November Market Update

The markets performed very well in November with the S&P 500 and S&P/TSX gaining 4%. The strong performance was bolstered by trade optimism between the US and China with talks to roll back some of the earlier announced tariffs in the Phase One negotiation. The strong market performance may be short lived as the political climate is mercurial under the Trump administration. For the time being sentiment has turned dramatically more bullish compared to just a few months ago. Gold retracted 4% after a strong rally and WTI Oil is up 7% at $58.12 USD per barrel.

Will the market continue to deliver strong performance while the broader economy has slowed?

It is worth repeating while the stock markets have performed well, the overall economy has slowed. Historically, markets peaked prior to recessions and every recession except for two in the past 100 years has been preceded by a deterioration in lending condition. For now credit conditions remain extremely accommodative.

Since the beginning of this year, we have increased our vigilance in watching for signs of a recession by watching the unemployment rate, consumer confidence, manufacturing indices and the interest rate outlook and for the time being, most of the thermometers for the economy remain healthy. However, it is not a time to overlook or rationalize warning signs of weakness but instead to react accordingly.

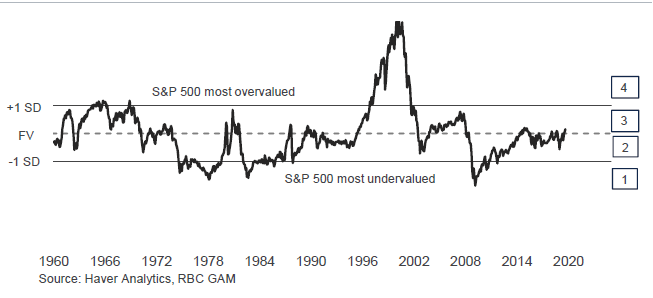

Have the valuation of the markets become too expensive?

Price-to-Earnings ratio is still an effective tool in gauging how affordable or expensive the market is. This is a ratio that expands or contracts depending on the expectation for corporate earnings growth. As of the end of November, the trailing 2019 Price to Earnings ratio is 15.8x for S&P/TSX and 19x for S&P 500. Through RBC Capital Market’s estimation on fair market value for S&P500, the market is slightly over-valued, but not extremely so. The Canadian index S&P/TSX is considerably cheaper but with lower growth projections.

Standardized S&P500 fair-value bands

Year- End tax planning tips and charitable giving

RRSP & TFSA Contributions

Tax residents of Canada have until March 2, 2020 to make a contribution to their RRSP or a spousal RRSP. However, if there is contribution room available, there is no penalty in contributing early – before December 31, 2019 and maximizing the tax-deferred growth. Check in in with CRA to make sure your contribution room is maximized and do not over contribute.

The 2019 TFSA contribution limit is $6,000 and the accumulative limit is $63,500. If you are planning a withdrawal from your TFSA, please do so before the end of 2019 instead of early in 2020. Amounts withdrawn are not added to your TFSA contribution room until the beginning of the year after the withdrawal.

The debate is on-going as to the pros and cons of RRSPs vs. TFSAs. Advice varies depending on individual’s circumstances, however, along with certain pension options and insurance, RRSP and TFSA are the few vehicles available to offer tax deferral on investment income and capital gains. For clients in the wealth accumulation stage, it makes sense to maximize both. For those that are approaching or in retirement, please work with an advisor to design a tailored tax efficient strategy to withdraw income.

Tax – loss selling

The strategy of selling securities at a loss to offset capital gains realized during the year is a year-end tax planning technique commonly known as “tax loss selling”. A capital loss must first be applied against any capital gains realized in the current year. Once the capital gains of the current year have been offset, the balance of the loss can be either carried back three years or carried forward indefinitely to offset future years’ capital gains. When you carry back a net capital loss to a previous year’s taxable capital gain, it will reduce your taxable income for the previous year. This reduction may result in a refund of previously paid taxes.

Last but not least, contribute to an RESP to maximize the $7,200 Canada Education Savings Grant per beneficiary. The limit for RESP contributions is $50,000 per beneficiary. Additionally, starting in 2020, eligible individuals aged 25-65 who are enrolled at eligible educational institutions can claim the new federal refundable tax credit on tuition and fees for training at annual allowance of $250 per year; $5,000 maximum lifetime tax credit.

Charitable Donations

When you make a donation to a registered charity, you can choose to claim a tax credit on your personal tax return. The donation tax credit reduces your federal and provincial income taxes in the year you make the claim. You do not have to claim the donation tax credit in the year and opt to carry forward unclaimed donations for up to five tax years. There is no limit to the amount you can donate in a year. However, for tax purpose, you can generally only claim a charitable donation of up to 75% of your net income in a taxation year.

When you donate a publicly listed security with accrued capital gains, you benefit from the elimination of the capital gain tax plus the donation tax credit. The combined tax savings can be significant. The tax credit varies depending on the individual donor’s margin tax rate, please consult a tax professional for the precise calculation in tax credits.