I’m getting to this early this weekend because I should be on the road to the cottage tomorrow. It seems odd to be starting summer this late, especially with the weather already so nice. We’re heading down to see how the camp fared over the winter, and how bad the damage was of the bear who decided to set up shop for a week in the fall. Leila’s certainly ready for summer (pictured here with her grandparents, who we’ve added to our “bubble” now that Winnipeg COVID-19 recovery seems to be on course). The dress is a 1980s original, made by my mother. I think Leila looks pretty stylish in it.

Already…a vaccine development update.

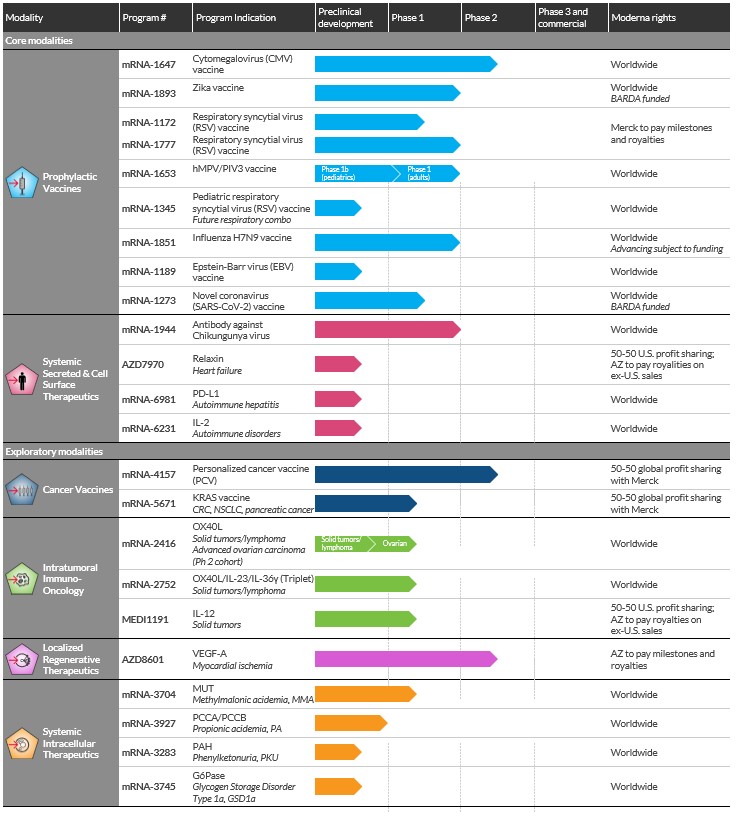

The biggest thing driving markets this week was the first green shoots of optimism. A company called Morderna released very preliminary results of a promising potential coronavirus vaccine. Interestingly, the vaccine, mRNA-1273, is built on Moderna’s mRNA platform which is an interesting new vaccine platform that uses mRNA instead of viral antigens in the vaccine. The mRNA then instructs our own cells to make the antigens, which are then used to prime the immune system. In theory, this is an incredibly flexible platform that could be used for the next pandemic, as well as other medicines.

Moderna’s current mRNA platform pipeline. From their website at www.modernatx.com.

Keep in mind that as with most early stage clinical development, there are some extremely important caveats to consider. This study included a very small sample size (45 individuals), and the company provided very little disclosure and data for analysis. To be honest, any potential vaccine news is surprising this early in the game, so whether this it “the one,” it’s at least promising that so much productive research is proceeding at such a rapid pace. This is one of nearly ten human trials and more than a hundred pre-clinical trials (the stage of research that does not include human subjects) underway around the world.

Ugh…China again.

There was also more progress on the easing of restrictions and reopening of economies. Offsetting this to some degree was the ongoing struggle to slow the spread of the virus globally, particularly in the emerging markets. The week is ending on a sour note on renewed tension between China and Hong Kong, which will likely have global ramifications, as well as renewed calls by the US president to end the detente in the US-China tariff war.

China recently announced that new national laws are being imposed on Hong Kong. We see this as being yet another potential source of stress in the relationship between China and the U.S., and another opportunity for the “blame China” politicians (who certainly have some basis for their criticism) to air their grievances. While justified to some degree, we view rising anti-China sentiment as unproductive for markets, so this is something we’ll be watching closely. Of note, the US Senate recently passed a resolution that would, if turned into law, make it harder for Chinese companies to list on US exchanges. A lot of the reporting suggested that the law would “remove Chinese companies from exchanges,” which isn’t the case—it’s a lot weaker than that and really just imposes stronger reporting guidelines to be met, but its easy passage speaks to the growing anti-China sentiment that is starting to show its head. This, while China’s economy seems on the road to be the first in the world to get back to some semblance of normal.

And, on the even less thrilling side…the Canadian banks.

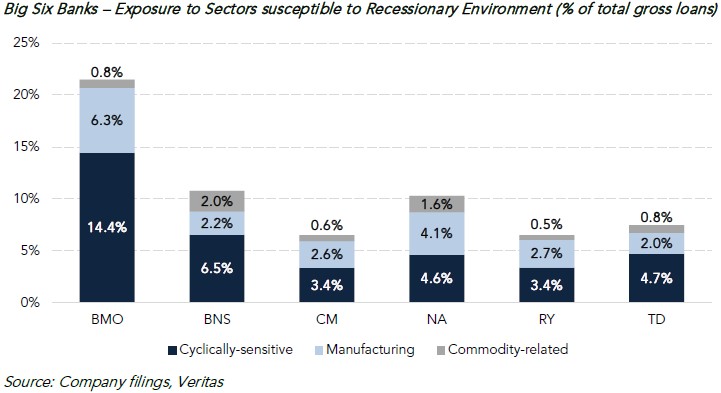

The Canadian banks are set to report second-quarter results over the next week. This is a particularly important update. First, the banks tend to be a good gauge of the health of our overall economy. The results for the period of February through April, and management commentary on the outlook, will offer clues about the extent and trajectory of economic damage in this country. Secondly, the banks represent a meaningful portion of most Canadian investor portfolios. If the U.S. banks, who reported their own results weeks ago, are any indication, the results are not likely to be very good.

This bad news may already be expected by the market and the bad news might already be priced in. The stocks of the banks are already trading at valuations that we last saw during the Great Recession in 2008. On first blush, that probably sounds like bad news, but in reality, it’s likely not. What this signals is that investors already expect the companies to face higher risks in the form of future loan defaults and customer bankruptcies. While these loan issues may not arise immediately, the banks have to effectively budget for them in advance and it is widely expected they will begin to do so with the release of their results. We take some comfort in the strong capital positions they have accumulated in recent years that can help provide some cushion against the credit losses that may come. While earnings may be volatile and balance sheets will be tested, we believe the banks will continue to offer sustainable dividend income for investors.

Links.

· The most fun thing I read this week was, “Doordash and Pizza Arbitrage,” by blogger Ranjan Roy. In it, he details the story of the time that he and a friend who owned a pizzeria figured out a way to get some risk-free profit out of Doordash.

· John Stackhouse, RBC’s in-house futurist, put together a fascinating piece titled, “8 Ways COVID Will Transform the Economy and Disrupt Every Business”, which relates well to the theme of technological acceleration that I teased last weekend. This is a must-read for every investor.

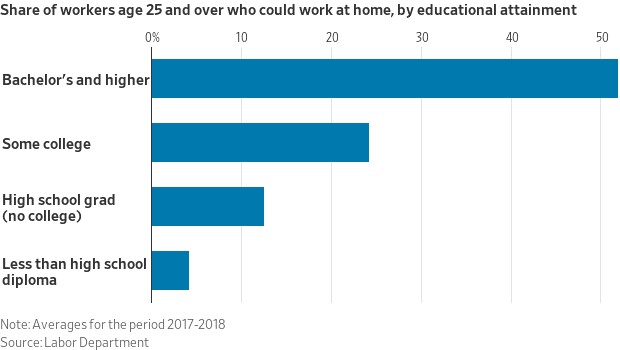

While I’m on the topic, here’s an interesting chart I found (from US data) of the potential for work-at-home to become a sticky part of the economy going forward.

· The most fascinating thing I read (well, the most wild story, anyway) was David Gauvey Herbert’s piece in Bloomberg, “The King of Germany Will Accept Your Bank Deposits Now.” Peter Fitzek claims, among other things, the Reichsbürger movement, a theory that Germany is not a country but an LLC controlled by Allies after WWII. But wait, there’s more…Freemasons, Rothschilds, cultists, a laser cannon. And that’s just the lead-in.

“And now, for something completely different…”

Please have a great rest of your weekend, and an excellent week next week. As we move into the (hopefully) next phase of the economic and financial recovery, you will no doubt have questions about what the future holds, and how it relates to you (or your family, friends, and clients). As always, know that our team is happy to help in any way. We are never more than a phone call (or an email, a WebEx, or whatever) away.

Sam

_________________

Samuel S. McLaughlin, FCSI | Vice President | Portfolio Manager & Wealth Advisor | McLaughlin Capital Management | RBC Dominion Securities Inc. | p:. 204.982.3967 | m:. 204.510.9479 | w:. mclaughlincm.com | http://www.linkedin.com/samuelsmclaughlin