed, driven as ever by growth in global population, productivity, and prosperity.

Global fixed income: Change of pace

The Jackson Hole Economic Symposium has been replaced, but questions regarding policy strategy remain. Expectations remain inflation will be a key focus at the new event. Thomas Garretson, RBC Senior Portfolio Strategist, explains Global central banks have struggled for years to hit inflation targets, and stable price growth has proved elusive as disinflationary forces have persisted. Though neither the Federal Reserve nor the European Central Bank is scheduled to meet this month, August may set the stage for an important September, particularly for the Fed and the outlook for monetary policy.