For those that have been following the markets, you have undoubted observed a significant rally from the lows. However most of the headlines on the economy have been negative. While it is normal for the markets to look ahead and act as a leading indicator it is important to understand what the expectations are in terms of economic growth and what kind of expectations have been priced into the current market prices.

Health of the “Main Street” Economy

The unemployment numbers are an important gauge to the health of the economy. Although keep in mind it is a lagging indicator so it is not a useful measure to assess inflection points of the economy. The latest numbers that are available is from April.

In Canada the latest (April) unemployment rate is 13%. As of May 21, 2020, 8 million Canadians are receiving CERB which is more than 30% of the 20million working population in Canada. The current labor participation rate – percentage of working population seeking for employment is at 59.8% while it was at 65.5% prior to the pandemic.

In the U.S., the latest unemployment rate is 14.7% in April. Some interesting statistics were provided by Financial Times. Certain sectors such as leisure and hospitality and Retail trade have experienced the most job loss. Lower income jobs are also the most significantly impacted.

Job losses by industry sectors

Job losses by income

FT: What to know about America’s newly unemployed, May 21, 2020

Health of the “Wall Street” Economy

Based our latest Earnings Report Card for US S&P 500 companies, as of May 6, 56% of the companies have reported there are a few key takeaways.

1) Given the current 2021 earnings projections, the markets/analyst expect a “V” shaped recovery.

2) Although most companies have pulled their forward guidance, management’s commentaries suggest they anticipate a long and slow recovery back to the 2019 level.

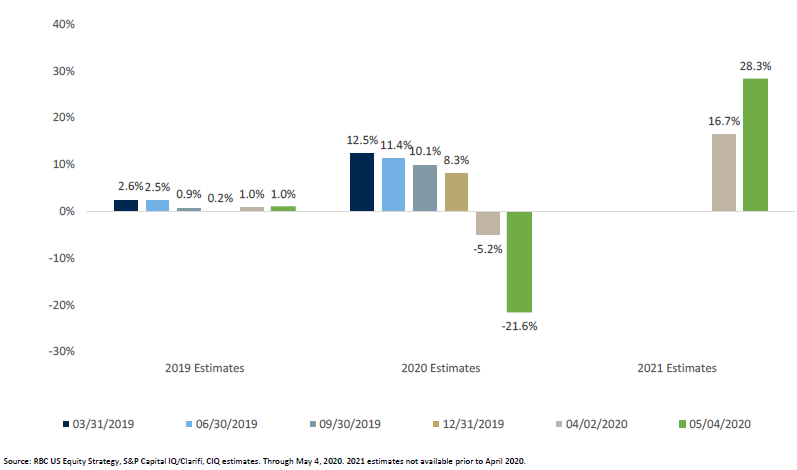

Currently, the earnings for 2020 have been revised down 20% while anticipating a 28% recovery in 2021:

Recent Shifts in S&P500 Calendar Year EPS Growth Estimates

In other words, markets are pricing in a V shaped Recovery in earnings: (Courtesy of Fidelity)

In our view, the 28% y/y earnings growth priced in for 2021 is too aggressive and will likely be revised lower.

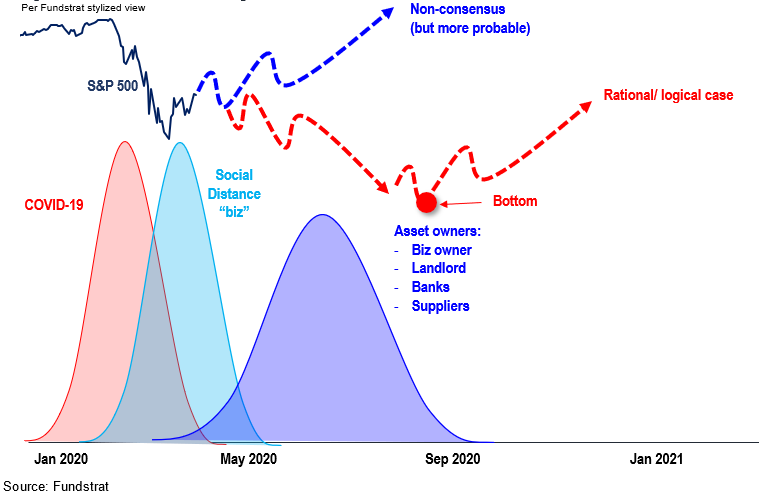

Courtesy of Fundstrat, The red line shows how the markets should behave if it were more aligned to the general economy and the blue trajectory shows how it could behave in anticipation of a recovery. So far we have been on the blue path.

Daily news can be persuasive in getting us to take actions and adjust based on the headline of a given day, however, sticking to a long term allocation that you are comfortable with is still the winning formula to investment success. This is a good time to take a family inventory and keep your personal goals front and center.