It has felt like a surprisingly slow news feed these last two weeks, which is amazing considering during that time: 8 of 10 trading days had intraday high-to-low changes of more than 2%; the Bank of Canada agreed to purchase $50 billion provincial and $10 billion corporate bonds; it was announced that a million Canadians lost their jobs in March, and there are now 22 million in the U.S. unemployed; an oil agreement was reached in the price war between Russian and Saudi Arabia, brokered by Mexico; and the U.S. crossed 700,000 COVID-19 cases with 38,000 deaths.

On the home front, we continue to struggle to find enough to occupy a highly active two-year-old, while both of her parents work from their shared home office (and occasionally the spare bedroom) as best they can. I haven’t had a haircut in too long now, and I’m considering whether I would be better to let Aveeve attempt to cut it, live with shaggy locks for another few weeks (at least), or just throw caution to the wind and give Leila a pair of safety scissors.

For a cute distraction, check out this link. Leila threw on her cowboy boots, filled her backpack full of books, and presented herself at the door asking to go to grandma and grandpa’s house, “on my own.” Of course, we obliged. Here she is trying to get around the side of the house where her tricycle is kept. She was not successful. But she did get dessert.

Silver linings are starting to show up all over the place in COVID-19

On the COVID-19 front, specifically, we are seeing what is hopefully the start of the end for the virus’ hold on society. It’s hard not to marvel at the scale at which resources have been rapidly deployed in searching for a treatment. Health care professionals and researchers are collaborating across borders in an astounding way, and information sharing is unprecedented (and yes, I’m getting as tired of that word as you likely are, but expect to see it a few more times in this piece). As I write this note, there are currently 614 clinical trials for drug treatments for COVID-19, and 78 vaccine programs underway. Society will prevail, as we have every time we cared enough about a goal.

More good news comes on “the ground” in the COVID-19 fight. We are seeing new case counts rapidly decelerating across countries like Italy, Spain, and Germany. This is enabling them to begin to slowly ease certain lockdown restrictions. Here in North America, it looks like we, too, may be close to entering this new phase. Still, I am certainly wary of calling it too early, and worried that the U.S., in particular, is moving too quickly to call an end to social distancing measures. And a number of countries – the United Kingdom, France, Turkey, India, and Brazil for example – are seeing new case counts with no evidence of slowing while Japan and Singapore have seen a reacceleration in cases forcing an escalation of restrictive measures. As much optimism as I have, it is tempered by the knowledge that we’re not “there” yet. That said, it finally looks like we’re moving from asking, “When will the new case counts level off?” to, “When and how will the lockdowns and social distancing measures get lifted?”

The progress is encouraging given the outlook was relatively bleak just a few weeks ago. But it remains to be seen how quickly people’s behaviour may return to “normal” until effective treatments or vaccines are readily available. On this front there have been encouraging developments, as well, but it is likely too speculative at this point to make any conclusions.

Oil agreement has limited impact for now

In March, oil prices fell dramatically as a result of a combination of the pandemic and a standoff between two of the world’s largest oil producers: Saudi Arabia and Russia. Under meaningful pressure, they, along with a few other oil-producing countries, came to an agreement over the past week on coordinated production cuts that last through 2022. The market’s reaction was muted as investors are rightfully preoccupied with weak demand that is occurring as a result of the global economic lockdown. But this agreement is particularly important in that it should help avert a worst-case outcome—breaching the global storage capacity—that could have resulted in even stronger downward pressure on oil prices.

The other markets are being largely ignored for now (and probably shouldn’t be)

Look at the chart below, describing China’s outperformance against the other emerging markets. China is far and away in a class of its own, with returns that have skyrocketed in comparison to its peers through COVID-19. The MSCI Emerging Markets ex China Index is now back to its level from 2009, where all of the COVID-19 damage has only dragged the MSCI China Index back to about the start of 2019.

Latin America has fared even worse, having been hit with COVID-19 shutdowns while economies across the region were already extraordinarily fragile and had been falling for almost a decade straight. The index is now back to 2002 levels! See below.

But it is not all bad news going forward. The International Monetary Fund has more than $1 trillion in its war chest, (as much as 25% of all emerging markets outstanding debt) and stands ready to deploy it as necessary. This is more than the IMF had at its disposal during the Asian financial crisis of 1998 and the global financial crisis in 2008. This should provide excellent support to nations that can’t spend their own money on stimulus packages and payroll protections.

Earnings come into focus

This week marked the start of the first-quarter earnings season. Expectations are low and are even worse for the next quarter given anticipation the global economic weakness may persist for the bulk of April, May, and June. The U.S. banks were the focal point this week as several of them reported results. Unsurprisingly, they were not good. Most are building vast reserves of capital in anticipation of future loan losses as unemployment rises and businesses customers may have difficulty repaying outstanding debt. Fortunately, the North American banking system is much better capitalized compared to the last recession, which should help them weather this economic storm. The challenge for investors, and bankers, lies in trying to assess how long this one may last. Should it extend beyond June, more reserves may be needed.

Hundreds of other companies are expected to report results and provide updated commentary on the economic backdrop in the weeks to come. It’s hard to imagine these businesses having any more insight into when the economic challenges will subside. Indeed, I think that investors will have to steel themselves for a spate of earnings that are zero or negative, something that should be shocking even if we expect it. As a result, we continue to anticipate uncertainty and volatility to remain elevated for the time being. This next couple of weeks, however, may unintuitively hide some good news. If markets don’t overreact to the horrible earnings, it may be confirmation that capitulation has indeed taken hold. Bad news not being able to shock investors any more has, in all previous recessions, spelled the start of the turn. Market analysts start to concentrate more on the eventual recovery than the damage ahead, and asset prices start to rise. This may have already started. Who would have thought that with all the bad financial news last week that the market could end up (if only slightly)?

Jobs, jobs, jobs (or lack thereof)

The jobs story, in Canada, the U.S., and around the world, has no precedent. As I have said in prior emails, this needs to be taken in context, as this is a “faultless recession,” with no massive asset bubbles popping, no wars happening, and no irresponsible government overspending to blame it on. Once the COVID-19 crisis is in the past, presumably, we can open the factories back up, dust off the items in the shops, and get back to consuming the way we used to. That said, the depth of the drop in employment is hard to ignore:

My brother Roy also updated the graphic I sent out a couple of weeks ago on the U.S. unemployment to take into account the new data. The picture is even wilder now:

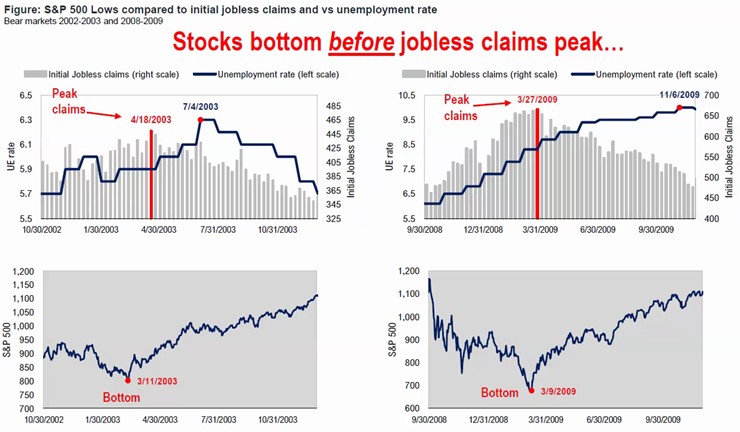

Keep this in mind as you look at the chart and graphic above: look at the chart below. It’s from Fundstrat and shows that in prior recessions the market typically turns before the bottom of the worst of the jobless claims happen, again reminding us that markets are forward-looking, anticipating what the future prospects of companies, consumers, and economies are, not the past earnings, spending, and growth rate.

Whenever this market turns, however, it is important to keep in mind that dollars invested today will eventually be outstanding investments. Here are all the prior post-war recessions and the returns on the S&P 500 and the TSX looking forward:

Paying for it all

One question that remains to be answered in any meaningful way is: how are we going to pay for all of this? We are right to be throwing everything-and-the-kitchen-sink at the economy right now, and ensuring monetary support is flowing to those in most need is the most important thing we can do. But at some point, sometime, we are going to have to figure out what this global spending means for individual economies.

To be sure, if one country decided to take these extreme measures, both fiscal and monetary, during a time where we didn’t have a severe recession and a financial crisis on our hands, it would cause a significant devaluation of their currency (capital outflows), a colossal erosion in central bank credibility, and a spike in country credit risk. Making these policy decisions in cohesion erases this immediate threat, but it won’t occur without some form of repercussion. Hopefully, the fact that pretty much everyone is in the same boat means that the path out should be cleaner than if there was some regionality to it.

There may be a silver lining in all of this in Canada. Take a look at our Bank of Canada balance sheet in comparison to other countries:

Source: RBC CM

We may feel at home like we’re spending money we don’t have, but in the context of our global cousins, we are Scrooges with fiscal stimulus. What this hopefully means is that we have the power to significantly raise our debt levels if needed, and if not required (because we are being responsible and spending funds “the right way”) we can potentially come out of this in a better place than some of our more open-walleted counterparts. To be clear, we don’t have the borrowing power of the U.S. or the E.U., but we do have a stable economy, an educated workforce, a lot of natural resources, and a technologically advanced industrial sector. We have room if we need it.

This isn’t the end, but it’s also not the beginning

Know one thing: we are watching all of this carefully. There will be a torrent of earnings releases in the next week which will likely show that some companies are excelling in this environment while others are decidedly damaged. That is why careful, active management of investments is so crucial to long-term performance. And it’s long-term performance that really matters because financial planning is a long-term exercise that takes into account your required cash flows, your time horizons, your unique risk situation, and your family. Bear markets and recessions are the noise that prove out the planning that you put in place before they happened. And while there is no “right time” to buy a stock, or a bond, or an investment property, history has shown that times like this are certainly more “right” than not if an investor has the ability to ride out the turbulence. If you have funds on the side, now is truly the time to consider what your timelines for that cash are and whether you should be putting that cash to work.

I look forward to speaking with you very soon. Please enjoy your week, stay healthy and safe, and reach out if you need anything.

Sam

_________________

Samuel S. McLaughlin, FCSI | Vice President | Portfolio Manager & Wealth Advisor | McLaughlin Capital Management | RBC Dominion Securities Inc. | p:. 204.982.3967 | m:. 204.510.9479 | w:. mclaughlincm.com | http://www.linkedin.com/samuelsmclaughlin

My Team

Erin Wiebe, FCSI, Associate Portfolio Manager | strategy & portfolio management; client service | p:. 204.982.2684 | e:. erin.wiebe@rbc.com

Natasa Ilic, Wealth Associate | wealth planning; administrative; scheduling | p:. 204.982.3961 | e:. natasa.ilic@rbc.com

Linda McLaughlin, Associate | account administration; trading; office management | p:. 204.982.2656 | e:. linda.mclaughlin@rbc.com

Jan Melnychuk, Associate | account administration; trust & estate administration | p:. 204.982.6882 | e:. jan.melnychuk@rbc.com

Remi Laurencelle, Student | marketing; special projects | p:. 204.982.2647 | e:. remi.laurencelle@rbc.com