At the risk of sounding repetitive – everything we do as a team is to help make our clients, and everyone around us, into better investors. This is our often stated “Why?” – and is the motivating factor behind every decision we make.

One of the dangers that every investor – including ourselves – face is falling victim to behavioral biases. We have long believed that being aware of and understanding these biases is the key to overcoming them, and providing our clients with better advice. We recently touched on this topic in a podcast with Myles Zyblock, Chief Investment Strategist at Scotiabank – which can be found here.

Why are biases relevant?

Classic economics assumes that we make rational decisions by correctly weighing the pros and cons of each potential outcome, correctly assigning probabilities to these outcomes, and making optimal decisions based on this data. However, as history has shown, humans often fall victim to sub-optimal decision making due to biases that are both cognitive and emotional in nature.

Here are five of the most common biases that investors fall victim to:

- Loss aversion : The tendency of investors to “dislike” losses more than they “like” gains.

- Overconfidence : The tendency to feel more educated / informed on a topic than one truly is.

- Confirmation bias : The tendency to look for information that supports a pre-established view, and place less emphasis on information that runs counter to this view.

- Mental accounting : The tendency to treat different “pools” of money differently (ex. taking more risk with “profits” vs. “initial investment”)

- Anchoring bias : The tendency to “anchor” oneself to a specific view (often based on personal experiences) and not adapt sufficiently to incoming data.

We felt that it was important to write about this topic because, as many of you are aware, the market environment we’ve seen so far in 2022 has been extremely difficult. These periods of pervasive negativity (or positivity) tend to be the times when behavioral biases are most prevalent.

Perhaps one of the best real life examples of the negative consequences of behavioral biases in investing is illustrated in this 2021 Forbes article: How Investors Are Costing Themselves Money. The article references one of the more shocking data points we have seen, which also happens to relate to one of our favorite legendary investors: Peter Lynch. Peter Lynch was the manager of the Fidelity Magellan Fund from 1977 to 1990. Over this tenure, the fund posted an incredible 29% annualized return – however, according to Fidelity, the average investor in the fund actually lost money during this period. This may seem nearly impossible to believe, but it is simply a product of the emotional and cognitive biases which lead investors to make sub-optimal decisions like rushing to buy following strong performance, and rushing to sell following weak performance.

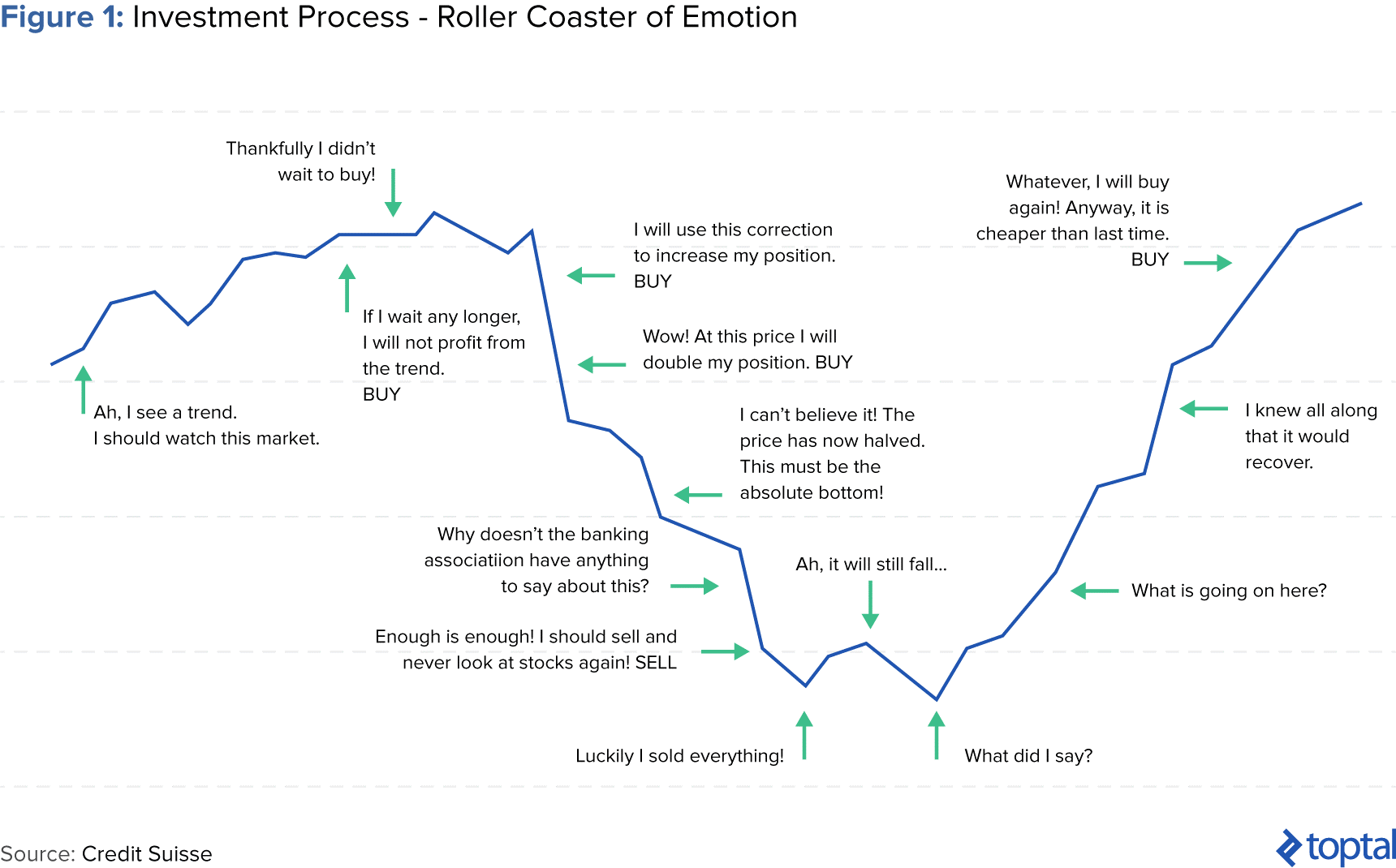

One final chart we wanted to share comes from Credit Suisse – it shows a “typical” pattern the average emotional investor will go through. Though theoretical in nature, we see this type of scenario play out time and time again in our dealings with clients. While no one (including us) is completely immune to these types of thought patterns, one of our biggest focuses as portfolio managers is to recognize and prevent them from influencing our own, and our clients’, decision making.

Bottom Line:

Timing the market is never advisable, and it is impossible to know for certain where we are on the “roller coaster” of investing emotion. However, the poor performance of markets so far in 2022, combined with the extreme levels of negativity among investors leads us to believe that we are closer to the bottom of the “drop” than many would believe. If this proves to be the case, we have no doubt that many of the actions / reactions undertaken by investors today will simply add to the book of examples of behavioral biases at work.

Thanks for reading.

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2022. All rights reserved.