March Market Review

March put up another month of good performance. S&P500 was up 1.8% and S&P/TSX was up 0.6% respectively. Notably, Chinese Shanghai Composite is up 5.1% on stimulus measures and year to date, the Shanghai Composite is up 23.9%.

Major North American market indices are now close to previous year’s market peaks prior to the correction last year. I reiterate a cautious approach going forward as global economic growth has notably slowed.

What about the much dreaded inverted yield curve?

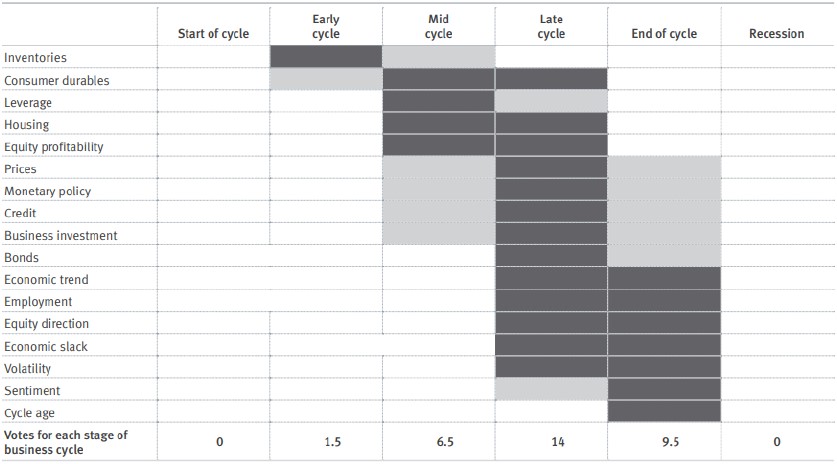

In late March, a key portion of the yield curve, 10year less 3month inverted, a historically reliable business cycle signal. Does the inversion of the yield curve immediately spell recession? Historically, the lead time between inversion of the yield curve and recession is between 9month and 4.5 years. Therefore, we will need more fundamental analysis before arriving at an investment thesis.

For the first time in nearly 12 years, the U.S. 3 month T-bill yield exceeds the 10-year U.S. Treasury yield. The Government of Canada curve has also inverted.

Bringing the inverted yield curve back to the fundamentals of the economy, it means financial intermediaries such as banks can no longer make a healthy spread from borrowing short term from depositors at a lower rate and lend at a higher rate over a longer dated time period. Therefore, credit lending will tighten which lead to slower business activities and eventually a recessionary environment.

What happens next will be dependent on action taken by the Fed. Should the U.S. Federal Reserve’s next decision to cut interest rate as market is now pricing in or continue the gradual path of raising interest rates? Cutting rates can potentially re-stimulate the economy and revert the inverted yield curve. Initial jobless claims and credit spreads are the key indicators we monitor for the future direction of the yield curve and economy.

Portfolio Recommendations

Given the strong price action in the markets from January to March, it is advisable to temper return expectations for the remainder of the year. It is a good time to consider moving to a more neutral position for some investors and be more defensively positioned in terms of asset allocation between Equities and Fixed Income.

Rita Li works with high net worth individuals and families to provide a high touch service in holistic wealth management planning. Her team encompasses professionals with in-depth taxation and legal backgrounds, together, they strive to deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP® with expertise in asset management. Rita obtained her MBA from Richard Ivey School of Business. Contact Rita for a complimentary consultation to determine whether the services she provides can be the right fit for you and your family.