A haiku about 2023:

The market goes up

Surprise, more rate increases

Econ is still good

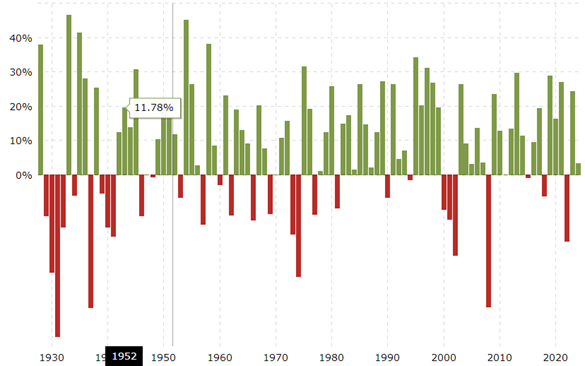

The last 30 months have had A LOT going on. From a stock market peak in late November of 2021 to nearly back to those peaks in December 2023, there has been a lot of movement. That’s a very simplistic view on what was a 20% down market in 2022 followed by a 24% gain last year. It seems abnormal but it’s much more common for strong positive years to follow strong negative years. Just look at this chart of the S&P500 going back to 1928.

It’s just that it’s not enjoyable to live through times like this. If you’re looking at your returns over the past 2 years, they are still relatively flat and especially so if you weren’t heavily concentrated in trillion-dollar tech stocks. It’s even more the truth if you had bonds in your portfolio over this time because 2022 was a historically bad year for bond returns and, unlike stocks which can recover quickly, bonds take longer to recover absent a sudden change in interest rates.

Where are we now?

Well, the US economy is not just holding up okay, it’s actually doing quite well. Inflation is down to around 3% but there is very low unemployment and wages are growing for workers which is a positive. I’m not going to prognosticate on the soft/hard landing debate for the US economy but will acknowledge that its strength continues. The recognition that the US economy did not go into a recession after the sharp, sudden interest rate increases led to a strong rally right into the end of the year. Much of that +24% gain for the S&P 500 occurred in the last 3 months of the year.

Some other points to consider:

- The Red Sea - being the major shipping route for most of the world’s manufactured goods, the attacks on ships transiting the Red Sea/Suez Canal has definitely disrupted shipping. Traversing around South Africa adds weeks to travel time. With no quick solution, this probably means that inflation will remain around 3%

- US elections. With apologies to the septuagenarians and octogenarians reading this, could we maybe run candidates that are at least in their sixties? My best recommendation is ignore as much of the election noise as you can and remember, don’t make investment decisions because of politics.

What does it mean for you?

Sadly, my ability to see the future is about equal to everyone else. Staying invested, even through those times where it hurts, is what leads to good returns over time. We will continue to do our best to keep our heads to make sure that everyone can enjoy living their life the way they want and not have to worry about short term market conditions.

Year End Client Successes

In 2023, we had 4 new babies born to clients and a bunch of new grandkids. We welcomed our third family with 3 generations of clients under our care. It’s always such a rewarding time to meet grandkids of long-standing clients and to help them get started on their own path to success. We had 2 new businesses launched by clients and a few clients make plans for retirement either last year or early in 2024. Vacations too numerous to mention happened including Paris, Mauritius and Portugal. Florida seemed to be a hot spot in 2023 (even I made it there for my first Walt Disney World family trip).

As in life, it wasn’t all roses last year. Sadly, two clients passed away and they are missed. Dealing with the death of a spouse is never easy but it is a constant reminder to enjoy our lives while living because it’s the only one we get.

I am excited for what’s in store in ’24.

-Sam