Good afternoon,

After another eventful and busy week for us, I wanted to take an opportunity to share some of our internal news and deliberations with you. I also wanted to remind you that we remain open for any discussion that you’d like to have regarding your portfolios, our thoughts on the current volatility and the route forward out of this, or anything else that you might be enquiring about. In this note, which may run rather long by the time I’m done typing, I will hopefully touch on several key topics:

- What we’re all up to

- How we have and are planning to create value in your portfolios:

- Investment changes

- Tax-loss harvesting

- Taking advantage of currency gains

- Investment changes

- Our thoughts on positioning going forward

- Low oil prices

- Current support coming from the Canadian government

- Some good news on COVID-19 that we think will eventually change “the narrative”

What we’re all up to

Starting at the beginning of the week, three of us went remote, while three of us are still in the office. Remote working is going smoothly. I’m thankful at a time like this that we have practice at this and aren’t trying it for the first time. What has been amazing is having Leila and Aveeve so close; I’ll admit to sneaking “out” to visit, and without a commute I am able to get in an extra half hour on either side of the work day that I wouldn’t regularly enjoy. This time has also reminded me how exception the team of people I work with is. This has obviously been a challenging time for all of us both professionally and personally. Every member of the team has taken everything in stride, has looked out for our clients in exceptional ways, and has supported me in everything I’ve needed to get done as well as supporting each other professionally and personally. I am thankful to have them as co-workers and as friends.

How we have been and plan to further create value in your portfolios

We are currently experiencing some of the sharpest moves – both up and down – in stock prices that we have witnessed in some time. It feels particularly extreme because of where we just came from. It has only been a year or so since we left behind a decade of unusual calm in the markets. The emergence of a pandemic has been the unforeseen catalyst that has driven this bout of heightened volatility. This has been exacerbated by a combination of the velocity of news (particularly via social media), fear and panic, illiquidity in the bond market, and the broad adoption of technology-driven trading.

We are not now and have never been market-timers or heavy traders. I don’t believe that actually adds value as often as it removes it. What we are is asset allocators and we invest through good times and bad. In our view, market volatility is most often an opportunity. Portfolio rebalancing is the most important tool in finance. As the market fell, we started to put small amounts of cash in portfolios to work. We believe strongly in a disciplined approach to investing, and that discipline had gifted us with some overweight cash positions in portfolios. The other side of the discipline coin is to have a plan to look at valuations and long term expected returns. This means taking advantage of companies, industries, and economies where we see opportunity instead of calamity in falling prices. There are a huge number of companies that will not be affected directly by the COVID-19 closures, and in fact many are primed to benefit from things like remote-working, digital payments, online ordering, government intervention in the economy, and low interest rates and oil prices. We are working with our portfolio advisory teams, outside analyst research, and other strategist opinions to come up with the best investment stance going forward, and as we do that, we are making strategic shifts to the holdings in your portfolios.

As we do these changes, one thing will be of particular benefit to you. As I’ve said before, we were fortunate that we had been taking profits prior to these market moves. Profits in a taxable account come with a tax bill from the gains, and now that we’re in the world we are in, we will be paying special attention to companies our clients own in taxable accounts where we can sell at a loss and replace with a new (more timely) purchase or with a similar company with similar prospects (think of selling one grocery store and buying another). This will have the effect of saving you money when you file your year-end taxes. On the other side of the coin, we have a number of positions in US dollars that have benefitted from the drop in the Canadian dollar against the US. We will also be looking for opportunities to repatriate some of your US money, likely by selling a US company and buying its Canadian equivalent.

The spread of COVID-19 is the key issue. The only proven way to slow infection rates is through social isolation and quarantine. It’s been successful in China and South Korea to some extent, and we are awaiting results in Italy, which has undertaken similar action. Elsewhere, other countries have escalated their containment efforts. It will take at least a few weeks, if not longer, to gauge whether these actions are enough to slow the rate of infection. Ultimately, governments have to sacrifice their economies to some extent for the sake of society’s welfare.

Our thoughts on current and future positioning

Governments and central banks have stepped up their efforts considerably in recent days. While more may be needed, it is clear that governments are taking more aggressive measures to limit the spread of the virus. Moreover, many have or are expected to announce significant fiscal measures – from emergency loans, to tax relief, to direct payments – to help alleviate the pressures that consumers and businesses will face over the weeks and months to come. Meanwhile, central banks have aggressively lowered interest rates but more importantly have undertaken a variety of measures, including coordinated policies, to improve liquidity conditions and ensure that businesses have proper access to credit should they need to borrow money.

Investors will need to prepare themselves for economic data that will deteriorate markedly in the weeks and months to come. One needs to only look to China to appreciate the severity of the weakness – readings for industrial production and retail sales fell substantially during its period of lockdown. But the degree of the fall in stock and corporate bond markets suggests markets are already reflecting high odds of a recession. The important question now is whether the measures that have been taken – and may yet be taken – by governments and central banks are meaningful enough to limit the impact to a period of months and a mild recession versus something that extends well into the second half of the year and is deeper in nature.

In the near term, we expect these large swings in prices to continue. In our experience, basing investment decisions on extreme scenarios and trying to make large portfolio shifts in today’s environment of big price swings is very challenging. It may be too focused on the short term and may do more harm than good given the increasing intervention by policymakers designed to stabilize the economy and eventually reignite economic growth. Past experience reminds us that market declines often end in a climactic fashion. But no one has the ability to accurately predict exactly when that will be.

We are committed to remain disciplined in our investment approach. This means: focusing on your long-term objectives and ensuring your portfolio is properly structured to deliver your required long-term outcomes.

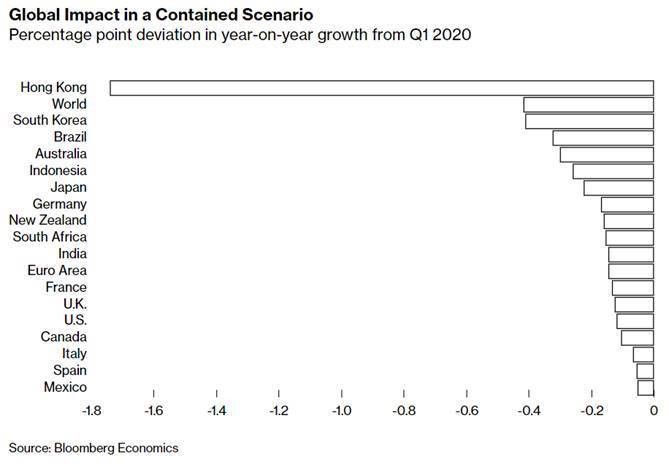

One thing to keep in mind as we look forward will be supply chains. China may be stabilizing and opening plants up now, but companies that rely on China for intermediate manufactured goods (think things like car parts) will face delays and shortages until China’s supply chain is fully operational again (see the graphic below for countries most affected).

Even in a best-case scenario, the so-called “contained” scenario, the loss of production for months upon months will cause major damage to world GDP growth (see the chart below for expected GDP loss if effectively contained). The hope is that demand going forward from the point of containment will not be adversely affected and we will pick up where we left off. That is undoubtedly overly Pollyanna-ish a stance, as individuals in the economy are being harmed in large ways and small today, but something between the best- and worst- case scenarii would still be reasonable and would still leave room for corporate earnings projections (and stock market prices behind them) to be reasonably strong looking out to future years.

There are a few major reasons why our portfolios have performed as well as they have in the face of the diving markets. If you’ve talked to me over the course of the past couple of weeks, you’ll have undoubtedly heard me express some humility. None of this is the result of some special knowledge or some stock-picking prowess. It is the result of little more than process-driven investing. As valuations were moving up into the end of last year and the start of this year, we were slowly moving down the average risk of portfolios. No one saw COVID-19 coming, and when information about it started to trickle out of China, no one initially knew whether China would contain it or whether it would spread as it has to every other region of the world. But if investors had already been lightening up on risk, they were obviously not immune to the global price shocks, but were somewhat protected. And their portfolios will be the ones that are in a better position to take advantage of market recovery when it happens. And it will happen. The question we are all searching for everywhere—in financial and personal affairs—is when.

Thoughts on current oil prices—the other shock that everyone has forgotten

Even before COVID-19 burst into our collective lives, there was another issue for markets. OPEC and Russia were just in the beginning days of a price war that has now driven the price of West Texas Intermediate Sweet Crude (the “WTI” people usually quote when talking about oil prices) down to just over $20 from a high of over $60. This has enormous effects across the global economy, both positive and negative. Low oil prices mean lower input costs for a number of industries, and lower shipping costs for everything. In the context of Canada and the United States, both major oil producers and both with relatively high production costs compared to Saudi Arabia and Russia, it also has a hugely deleterious effect on our economies as a whole. As one of the most expensive forms of oil production, US shale is the biggest loser. The average break-even cost of a barrel of US shale oil is around $45, which means at the current $22 price means that the drillers are losing money with every barrel they pull out of the ground. Although there is no clarity on how long the oil price war is likely to last, neither Russia nor Saudi Arabia can afford to engage in a prolonged market-share war. Russia could burn through its $150 billion national wealth fund in roughly three years in a market-share war, while Saudi Arabia could burn through approximately 10% of its foreign reserves, when export prices fall to $30 a barrel and Russia's exports rise 200k barrels a day and KSA's rise 2 million barrels a day (see table below).

Our contention here is that the oil price war, just like the COVID-19 fight, has an end. The path through to that end, however, will determine what kind of damage is done on the way there. As with everything, low oil prices do represent an opportunity for some companies and some industries, and we are balancing those considerations with other drivers as we contemplate how to navigate the future.

Current supports coming from the Canadian government

I am, at a time like this, quite proud to be a Canadian. We are a hardy people (maybe owing to long, cold winters), and we are taking the current situation in stride. Our leaders in Canada, from the Prime Minister to the Premiers to the mayors and reeves, have all been fantastic, too. There seem to be no party lines in this crisis. PC, NDP, Liberal. Everyone seems to be on the same page, and instead of searching for problems with each other, all levels of government seem to be looking for ways to reinforce and support each other’s policies and messaging. Watching the news out of the States as a comparison, I firmly believe that we are doing as good a job as one might hope given the uncertainty in outcomes and the speed of the contagion. Two days ago, the Canadian government posted their “COVID-19 Economic Response Plan,” the entirety of which can be found [here]. It is expansive, well-balanced, and—most importantly—massive and broad-based in its support. There are too many initiatives to list here, but there’s almost something for everyone in the plan. It injects a massive amount of money into the Canadian economy, over $27 billion new funds and $65 billion in new credit and tax deferrals, there are specific supports for small- and medium- sized businesses, and there are a number of actions to help individuals and the economy writ large. Governments around the world are enacting similar plans of varying size and precision. The expectation is that this will provide the floor that economies need under themselves as they work through COVID-19 disruptions and allow those economies to resume somewhat normally on the other side.

Some good news on COVID-19 that we think will eventually change the narrative

A lot of the ideas below I am cribbing from an email passed on to me written by Peter Diamandis, the author who wrote Abundance. Most of the information has been updated as new information has come out (the email was sent about a week ago), and I have added a few more bright spots, but I wanted to make sure he got credit for the inspiration.

A) Social distancing, heavy testing and contact tracing, and travel restriction do work. Speaking anecdotally, here in Winnipeg people are taking things seriously. And it seems to be making a difference. As of last night, Manitoba has had two days with zero new COVID-19 cases. We had an 18th case just this morning, but this, too, was travel-related and we still haven’t seen any confirmed community transmission. There is a backlog in test kit results, so no doubt we won’t stay at 18 cases forever, but the recent information is indeed heartening news.

B) Just like during the recent Ebola outbreak, Canadian researchers are at the forefront in the COVID-19 fight. A group of Canadian scientists were the first to isolate the COVID-19 virus [link], which means that scientists around the world can now replicate it to test against drug candidates and potential vaccines.

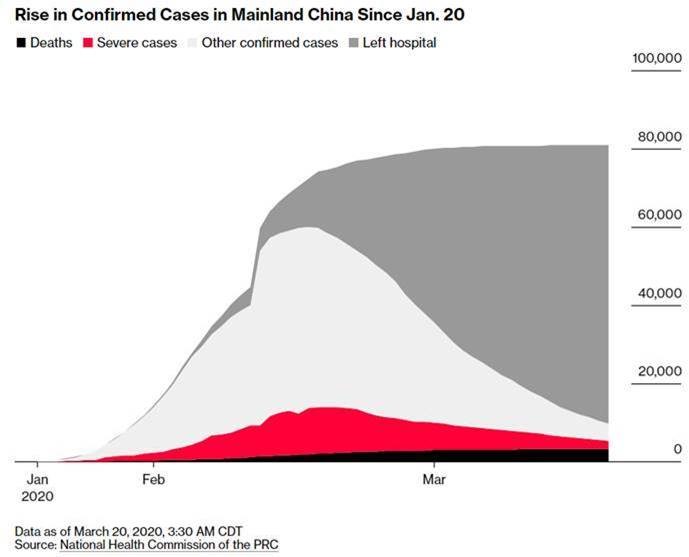

C) China seems to have it under control, at least for now. There were only 46 new cases of COVID-19 there as of March 20th, and the trend seems good as more and more people move to the “recovered” label (see table below).

Other countries are still seeing a rise in new cases, but as countries take lessons from China and South Korea, hopefully the length of time it takes to reach “containment” has been shortened and the outcomes are more palatable than they were in China or Italy.

D) One of the keys to lowering death rates is standardized and effective treatment protocols. Medical teams across the world are sharing their best practices and learning from each other. Seven patients who were treated for COVID-19 using a novel treatment protocol employing drugs used to treat swine flu, HIV, and malaria at Jaipur’s Sawai Man Singh (SFS) Hospital and Delhi’s Safdarjung Hospital in India have fully recovered. The treatment protocol will be widely scaled to other hospitals across the world [link].

E) And, finally, this, too, shall pass. Or, maybe a too cheekily: this, too, shall bottom. And when it does, we will eventually look back on it having been rewarded for our cautious optimism about the future and calm detachment during the hardest times. The below I pulled directly from an email that Linda in my office passed on. Unfortunately, the person who sent it to her stripped off the attribution, but the message was too good not to include.

Look at this chart. It shows how much the economy has grown in the last 170 years:

Do you know what happened during the years this chart represents?

• 1.3 million Americans died while fighting nine major wars.

• Four U.S. presidents were assassinated.

• 675,000 Americans died in a single year from a flu pandemic.

• 30 separate natural disasters killed at least 400 Americans each.

• 33 recessions lasted a cumulative 48 years.

• The stock market fell more than 10% from a recent high at least 103 times.

• Stocks lost a third of their value at least 13 times.

• Annual inflation exceeded 7% in 20 separate years.

• The words "economic pessimism" appeared in newspapers at least 29,000 times, according to Google.

And yet our standard of living increased 21-fold.

Being an optimist does not mean you think things will always be good. That's complacency. Optimism means you are confident in people's ability to solve problems and make the world a little better, even if the path to get there is filled with constant setbacks, declines, challenges, and panics. As the world feels like it's falling apart, take a moment to remind yourself that being optimistic about the long run and accepting of chaos in the short run is not contradictory. It's history.

I hope that you have an excellent Containment Weekend. I hope that you are using this as an excuse to re-connect with your family. I hope that you are getting outside to enjoy the world on walks in the sun. It’s odd—I’m an incredibly social person, and I thrive on being in crowds and among groups of friends. I’ve never been so physically isolated for such a long time from others. But I’ve also never felt closer to my family, friends, clients, and colleagues. Out of distance, a shared challenge, and a little boredom have sprung countless group chats, email chains, non-business conference calls, and Facebook updates. I have talked to people around the world with whom I have lost contact with over the years. I hope that you are using social distancing to enhance your social connections, too.

I look forward to speaking to you (and one day, actually seeing you in person) very soon.

Sam