Inflation and Why it Matters

- Middle class consumer perspective

The opening graphic covers US inflation data from several perspectives. The point of the graphic is to show that inflation bottomed late 2023 and is now, at best, flat and most likely rising again.

The impact of inflation in the budgets of everyday people is vicious. Without discretionary assets that can be deployed to hedge inflation, poor and middle-class households are challenged.

Higher interest rates work to combat inflation by making money more expensive to access. At least, that is the theory. But this cycle has not proven this axiom to be completely reliable.

A lot of wealthy people got a big raise on their savings when interest rates increased, and this gave them more money to spend.

The net result has seen an increase in the “wealth gap” in society.

- US Federal government perspective

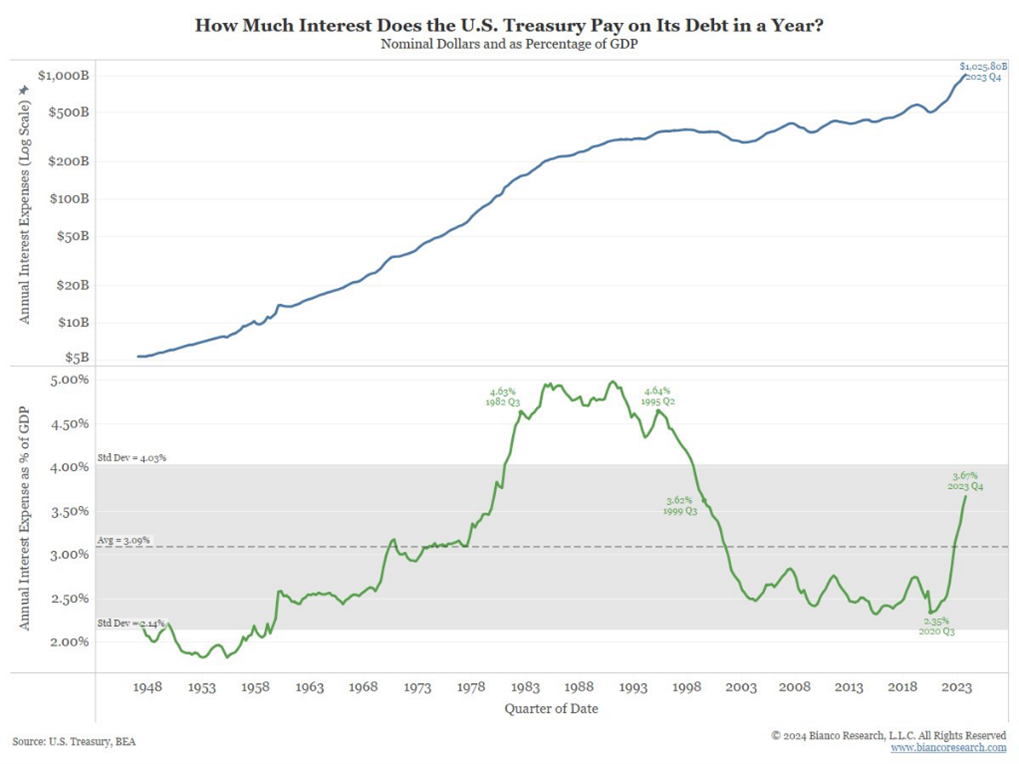

The next two charts look at the US Federal government’s dilemma in terms of higher inflation and interest rates.

The chart above is key. It shows the US Federal government’s interest cost in both dollar terms and relative to Gross Domestic Product (GDP).

Higher interest rates create a much higher interest cost for the US government…. quickly!

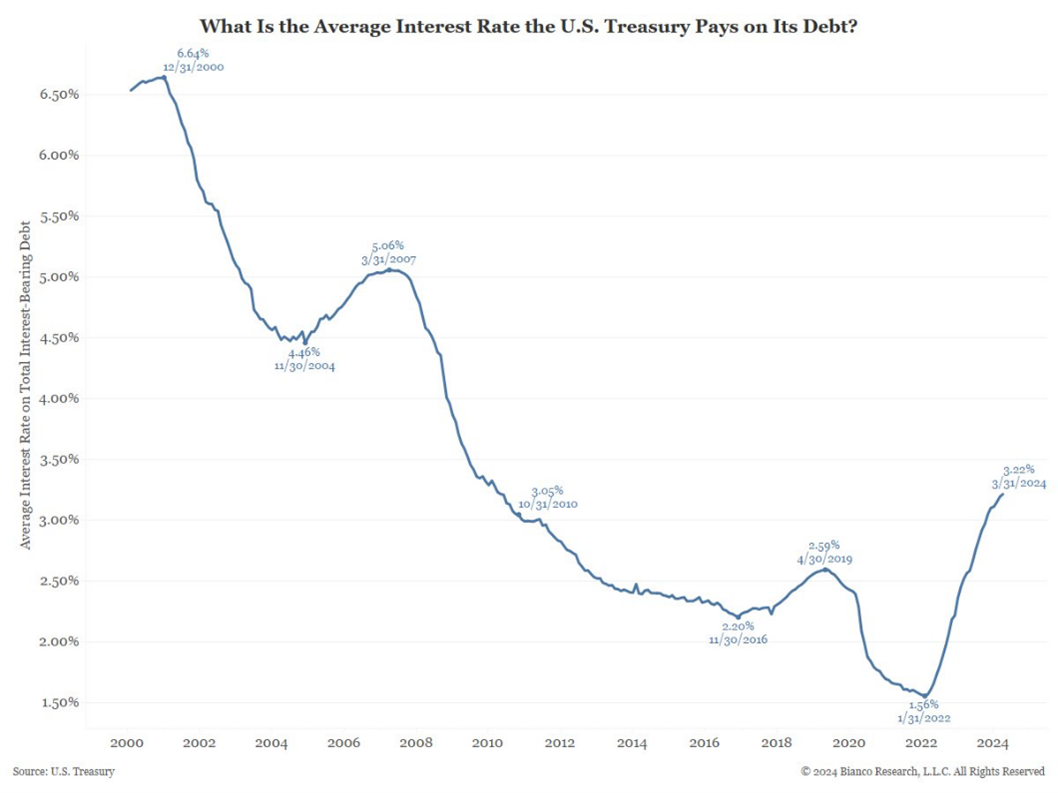

The next chart shows the average interest rate the US Federal Government is paying on its debt. With so much of the debt denominated in short term instruments (Treasury Bills), the average interest rate increases quickly too.

We could look at a bunch more charts to make these same points that most people accept as factual already.

Let’s cut to the big question: What do the politicians and central bankers choose to do? Do they fight inflation with higher interest rates, or do they cut interest rates to stop their interest rate costs from spiraling higher?

The answer to that question will trump the economic data for the next few months.

My bias is that they decide to cut interest rates ONCE south of the border before the election which makes me BULLISH on things that hedge inflation. We will see…

To finish this editorial, I want to show you a Barron’s magazine headline that is exactly the kind of thing that is meant to trigger you as an investor to make a non-researched decision.

There is no possible universe where that statement is true! Yet it was printed in a reputable business publication to get clicks and elicit a response.

I’m not dumping on Tesla specifically here. It could have said Nvidia or Microsoft or some other popular tech stock.

High beta growth stocks are NOT a haven of any sort!

There are more and more of these types of clickbait headlines created and disseminated these days. Filter what you see and ask yourself if the statement seems to be “stretching the truth”.

Have a great week!