January in Review

January 2020 started the year strong but ended the month with relatively muted performance with S&P500 down -0.2% for the month. Canada measured by S&P/TSX was up 1.5%. 2020 started the year with many worries, such as global slowdown in GDP, lower earnings growth for blue chip companies; just as concerns for trade wars between U.S. and China start to fade into the backdrop.

2020 Outlook

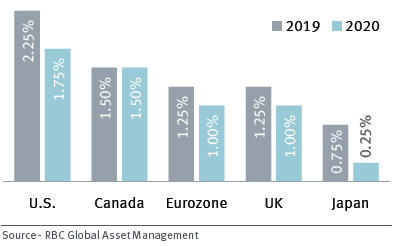

The International Monetary Fund forecasted the GDP growth at 3.4% for 2020 in October last year. GDP growth has been revised lower given the accumulation of sovereign debt and trade uncertainties. RBC’s economics team forecasts a much lower growth rate in the U.S. for 2020 compare to the previous year.

RBC’s annual GDP growth forecasts for developed markets

Despite a slowing economy and earnings growth, the stock markets in 2019 still delivered stellar performance. Quite a lot of the performance can be attributed to central bank actions to provide ample liquidity and to keep the interest rates low. This accommodative monetary condition has not changed in 2020. While the policies will not be as effective in the future, the very accommodative stance serves to postpone the likelihood of a recession.

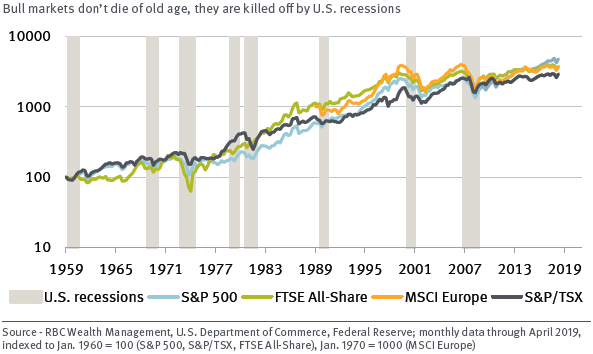

The risks of U.S. recessions

The impact of coronavirus

Naturally there are jiggers around coronavirus and the impact it can have on the markets.

The most impacted by the coronavirus has been the energy sector so far. Given the travel restrictions and lower demand for oil, WTI-oil was down -15.6% in January. The news on temporary starbucks closure in China and reported disruption in Apple’s supply chain will surely put stress on corporate earnings but it is too early to declare an emergency.

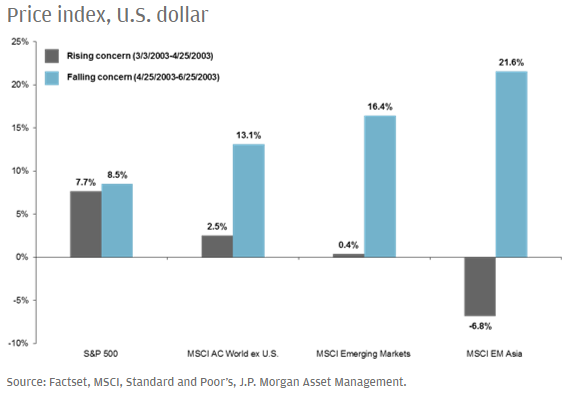

In the past, using SARs, Ebola, and Zika as examples, we have seen the impact on the markets to be short lived and have observed a recovery in the 1-3months following the drawn down in the markets.

Equity performance during the SARS Outbreak

For 2020, given the limited ammunition by global central banks, most institutional managers have a forecast of soft landing in the economy and slight pickup in corporate earnings relative to 2019. As such, the expectation is for there to be a modest upside for the stock markets.