A Picture of How

Financial Markets Once Functioned

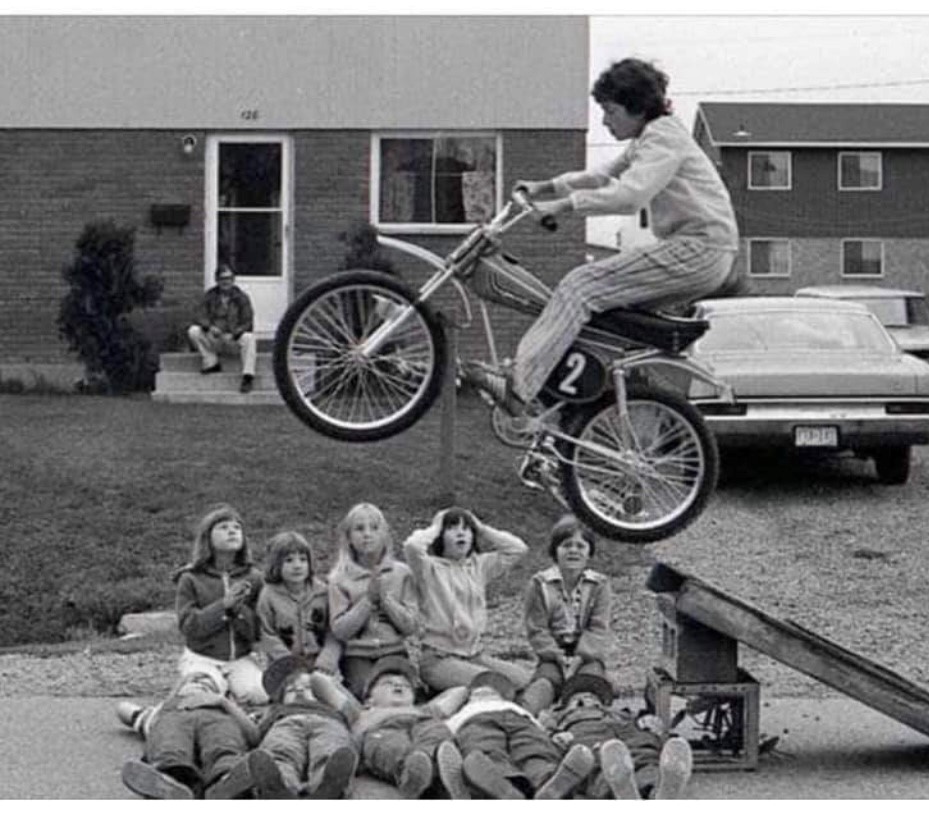

Saw this picture on social media last week. It really captured my attention. Let me share with you a few thoughts.

First, notice how the girls are sitting and watching the entire spectacle. If I had to make a wager, one of the girls probably thought the idea up in the first place.

Second, you have to love the courage of boy number five at the end of the body line. He looks pretty relaxed for a guy most likely to need a visit to the hospital in a few seconds.

Next, check out the father watching the whole thing unfold from the steps of his home. He is taking it all in. Notice he’s not running around worried about the safety of anyone or the fact that there is zero safety equipment in play here. Nope, he’s just a spectator saying to himself “kids will be kids.”

Then you have the ramp. The cinderblock supports are suspect at best and the 120 degree “V” where the ramp meets the road does not make for a smooth takeoff. (You’d think the adult watching might have pointed that out but that would take away the learning opportunity, wouldn’t it)? Clearly, this plan came together quickly. Find some stuff…make a ramp…jump some bodies like Evel Knievel.

Finally we have the legend-guy jumper. No helmet, no safety gear, no weighted or specialized bike. (It even still has a kick stand on it). I bet that bike weighs 45 lbs. at least. The lack of planning, quality materials and poor prospects of a successful outcome are not a concern in this picture. Right in THAT moment, he is giving it his best shot…pure and simple.

What cracked me up was just how accurately this image represented the timeframe it was taken in. Kids just went out and did stuff. Little or no supervision. Good stuff and bad stuff happened….and, as long as they lived, they learned from their mistakes.

Financial markets used to be like this too.

There was nobody trying to pull some proverbial financial lever or push some interest rate string to smooth out every economic bump in the road. The participants in the market place created the prices of assets via willing buyers and sellers.

Let’s face it. If the soaring bike crashes or kid number five gets landed on and needs medical assistance, the adult watching in the background will get up and help out. But it will have to be pretty bad before the kid gets driven to the hospital. More likely, the adult will say “it’s only a scratch, you’ll be alright in a minute.”

In the same way, financial markets were once allowed to sort out their own dislocations. Yes the authorities were there to act if necessary but the threshold for necessary was much higher than today.

Which leads me to my punchline: There are some serious downside risks, especially to Canada given our nation’s much higher relative real estate prices and the Canadian economy’s overall higher exposure to real estate related industries.

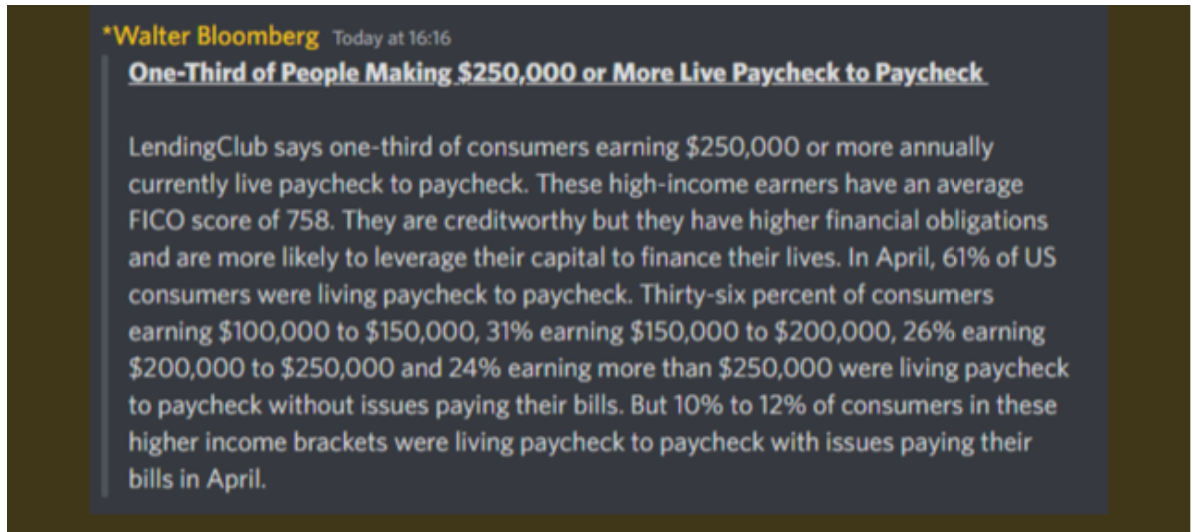

I’m not saying it is going to happen any more than I think kids are going to go back to playing like they did in the 1970s. But the level of inflation the world is experiencing has become deleterious to average households and it needs to be reined in.

I don’t think it can be overstated. When oil, gas and food prices are surging the average household is getting stressed. Remember when you pay an extra $50 to fill your gas tank you don’t get to drive an extra 100 kilometers. You just pay more. Same when you pay $29.00/lb. for streaks for your family. Same number of steaks as before…just more money spent.

Thanks for the replies to my more action oriented email on Wednesday. It always helps me when you touch base if you are unsure about anything.

Have a good weekend!