Third Quarter Market Review

The third quarter has been a volatile year with political turmoil dominating the news cycles in the U.S. However, putting the headline risks aside, U.S. markets have held up remarkably well.

Third Quarter Earnings Update

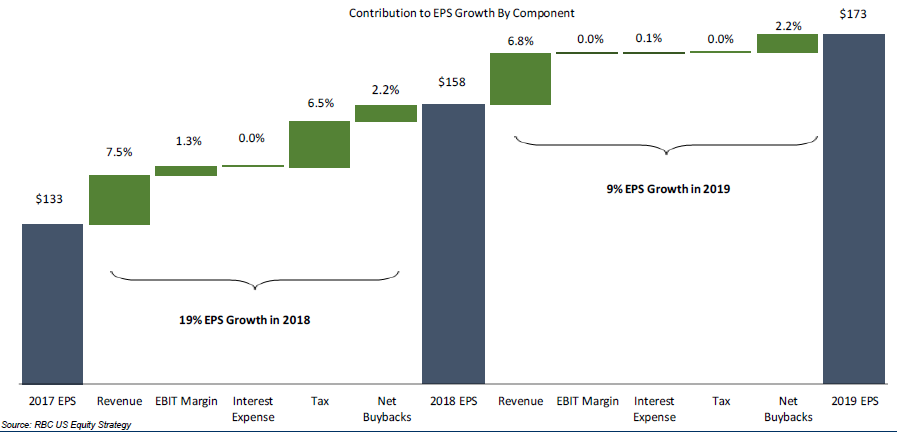

I have emphasized the importance of strong corporate earnings growth and their role in the continuation of the current secular bull market. So far the reported earnings have not disappointed. We are now forecasting an estimate of $158 for earnings per share for S&P500 which represent a 19% growth from the previous year. 7.5% is from the top line Revenue growth, 6.5% stem from the benefit of tax cuts and the rest of the growth is a combination of profit margin expansion as well as share buybacks. (Exhibit 1)

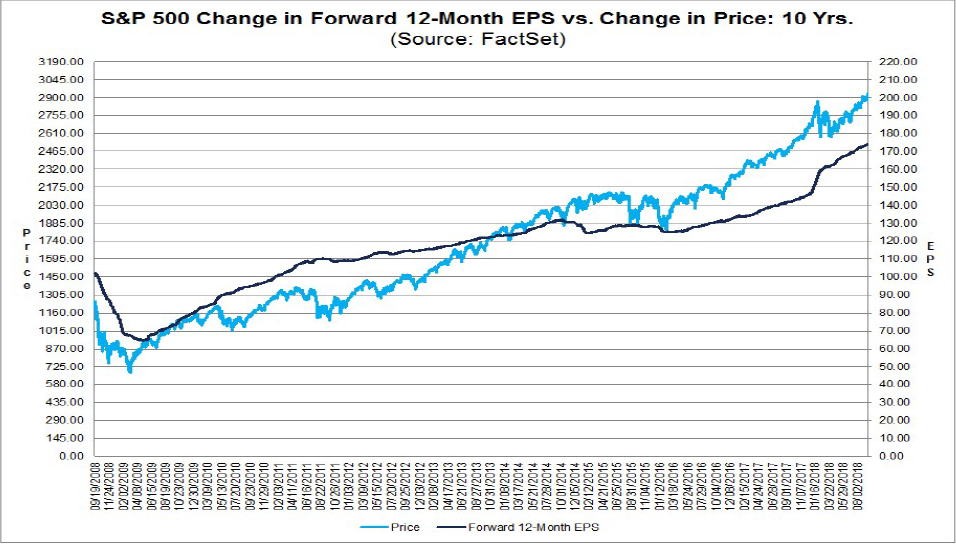

Looking ahead for the market performance for 2019, we have a forecast of 9% for growth in earnings per share. While the relationship between earnings growth and market returns are not a precise one to one ratio, there has historically been a strong correlation between the two. (Exhibit 2)

S&P500 EPS Estimates: $158 in 2018 and $173 in 2019 (Exhibit 1)

Share Buybacks and positive market performance

Share buybacks have been a driver of earnings growth. Share buybacks is when companies return capital to shareholders by buying back a percentage of their own shares. In general, this is a positive for shareholder returns and overall market performance. In 2018, we have seen a near-record number of buyback announcements with an aggregate dollar value of $708 billion. Some of these benefits should flow through to 2019 and continue to support the market performance.

S&P500 Earnings per Share and S&P500 Price Change from 2008 to 2018 (Exhibit 2)

US – Mexico – Canada Agreement (New NAFTA)

Details will continue to roll out in the coming days but the first read is positive with limited concessions made on each side. The recent trade tension shines new focus on Canada’s economic dependence on our neighbor to the south and the urgency to develop strong diplomatic ties with other trading partners in the future.

First read break-down of main agreements in the US-Mexico-Canada Agreement:

- Chapter 19 Dispute Mechanism stays in place.

- U.S. has made the concession to leave the dispute mechanism as is. It allows both nations to have a panel to discuss a conflict, as opposed to heading to a court, which is very costly

- Dairy Supply Management stays in place, but with a compromise

- Canada will have to open the Dairy market for US import, and the RBC Capital Markets analyst indicates US imports will increase by 3.69% and also points out that 86% of dairy products in Canada will still be domestically sourced and protected by production, price and import controls

- Steel and Aluminum

- Imports will still have tariffs, however that is something that can be eliminated in the future

- Auto

- From our analysis, the proposed cap, before tariffs are imposed, will be 30% higher than what Canada is currently exporting to the U.S. today which mitigates the impact significantly

The outcome is overall positive and reassures us that in the era of protectionism, the North American treaty is still intact. President Trump has managed to secure his legacy through renaming the NAFTA to what is now known is the USMCA.