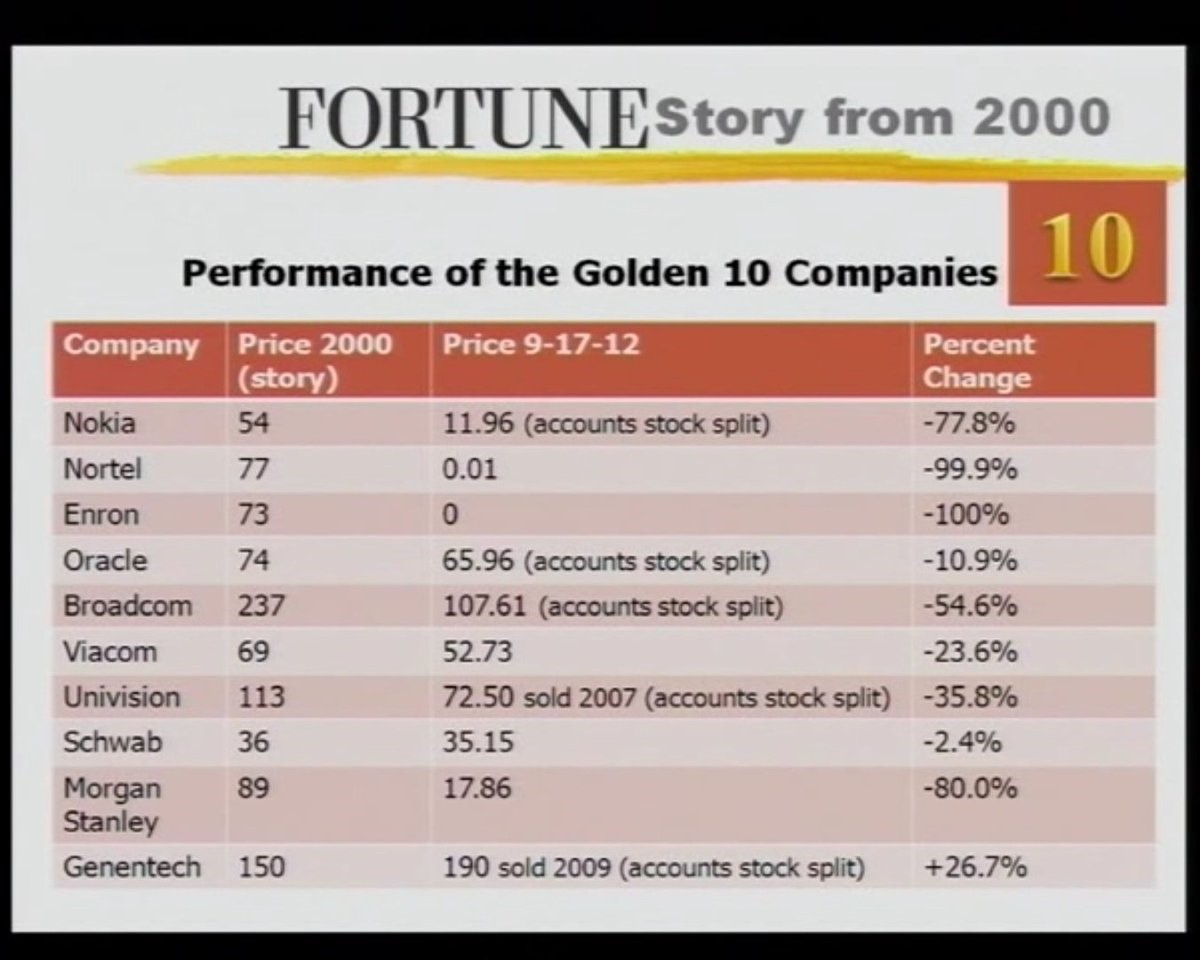

I found this picture today as I skimmed through my favourite social media site (definitely NOT Facebook). It is a picture from a Fortune magazine article in 2000 naming their ten picks to last the next 10 years. Ummm, I sure hope the people responsible for doing this have found something they are better at doing.

(Source: Poor Investor’s Almanack via Twitter @PIAlmanack)

A caveat to this picture- the price data on the survivors is about 6 years out of date but the point remains, no one knows what is going to happen tomorrow! It doesn’t seem like it because of my good genetics but I was working when each of these companies was actually in business. I have clients that had Nortel (sadly a few that still have Nortel) or Nokia. I pick on Fortune because it is an easy target but EVERYONE at that time thought there was no chance most of these companies wouldn’t be wildly successful. Does that sound a bit familiar?

Of course there is a reason we call it “The Tech Wreck”. Those halcyon days didn’t last. Enron blew themselves up with shady financial management and outright fraud. Nokia is like a zombie that won’t die, it lurches around and we know it is there but it is rotting. Oracle and Broadcom are both alive and doing well although Broadcom had to reinvent itself over the past decade to survive- never an easy thing to complete. In all, 8 of the 10 picks survived in some form as of 2012 even after the Tech Wreck and the Global Financial Crisis.

This is kind of the point of the post though. Fortune made a bold prediction 18 years ago. They gussied it up with a cool name [Narrator: Who wouldn’t want to invest in The Golden 10?] and chose some of the biggest darlings of the time. They chased the past performance and extrapolated that into the future on a straight line. Here we are 18 years later and we have cloud computing, YouTube and Netflix- none of which were in existence or even dreamed of back then. It is too difficult to know the future. Adding on the extra level of complexity of picking which companies will gain from that future is just too difficult a task.

Now that we are approaching the end of the year, there will be more and more stories about “The best stocks to own for X years”. When you see them, take them not as literal guides for your portfolio to follow but as entertaining fluff pieces. Definitely do not call your advisor asking to buy the Sam Rook 2025 Superstars Portfolio [Note: NOT a real thing]. Successful investing is a process of small decisions that add up over time. There is no golden portfolio to set and forget. You do not need to check every day but you should be minding things and keeping a distanced eye on your holdings.

More importantly, take this list into consideration when you look at your current portfolio. The FANGs have done tremendously well over the past 5 years and it seems like they will always do well. I am here to tell you that likely won’t be the case. Any one of Amazon, Google, Facebook, Apple or Netflix could fall on hard times. To be successful over time you have to be willing to be a bit heartless with those positions you have fallen in love with because none of these stocks love you back. Research in Motion didn’t love you but your heart sure hurt when it went down in your portfolio.

But only love can break your heart,

Try to be sure right from the start.

Yes only love can break your heart,

What if your world should fall apart?

-Neil Young (Only Love Can Break Your Heart-1970)

For a complimentary heartbreak protection review, contact me here.