The U.S. and Canadian economies are powering ahead. Q1 GDP growth for the U.S. came in at a very strong 6.4% (and we suspect may be eventually revised higher). The Canadian economy looks to be keeping pace and we think it will do so over the full year. Consumer spending, by far the largest component in both economies, has been leading the way. But capital spending by business looks to be taking off too—non-residential capex in the U.S. grew by a chunky 9.9% in Q1 following an even stronger Q4 last year. Importantly, equipment and software spending advanced at a startling 26% annual rate.

Meanwhile, with new orders running at a blistering pace for both manufacturing and services, inventories too low despite efforts to replenish, and economies not yet fully reopened, this powerful GDP momentum is likely to extend through 2021 and well into 2022, in our opinion. An eventual U.S. infrastructure spending initiative will add a positive impetus for several years beyond 2021.

With the Conference Board’s Measure of CEO Confidence at a 17-year high, quarterly earnings and forward guidance are likely to remain upbeat. And analysts’ earnings estimates, on balance, are unlikely to be revised lower anytime soon.

While Europe and the UK have lagged North America mostly due to pandemic-related lockdowns and Brexit confusion, consumer and business confidence are on the rise and imminent reopenings are likely to boost sentiment further. The comeback in the tourism sector— important to the UK, France, Spain, and Italy—should be a big addition to GDP in the second half of this year and all of next.

China’s recovery continued through Q1, albeit at a somewhat slower pace. Monetary policy tightening has already produced some volatility in debt markets but is unlikely, in our opinion, to seriously alter the GDP trajectory in that country.

Strong economic and earnings momentum, robustly positive consumer and business confidence, and policy still set at “supportive” combine to produce a constructive outlook for equities. The major trend is likely to remain upward as long as the outlook for the economy remains positive. Corrections can arrive at any time, but we believe that concern about higher-than-normal valuations is very unlikely to be the trigger.

We recommend a global balanced portfolio be moderately Overweight equities.

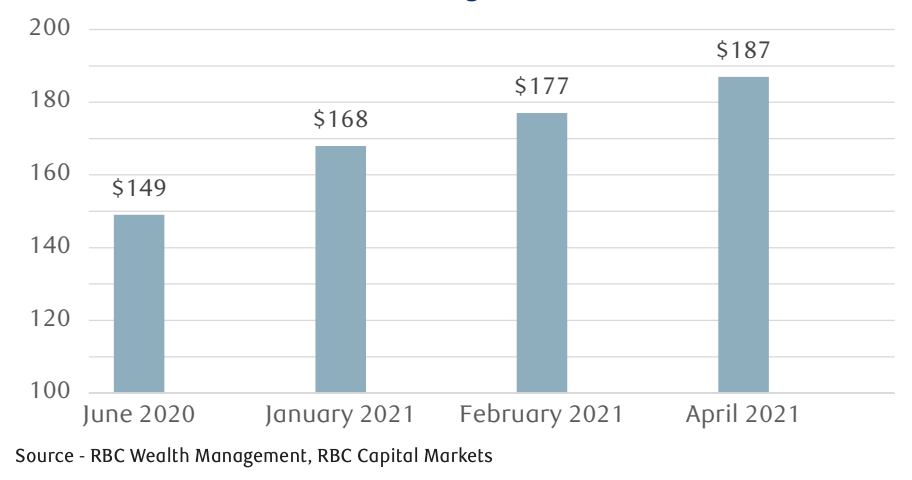

Evolution of our 2021 S&P 500 earnings estimate