Good afternoon,

This past week felt like quite the bumpy ride as the market seesawed between modest gains and losses, punctuated by the sharp drop on Wednesday and the falling market today. This tug of war was somewhat fitting because it encapsulates an interesting dynamic. More specifically, the risks posed by the pandemic offset, for now, by the efforts undertaken by governments around the world to buy time for their economies to recover.

The TSX, S&P 500, and DOW, closed the day all in the red today and for the week. Markets came under pressure as Texas rolls back its reopening plans amid the rise in virus cases; Florida reports close to 9,000 new COVID-19 cases, a record single-day increase; Microsoft announces it will shut down its retails stores permanently; and Unilever announces it will pause social media advertising in the U.S. for the rest of 2020. Crude is also moving lower and has slipped below $38/bbl.

I have long talked about the coming economic shift that we see happening. This will likely not be a “V-shaped recovery,” nor will it be the dreaded “L-shaped recovery.” Instead, we expect a divergence of returns from this point forward, with some companies and industries seeing their prospects brighten considerably, while others will be hit hard by the aftermath of COVID-19 and the economic fallout that comes next.

Keep in mind—this doesn’t mean, “Buy the tech stocks, ignore the rest.” Instead, some of the best opportunities will be in the strongest members of otherwise disadvantaged industries. Traditional retailers that are best able to transition to hybrid online/in-person fulfillment (think Walmart, Canadian Tire, Loblaws, Lululemon), especially those well capitalized enough to make investments now will be able to handily outcompete their real-estate anchored, non-digital-native, cash constrained competitors.

We are looking out now to the next leg of the recovery, as well as to make the investments that will drive performance for the coming decade. At a time like this, it is important to take advantage of the short-term opportunities arising from mispricing of risks, but just as important to look for the drivers of the economy under the “new normal” that exists once the economy finds its footing once again.

We continue to believe that, looking back on now in five years’ time, we will be astonished by how much progress was made in such a short time in the realms of healthcare, artificial intelligence and automation, digitization and e-commerce, and the new industrial revolution (more on that in a later email). Also to come, in our minds, will be the things that have fallen off the map, so to speak, while all the air in the room has been taken up by COVID-19: environmentalism, energy efficiency and renewable energy, and resource utilization (both in efficient use and in coming supply tightening).

The COVID-19 update

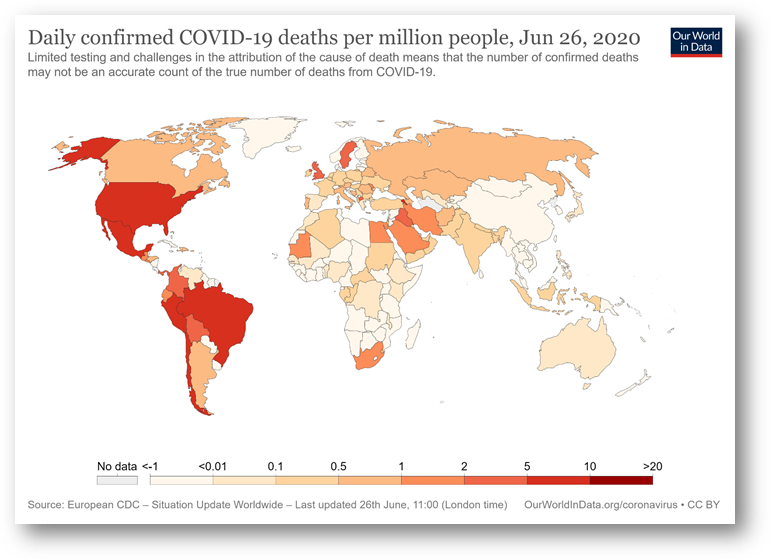

Some of the virus trends of recent weeks remain firmly in place. Positively, lower new infections in Canada and Western Europe. Meanwhile, Central and South America remain problematic with Brazil reporting new daily cases that exceeded 30,000. On the other side of the world, India, Pakistan, and Indonesia are three countries that are struggling with containing the virus’ spread, with record daily new cases reported this week, again.

The U.S. is where most have intensified their focus. The economy has shown signs of momentum over the past several weeks and there were expectations this would continue. However, virus trends in the country are now firmly heading in the wrong direction and pose more of a risk to the recovery than a few weeks ago. There is some nuance to the data. But, at a high level, the country is averaging more than 35,000 new daily cases, nearly double the daily level it had seen over the past month. Furthermore, the pandemic has become more widespread in contrast to the situation a few months ago when the state of New York was largely responsible for much of the country’s caseload.

Some of the U.S. increase is likely a result of higher testing. We have also seen evidence that suggests a higher amount of the newly infected in some states are meaningfully younger. This may help explain why hospital admissions and mortality rates nationally haven’t necessarily followed the new caseload meaningfully higher just yet. Nevertheless, it has become increasingly apparent that the spread of the virus is escalating and may need to be addressed.

China came back into focus this week after an outbreak of the virus in a Beijing food market. While the recent number of daily new cases has moderated, it has led to regional lockdowns, quarantining, and restrictions on travel to and from neighbouring regions. This comes after months of successful containment and illustrates the risk of the virus resurfacing in fits and starts.

Some positive news did emerge this week with respect to a therapeutic. A well-known steroid called dexamethasone, used to treat a range of conditions such as arthritis, asthma, and allergies, was found to help the survival rates of some of the sickest virus patients. While details are still sparse, this could improve the ability of the population to cope with the disease.

Government action

The Canadian government took action this week and extended one of its pandemic-related programs, the CERB (Canada emergency response benefit), by two months. As a reminder, this program was launched in April and promised to provide taxable payments of $2,000 per month for up to 16 weeks to Canadians who lost income because of the pandemic. The payments were set to expire in July for some of the 8 million Canadians who had applied. This announcement should help the country buy more time for its economy to recover. It has been costly, with the government confirming it had spent $45 billion in payments by the end of May, surpassing its initial estimate of $35 billion. Nevertheless, the program has more than likely helped the economy avoid an even worse recession than it is already grappling with.

The Canadian government is not alone in its efforts to find short-term solutions to help offset the economic damage. Governments around the world have undertaken similar responses and some continue to debate extensions and additional action. For example, the U.S. is discussing another round of fiscal stimulus that would add to the more than $2 trillion they have already announced. It too is also exploring an extension of jobless benefits that were implemented a few months ago.

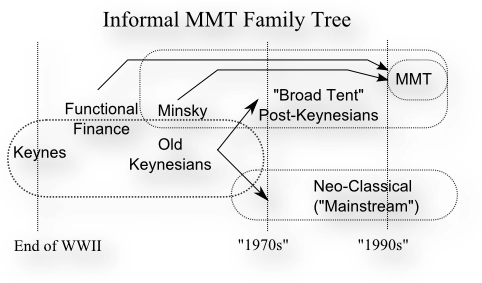

These aid packages are costly and will undoubtedly add to the high debt burdens that governments around the world are already wrestling with. But, that’s a problem for another day and something we will discuss in the future once this crisis subsides. For now, we believe the ongoing responses from governments globally are a key reason why investors appear to be looking past the pandemic and current economic malaise with a sense of hope and optimism towards the future. Who knows, we might all be boning up on our “Modern Monetary Theory” bona fides soon enough.

Political noise just getting started

I would be remiss if we did not briefly touch on the political commotion that is set to swell in the U.S. in the weeks to come. The first of many rallies occurred this past weekend with the Republican Party kicking things off in Tulsa, Oklahoma. Moreover, this is happening during the still growing social movement sparked by #BLM protests across the US, Canada, and other countries. Elections can have important investment implications and it is another factor, among many, that we have to think about as we manage portfolios. We will discuss potential political scenarios in future commentaries. For now, we remain focused on the pandemic and economic recovery.

And lest we fool ourselves, the looming US election is likely to increase the social pressure and inflame the divisions seen in society than it is to lessen them. The US is always divisive in their politics, and this election already is proving to be one of the more partisan in memory. A slew of polls came out over the past week or so showing that Joe Biden, despite running almost no real campaign to this point, has a commanding lead over Trump across the country, and, importantly given their Electoral College system, in most key battleground states. If the election were held today, Biden would certainly be the decisive winner. There is a long time to November, and many negative campaign ads to run between now and then. Don’t count either candidate out yet.

Furthermore, I believe that the influence of #BLM will not have lessened by November, and it shouldn’t. The success so far of #BLM has been astonishingly swift, with municipalities, companies, and individuals all being forced to grapple with their own role in the socioeconomic consequences of systemic racism in their societies. There are already real economic consequences being felt (look, for example, at companies finding themselves on the ‘wrong side’ of the equality movement), and I doubt that there is a board meeting or a city council meeting taking place right now that hasn’t at least taken the bottom-line consequences of their social messaging into account. Furthermore, I think that other social progress movements will also have their turn. Environmentalism has taken a backseat of late, as the “Social” and “Governance” parts of “ESG” analysis have taken the wheel. Don’t expect it to stay in the background, especially as the US election heats up. Countries and companies will all be reckoning with their environmental impacts. Interestingly, at nearly 30%, Canada ranks reasonably well in terms of the share of energy supply derived from renewable sources. By contrast, Japan and the U.S. have a lot of catching-up to do.

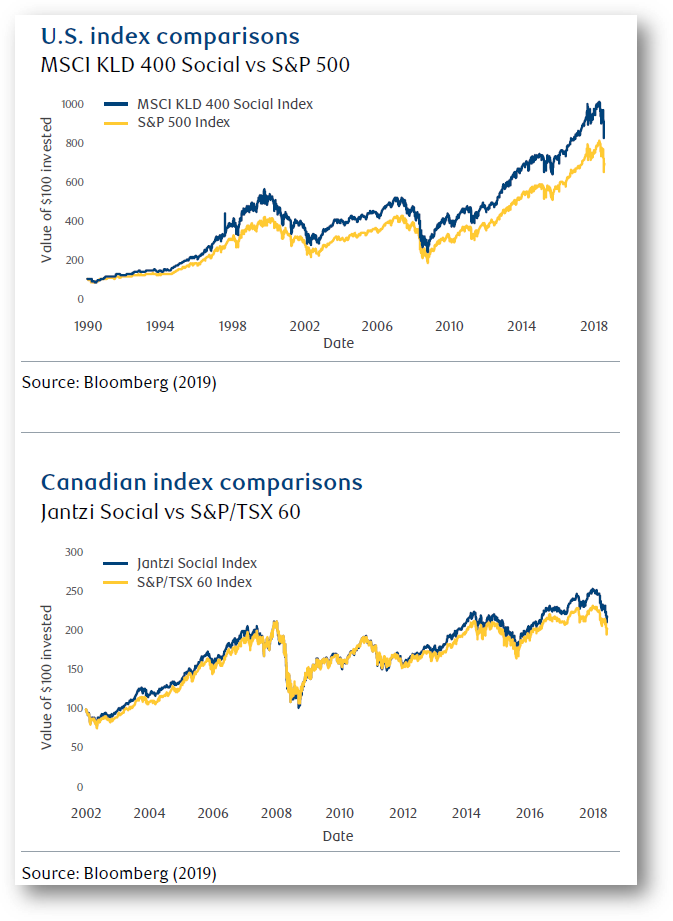

Not that altruism isn’t a useful goal in-and-of-itself, but there is a very good argument for buying companies who take social considerations into account when making their decisions: companies with good ESG principals have done better through the pandemic. No longer do you have to “sacrifice” return to sleep better at night. Instead, ESG funds (and the stocks contained within) have outperformed the broad indices, likely due to the fact that companies with good ESG scores also tend to have stronger balance sheets and are more forward-looking in their capital allocation decisions, so were involved in more of the industries that performed better during COVID-19 lockdowns. Moreover, the benefits of adding an ESG (or SRI, or Impact Investing—all slightly different emphases) slant to investments decisions isn’t limited to today. Indeed, ESG portfolios, in particular, when combined with traditional financial analysis, have been shown to have no downside effect on returns while lowering overall portfolio risk. A company with a high environmental score, for example, isn’t just good because it doesn’t damage the environment, but because it often is investing in technological innovations in energy efficiency and carbon reduction that lead to better earnings quality, better margins, and higher profitability. Or, as many companies are finding out today, having a high governance score reflecting a diverse board of directors and senior leadership means not only that you aren’t being singled out by a social movement, but that you have been proactively “walking the walk” which leads to better decision making and better penetration into diverse populations.

Have an excellent, hopefully very relaxing, likely very hot weekend (or extra-long-weekend, if you’re stretching it out through Canada Day). For my part, we’re currently in Kenora, enjoying what has been promised to be a very sunny few days. If today is any guide, I’ll be sad to pack up my bags and head back to the city when the weekend is over.

All the very best,

Sam