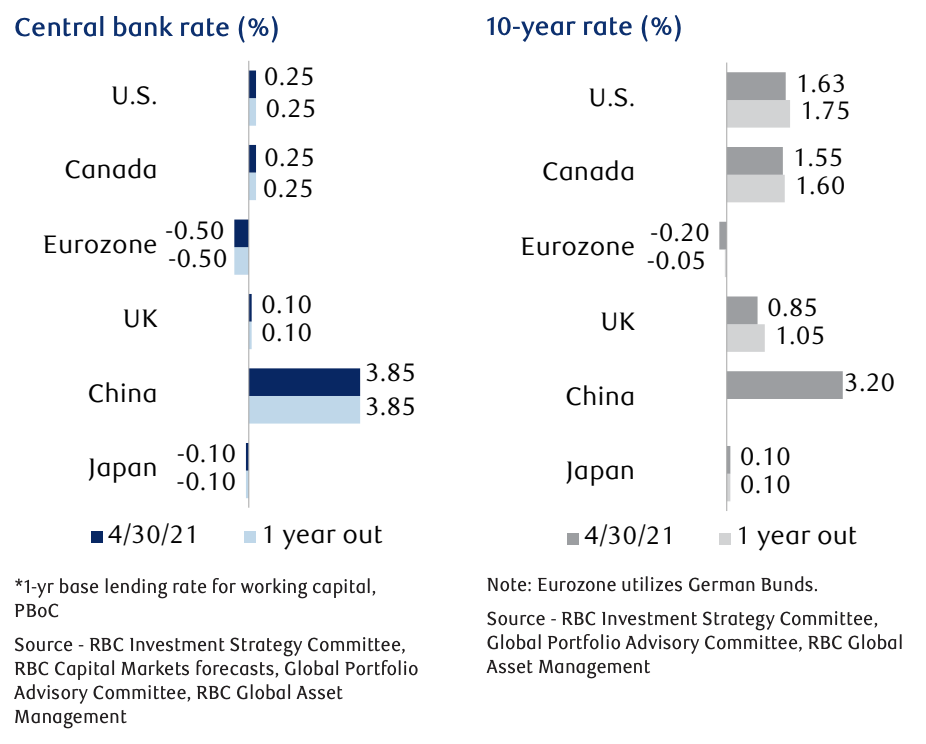

Treasury yields declined in April despite a flurry of positive economic data, including strong gains in nonfarm payrolls and retail sales. With vaccination rates in the U.S. moving higher, conditions point toward continued strong growth in the second and third quarters.

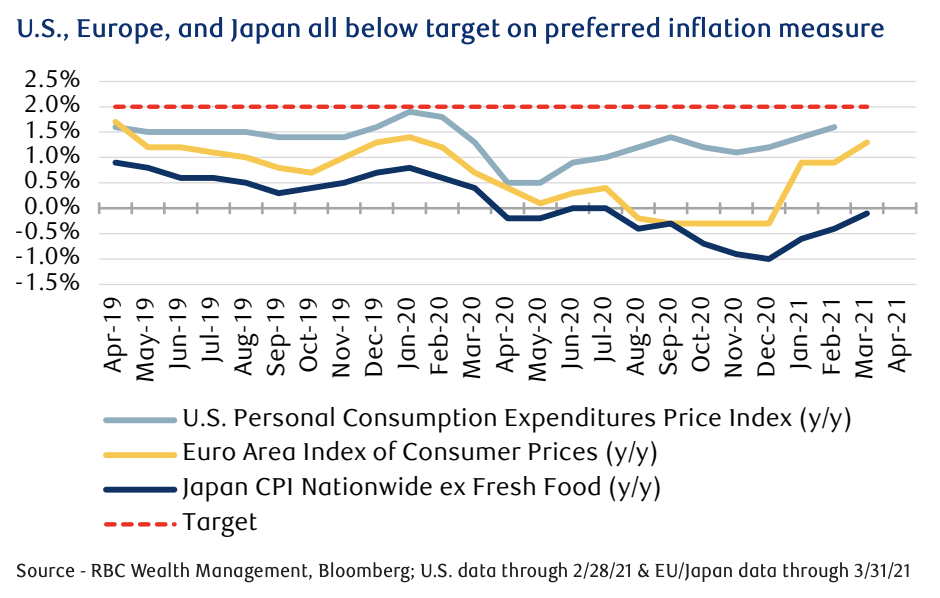

Rising bond prices are atypical against a strong economic backdrop, but we see several reasons for the recent demand. One is the high rate of global infections, which has led to some limited border closures. The absolute level of Treasury yields— which even after currency hedging is higher than that of many foreign government bonds—has also sparked demand from overseas investors. Another factor is the still-low rate of inflation: although retail sales were up 9.8% in March from the prior month, March’s core consumer prices were only 1.6% higher than 2020.

The recent strong data is unlikely to change monetary policy in the near term. The Fed has consistently guided to accommodative policy until employment has recovered and inflation is well-established. This stance is generally in line with other developed market central banks.

The head of the European Central Bank, for instance, said that it is premature to even discuss scaling back stimulus, and the Bank of Japan maintained its aggressive policy stance at its April 27 meeting. The Bank of Canada did recently cut the amount of its bond purchases, but it remains an outlier among G7 central banks. With Fed policy unlikely to change and largely priced in, investor emphasis in the U.S. is shifting to fiscal policy that is more difficult to predict. The Biden infrastructure plan equates to nearly 10% of GDP but faces an uncertain future in Congress. Similarly, the administration has proposed corporate and capital gains tax changes that, if implemented, may potentially impact future individual and corporate investment. We believe investor uncertainty around these proposals—particularly the changes to tax policy—could provide additional temporary support to bond prices.

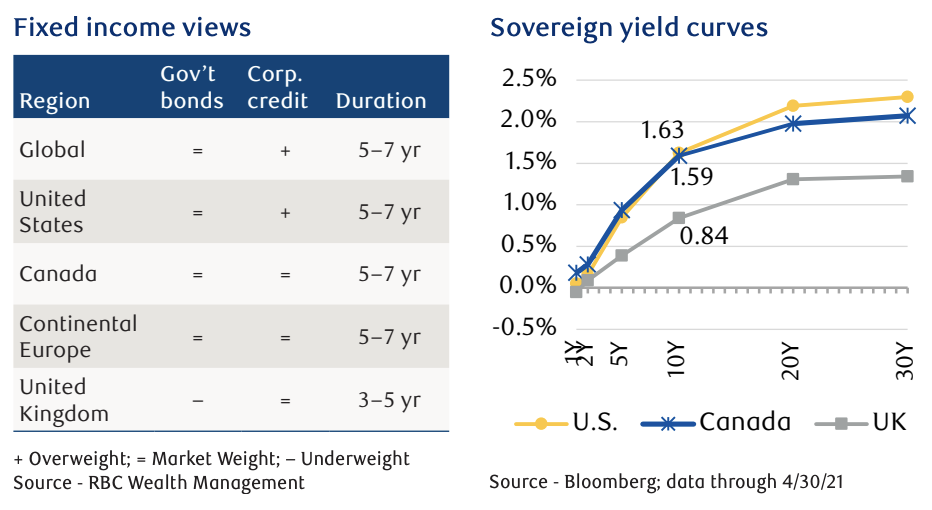

We continue to believe in the growth story and expect rates to rise over time. In the U.S., we believe yields on the 10-year Treasury will likely be near 2% by year end. Were 30-year yields to reach 2.5% over that period, we would view them as potentially attractive for the long term.

Despite recent strong data, inflation is still running below the target of 2%. Accommodative policy will likely remain until inflation is well established.