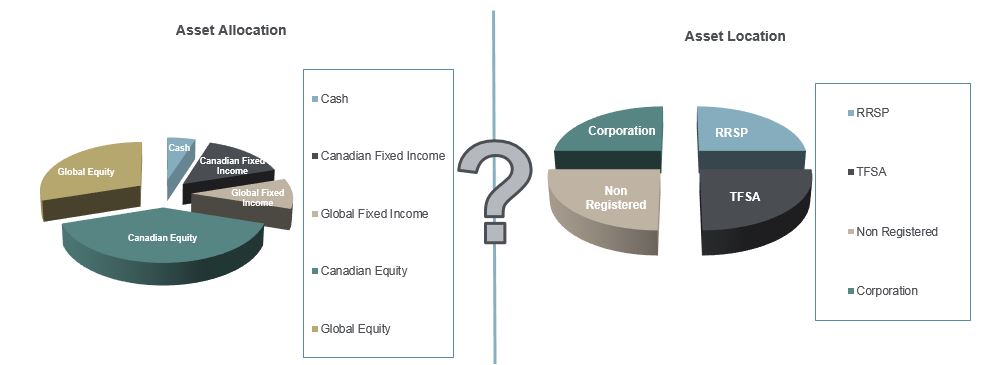

The process of determining how to hold your investment assets:

The above illustration is a ficticious 'pie chart' of a client's potential 'Asset Allocation' as well as their potential 'Asset Location' (where they could potentially have pots of money). The question becomes: Based on your personal scenario, what is the right mix for both 'pie charts'?

Why is this important?