In an era where Artificial Intelligence (AI) takes bold strides into our day-to-day lives, no industry remains untouched – including finance and investment. AI's reach into the world of investing extends from robo-advisors and automated investment strategies to portfolio optimization and trading services. The proliferation of AI today is fostering a seemingly more autonomous financial world.

This raises the question — are human financial advisors facing obsolescence? In our (undoubtedly slightly biased) view, the answer to this question is no. Despite AI's meteoric rise, the indispensability of human financial advisors will persist, particularly when it comes to managing the emotional and behavioral biases inherent in investing. We believe that advisors who embrace the efficiencies of AI, while focusing their efforts on the coaching and planning aspects of their roles stand to benefit immensely from this emerging trend.

AI in Investment: A New Dawn

AI stands tall as a game-changer in the investment landscape. Its ability to dissect enormous amounts of data, recognize patterns, and make real-time decisions is nothing short of impressive. These capabilities have already been fields like medicine, where AI has already far-surpassed humans in things like medical imaging analysis (see Episode 4 of our Behind the Numbers Podcast which explores this very topic here).

This year, we have integrated a new AI service into our investment process (to complement others which have been in use for years). This new addition is helping to optimize and improve our idea generation, and investment evaluation processes. The proliferation of AI-tools in finance promises not only to improve investment methodologies (for those who learn how to utilize them properly), but also to increase efficiency and lower costs over time.

Emotion, Behaviour, and Investment: The Human Element

Paradoxically, one of the greatest benefits of integrating AI into an investment process is also one of its greatest weaknesses: dealing with human emotion. As we’ve spoken to clients about time and time again, emotional detachment is a key quality to investment success – and AI is well-insulated against the various emotional and behavioral biases that humans are highly susceptible to.

However, the process of investing one’s assets elicits a spectrum of emotions including fear, overconfidence, regret, and even greed. These in-turn often spark impulsive decisions, possibly deviating investors from their financial goals. This is a topic we have spoken and written about often, including in a recent blog post: Good Behaviour = Good Investment Outcomes.

Managing these types of emotions and behaviors is something which we believe AI will continue to lag humans in for the foreseeable future. A robo-advisory tool could be programmed to share data, historical examples, and all sorts of information that should dissuade emotional decision-making, but presenting it in such a way that the human end-users feel acknowledged, reassured, and connected with the process is another challenge entirely.

Human Financial Advisors: The Emotional Compass

During the investment journey, human financial advisors can act as emotional compasses. They resonate with their clients' fears and aspirations, anticipate emotional responses, and can guide clients, making sure their decisions are in line with their dreams and goals, as well as their risk tolerance. Moreover, financial advisors play an educational role, helping their clients identify and manage biases to avert investment blunders. This guidance is invaluable, especially during volatile market periods when emotions run high.

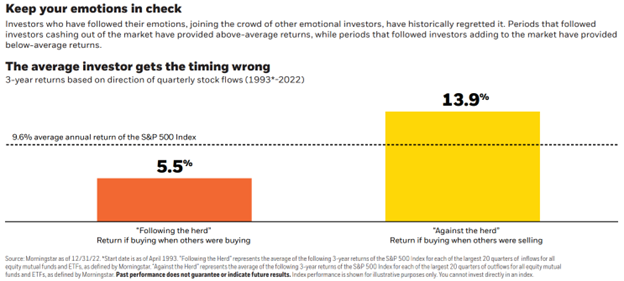

The simple fact is that most investors make sub-optimal decisions with respect to deciding when to buy and when to sell. The chart below was sourced from Morningstar, and it shows the average 3-year returns for investors who buy when most others are buying (orange column), versus the average 3-year performance of investors who buy when most others are selling (yellow column).

Source: Morningstar

The importance of managing emotions is perhaps best illustrated with a real-world example. Many will remember the Global Financial Crisis of 2007-2008, which caused one of the most severe periods of market volatility of this generation. All told, the S&P 500 declined by 48% in approximately six months between August 2008 and March 2009. For many, this type of market decline brings on feelings of extreme stress and negativity – and we have in fact met or spoken to many investors who tell us they “never recovered” from the losses in 2008. However, the fact of the matter is, by the end of 2009 nearly half of the decline was erased. In fact, investors who bought at the October 2007 peak and simply held their investments until today (including the recent 2022 drawdown) would have averaged a return of around +8.7% per year (with reinvested dividends).

The Road Ahead: AI and Human Advisors in Tandem

The future of financial advisory services is not a battle between AI and human advisors, but a harmonious coexistence. AI, with its data-driven insights and automation capabilities, will relieve human advisors from more mundane tasks, and help control costs and increase efficiency. This will allow good financial advisors to focus on their strong suit — understanding client needs, emotional nuances, and behavioral biases, while delivering personalized and empathetic service.

In a nutshell, the ascension of AI doesn't overshadow the importance of human financial advisors. Their unique ability to navigate clients through the emotional labyrinth of investing is unmatched. Amid an AI-dominated world, the human touch in financial advisory services will become not less, but perhaps more valuable than ever.

Thanks for reading,

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2021. All rights reserved.