Financial markets around the world have undergone a dramatic correction this week, with the rise in investor risk aversion following the concerns over the spread of the coronavirus. As we were cautioning our clients at the end of 2019, valuations were looking stretched coming into 2020 already, although economic conditions looked quite supportive of continued expansion. The coronavirus news dominating the headlines has, obviously, brought some of those valuations into sharp focus, so I thought some information on the current state of affairs and thoughts on where we might go from here would make for interesting weekend reading.

Novel Coronavirus Disease 2019, or “COVID-19” for short, originated in Wuhan, China beginning in late December. As of late, the World Health Organization (WHO) reports a majority of the cases (over 97%) remain in China. The increase in the virus is no doubt alarming. Certain factors, however, are important to consider to bring this into context.

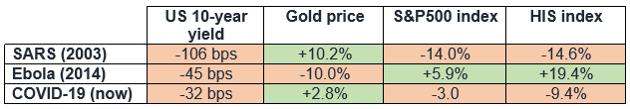

It appears that fear in the marketplace is less a function of a real fundamental shift in the global economic backdrop and more related to investor fear itself. Consider the following cases related to the market reaction and previous virus outbreaks.

Further, look what the world markets went through during the last several viral pandemics for an idea of the range of possibilities for what might come looking forward into the future.

Dow Jones had a much more robust chart in some of its research materials that covers not just SARS- and COVID-19- like diseases, but major health outbreaks over time that gives additional context.

From recent news, there is also growing confidence that the virus has been contained and that the spread of the virus is levelling off due to the efforts of the Chinese government. This, hopefully if contained properly, follows our view that market impact is likely to be relatively short-lived but will presumably carry a lasting impact.

What does this all mean for investors?

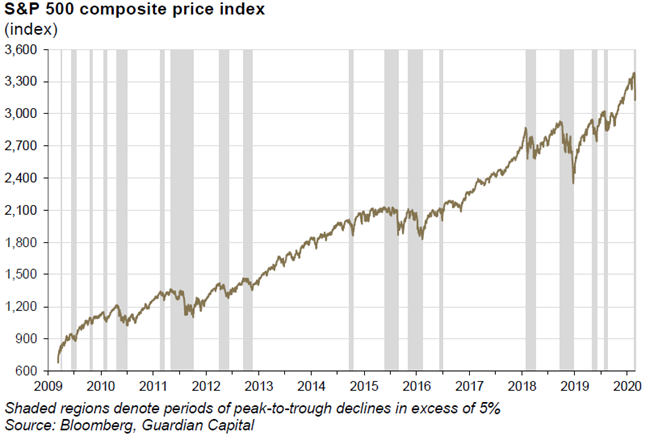

Ultimately, the risk to markets depends on the extent of the spread of the virus, as the relatively low mortality rate of 2019-nCoV (~2%) is well established at this point. As always stressed, long-term goals shouldn’t affect your decisions relative to investing. Performance during past viral outbreaks have still tended to be brief and positive. The figures below demonstrate other epidemics and the rebound of market performance.

Of course, in the near-term, volatility is likely to persist against increasing headline risks of “COVID-19”. What must be considered is that such volatility will likely prove temporary and is unlikely to spur and form a bear market, or pull-back. While the situation is clearly subject to change, there still remains little reason to anticipate the situation to materially deteriorate. Based on market sentiment, global economic expansion will likely continue and will prove to be another bump in the road for markets to ultimately climb.

Our strongly held view coming into this was that the short-term fundamentals of the underlying economy were strong and that the longer-term demographics should continue to propel economies (and markets) forward for some time to come. We will have to assess the short-term economic impact of COVID-19 as more information becomes available, but the longer-term demographic trends should be supportive for any investor who has time on their side. As we move through the volatility that the news cycle will continue to bring, things like strong balance sheets, protected business models, industry leadership, and relative value against peers will become paramount indicators of which companies do well through this crisis. These have always been our focus, and we expect that the prudence will pay off.

For more information on expectations of the coronavirus, download below the RBC Global Insight for March, 2020.