Skip to the bottom of this blog post for the Global Insight 2019 link

Starting this week, I want to first wish a belated greeting to my American friends who celebrated Thanksgiving on Thursday. I hope the day was filled with too much food and too little politics.

I will concentrate on the equity markets in this missive, as the bond markets have been relatively uneventful. On the stock side of the ledger, there has been broad-based weakness in basically all markets around the world. The market is positive this second, but as of Friday the Toronto Stock Exchange was down 6.9% since October 1st; the S&P 500 was down 9.3%; and the MSCI All Country World Index was down 9.2%. Importantly, the US Tech sector has been particularly painful for investors, with negative returns quarter-to-date in companies like Apple (-23%), Facebook (-20%), Nvidia (-48%) and Netflix (-30%) suffering routs after a very strong start to their years. The magnitude of the fall is quite something. In fact, five US tech companies (Facebook, Amazon, Apple, Netflix and Alphabet) combined lost $800 billion in market cap since September.

It’s debatable where the weakness comes from. The most likely culprit is (as is almost always the case) trade: in this instance, the tariffs the Trump administration has put on imports from around the world. Tariffs are almost universally a bad idea—they hurt your trading partners, sure, but they hurt you more. The idea that “China is now paying [the US] billions of dollars in tariffs” (DJT, Sept. 2017) is a complete miscomprehension—willful or not—of how tariffs work. When the US imposes a tariff, it makes the goods covered cost more (10% or 25% these days) for the importer. The importer might absorb some or all of that extra cost, sure, but then this presumably US-based company is now that much less profitable. If they can’t absorb the price, they will pass it on to the end consumer, who will now be the one who ends up paying the premium and being left with that much less in their pockets to spend on other consumer goods. For a good in-depth description of this effect, read this Bloomberg article by Peter Coy.

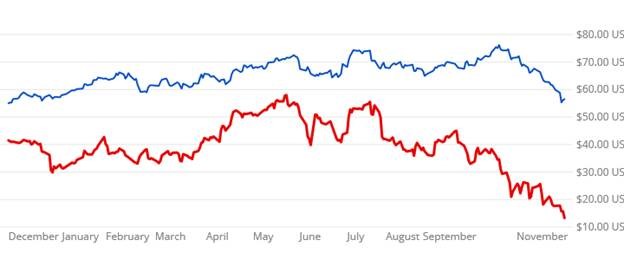

Another driver for weak markets in Canada is the low price of oil. This is great for our non-oil-product manufacturing sector, sure, but a huge part of the Canadian economy is reliant on oil company profits. With oil now down to $50 from its almost $75 price back in October, and with lower quality Canadian oil hovering around $12 a barrel, many oil projects are no longer profitable. This is largely the fault of politics as much as anything else. Iranian oil was taken offline with the US pulling out of the Iranian Nuclear Deal, but OPEC immediately stepped up production and oil supply is now higher than it was in June. And the heavy discount being placed on Canadian oil has to do with lack of pipelines to move the oil out of Alberta and to the refineries. If prices stay this low through 2019, Alberta’s government could lose up to $5 billion in revenue or 10 per cent of the province’s budget.

Chart: Western Intermediate (blue) and Western Canadian Select (red) oil prices

Chart: Peter Evans / CBC

If your portfolio contains a cash position, and especially if that cash was generated during the positive market of 2017 or the first half of 2018, you are in a great position to take advantage of the above. At some point this negative market will break. Most likely this will happen in the last couple of months of 2018, and my personal prediction is that it will be predicated on a breakthrough in trade between the US and China. Don’t think I’m getting over my skis here: I’m not expecting anything like Xi and Trump hugging and signing a free trade deal. What I do expect is that as the market keeps falling, Trump, who is generally obsessed with the day-to-day movements of “the DOW” (he celebrates positive intra-day moves as if they prove his thesis, anyway) will be forced to look to take actions that will calm concerns on trade. Positive moves on Brexit should also provide some relief for weak stocks, should Theresa May ever manage (bother?) to bring some sort of consensus coalition to bear.

Regardless of how you are currently positioned in this market, the important thing, as always, is consistency. That means having a plan and sticking to it. That doesn’t mean that your plan should be “I just put my head in the sand and ride it out.” Working with an advisor should mean that plans contain contingencies, that they are made with flexibility and adaptability as primary considerations, and that the “plan” is well articulated to you. Question the advice that you are given, make sure that your “plan” is actually a pre-considered course of actions to be taken under various circumstances and not a reactive “bet” on the future; no one person is right about the course of events at all times, and a real plan should anticipate things not going as your advisor predicts.

All that said, it is important to have a view of the probable future to guide you. An important resource for me is always RBC Wealth Management’s excellent Global Insight 2019 Outlook, which showcases unique perspectives on issues and opportunities that could define the year ahead.

You can enjoy the complete report in PDF format here: 2019 Outlook.

Or, you can read each article separately by clicking on the mobile-friendly links below.

2019 investment stance: Our outlook for the economy, equities, fixed income, and currencies

Navigating the late cycle: Should an equity investor “make hay while the sun shines” or prepare to hunker down? Some of both we think.

Don’t wait for fear to do the work of reason: Build defense by dialing back risk in fixed income portfolios

Next-gen backbone: Infrastructure investing in the 21st century

Uncharted territory: A generational shift in U.S. and China relations

Artificial intelligence: Welcome to the age of transformation

Please take a few moments to familiarize yourself with the 2019 Outlook.

I appreciate the opportunity to serve all my clients and relish in helping them to accomplish your long-term financial goals, regardless of what “the markets” bring. Please contact me with questions and to discuss your own planning or our thoughts on the future.