One of our most strongly held beliefs when it comes to investing is that the core of our portfolio should always be exposed to long-term secular growth themes. One question we hear fairly often is: What does “secular growth” mean?

While there is no precise number or metric to determine what falls into this category, the idea behind what constitutes “secular growth” is simple - a period of fundamental change or evolution occurring in a sector or industry, leading to significant and persistent growth.

The reason we seek these themes out as the focal point of our portfolios is simple: they present opportunities to generate significant returns in a manner that we believe is very low risk when taking a longer-term view.

Many investors mistakenly associate the idea of growth with higher risk, but we believe this is misguided. To be clear, there can certainly be a high level of risk (and potential return) associated with investing in an earlier-stage company that is growing quickly. Our belief is that when you take an approach that involves investing in various secular growth themes via companies at differing stages of maturity, you can create a core portfolio that has both a stronger return potential, and a lower risk profile, than the overall market over time.

The higher return potential comes from the prolonged period of growth resulting from whatever secular growth trends are being invested in. The lower risk potential comes from several factors, including a resilience to negative economic conditions, and the ability to maintain higher quality balance sheets, to name a few.

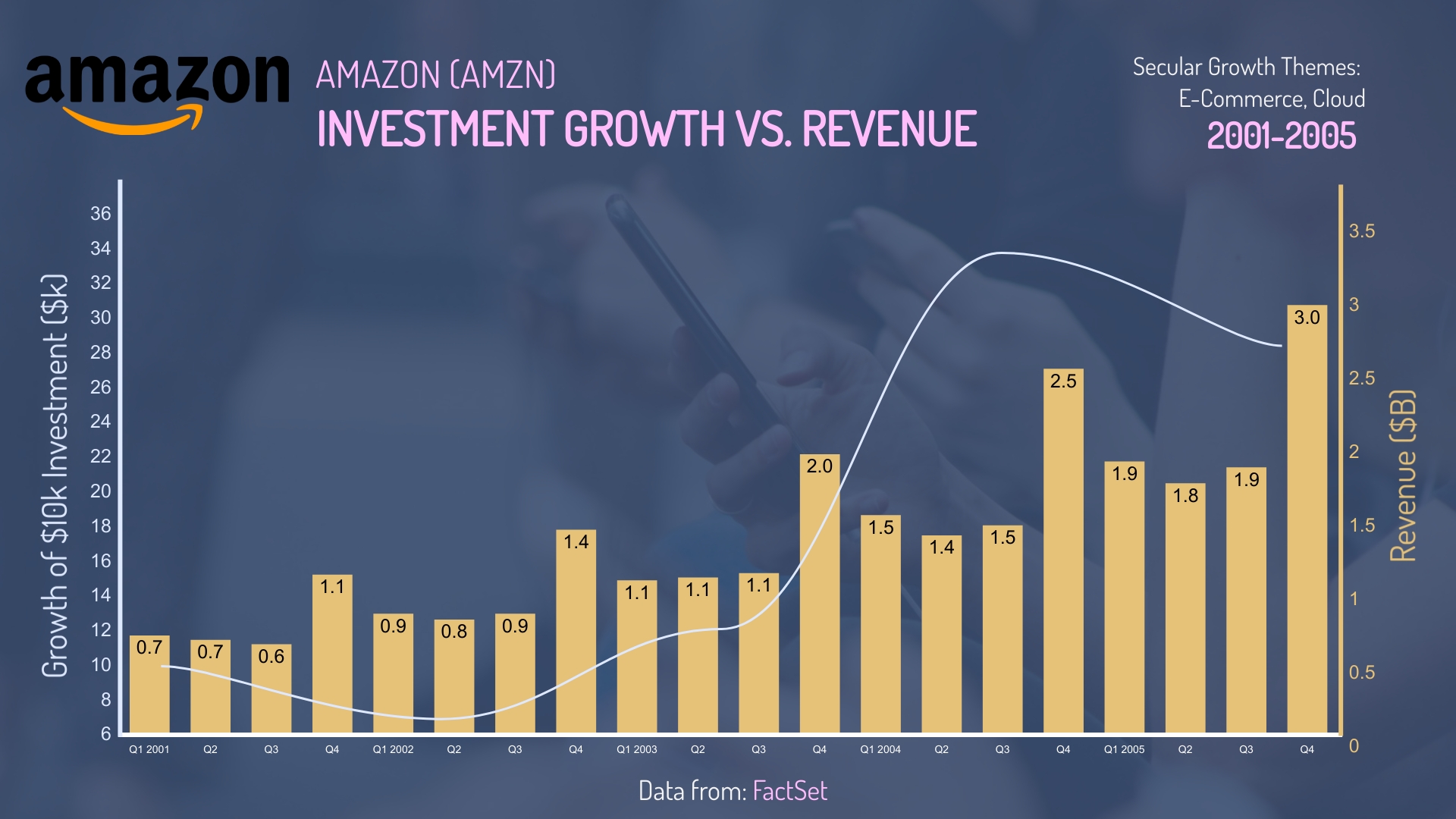

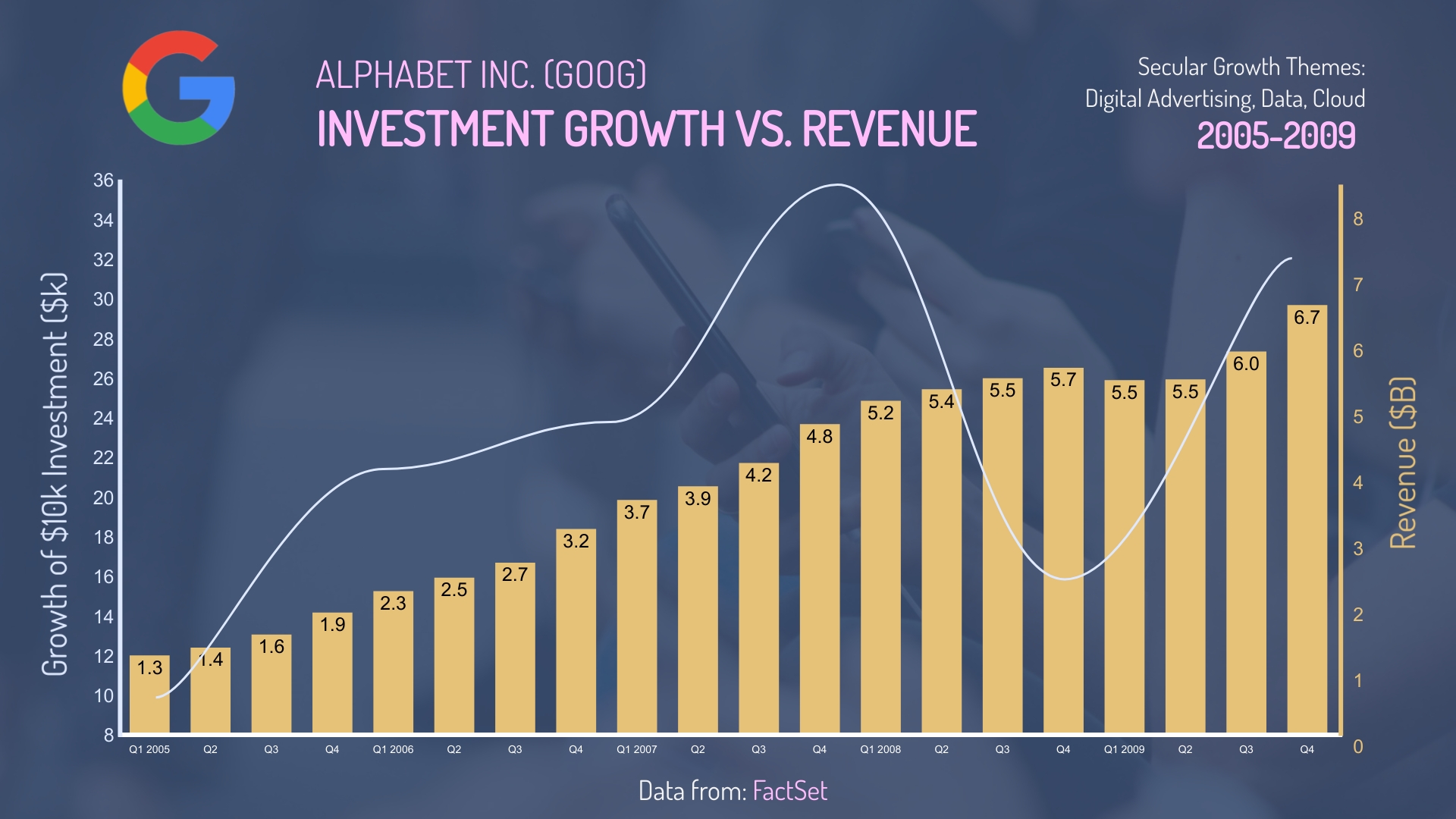

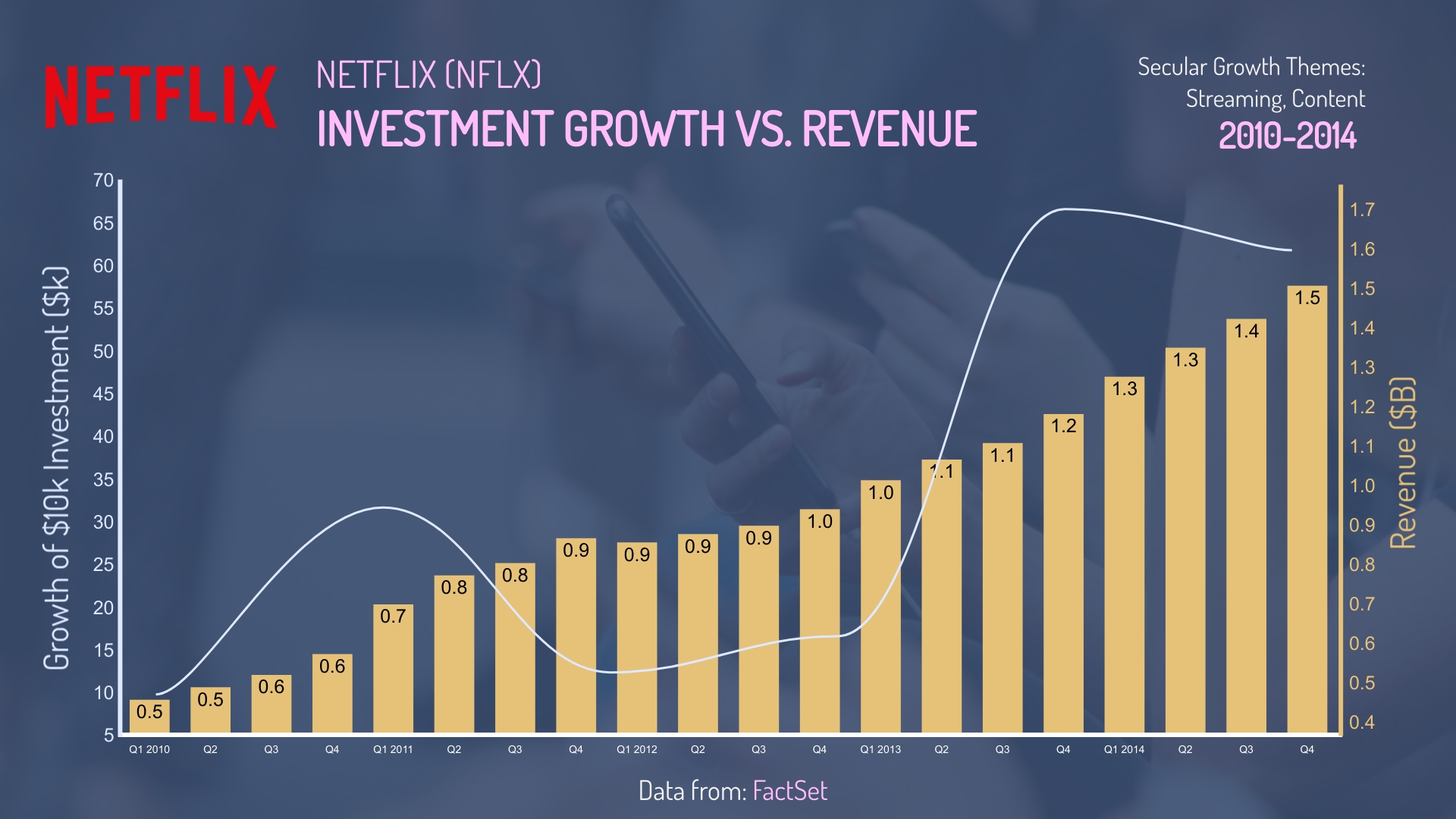

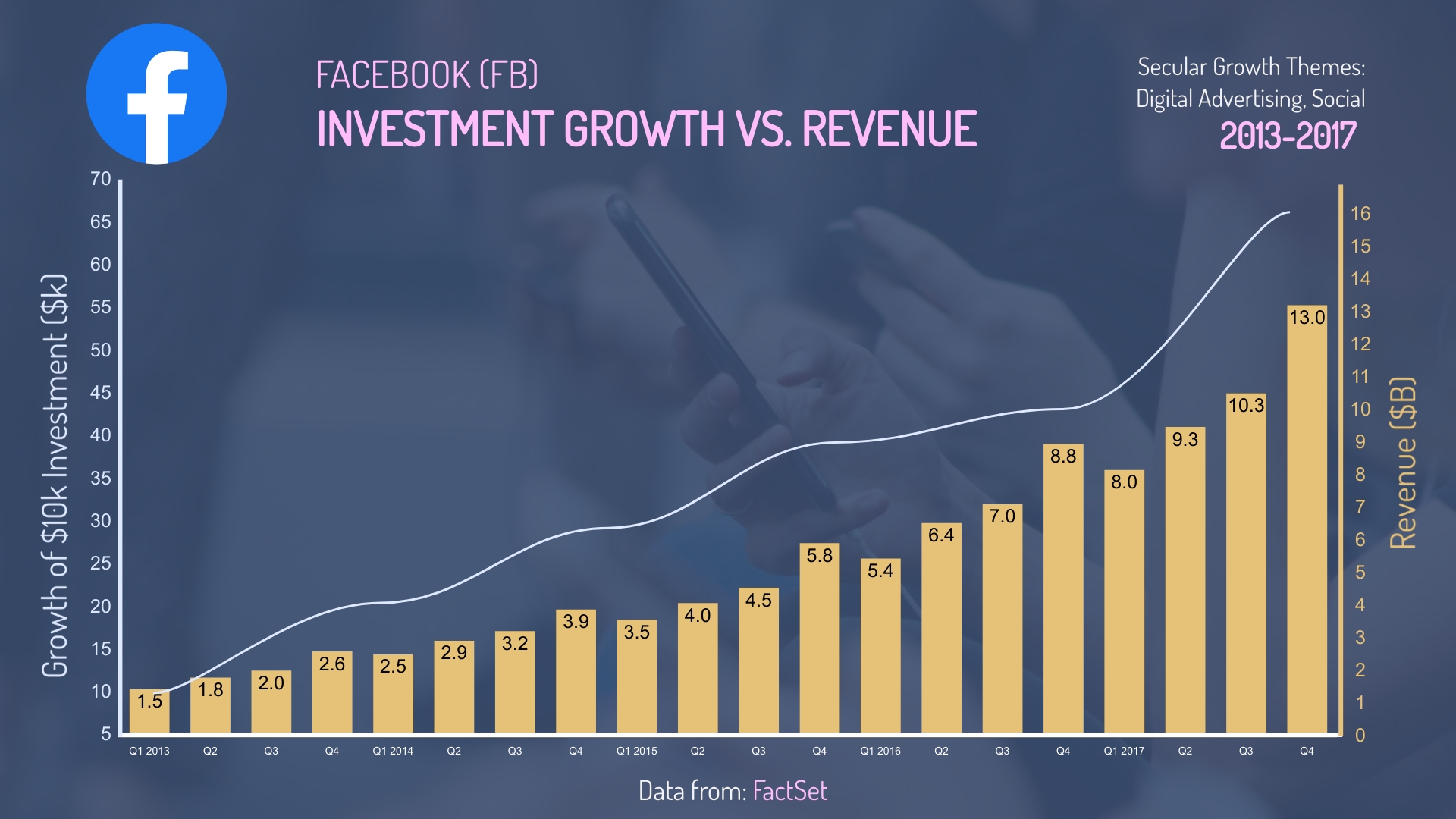

While speaking theoretically about secular growth investing like this can start to get the idea across, we felt that providing some examples could do so even more. Below is a list of several companies who have been involved in “secular growth” over recent years (note: some still are). We will highlight some data taken over 5-year periods, in an effort to demonstrate how investing in businesses like these can lead to strong performance independent of the overall market:

All of this is of course a very simplistic illustration, looking only at top-line revenue growth of a few companies that fall squarely into various “secular growth” trends of the last 20 years. Note that many of these 5-year periods include some very volatile periods either for the overall market, or the companies themselves (ex. AMZN – post dot-com bubble, GOOGL – 2008 Financial Crisis, TSLA – bankruptcy fears).

Whether it is in some of the same trends from the examples shown (ex. e-commerce, online advertising, data, software, cloud, sustainability, social, mobility, etc.), or various other themes we believe will prove to have similar trajectories over time (ex. streaming, healthcare technology, cybersecurity), we believe with high conviction that a portfolio exposed to long-term secular growth at its core will continue to reward investors handsomely over time.

As always, if you would like to discuss any of the information discussed in more detail, please feel free to contact us at any time.

Sincerely,

Di Iorio Wealth Management

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor [named above] who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2020. All rights reserved.