How Does It Stop?

Have you ever wondered how small/medium sized hedge funds try to gain an edge in the financial markets? If they are not large enough to pay for their own in-house research they have to go out and buy it.

Of course they get the research from the normal sources like brokerage firms and newsletter writers. But much of the research coming from these sources is “narrative based” and oriented towards selling a product or idea.

More often though, they go to boutique research firms with expertise in specific areas that have nothing but research to sell. Why? Because they don’t want a conflict of interest to blur the quality of research.

You or I can listen to these types of calls from research firms. You have to pay to listen to them, but they are available. I subscribe to Hedgeye on a monthly basis and listen to calls from two other sources a couple of times of year when I think their perspective is valuable to what we are doing.

Here is a short story that happened on a call with a group of hedge fund managers and others listening:

Topic of call: How do the financial markets navigate the next 80 days with three interest rate increases forecast of 0.50% each?

Body of call: Basically watch the ranges on interest rates and don’t assume the Federal Reserve will panic early to save the markets.

#1 Question: “How does this stop?” The Fed ALWAYS steps in to save the market. Are you saying the US Federal Reserve is going to let markets just tank lower?

The fact that this is even a question could easily be the topic for a book. Really, if inflation is running too hot and higher interest rates with less liquidity would cool inflation, the pathway forward for central banks from a historical perspective is pretty clear.

So how can it be that a group of sophisticate investment managers can’t BELIEVE that this simple solution will be implemented? In a nutshell, it is the Pavlovian response to the central banks continued actions that have supported asset prices for the past 40 years.

Let me keep this short and summarize my message:

Nobody knows what comes next. Investors are being asked to figure out how the largest financial bubble in history unwinds itself with day to day certainty. That is simply not possible to do.

With that disclaimer in place, let me concisely state what I am watching.

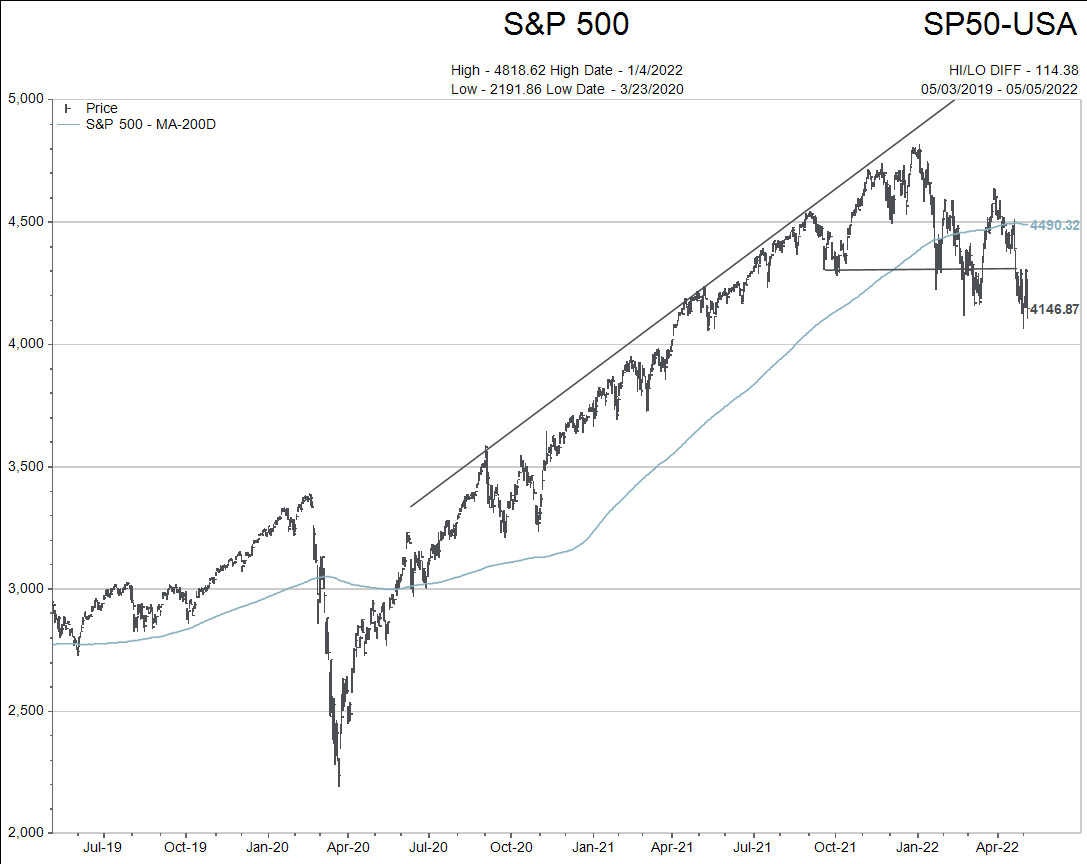

- The technical levels of the stock markets. Please refer to my chart below that has been used multiple times during 2022.

The downward trend of lower-highs and lower-lows continues. Bullish investors need this trend to break to get more excited again. A close above the blue 200 day moving average line would be a good start.

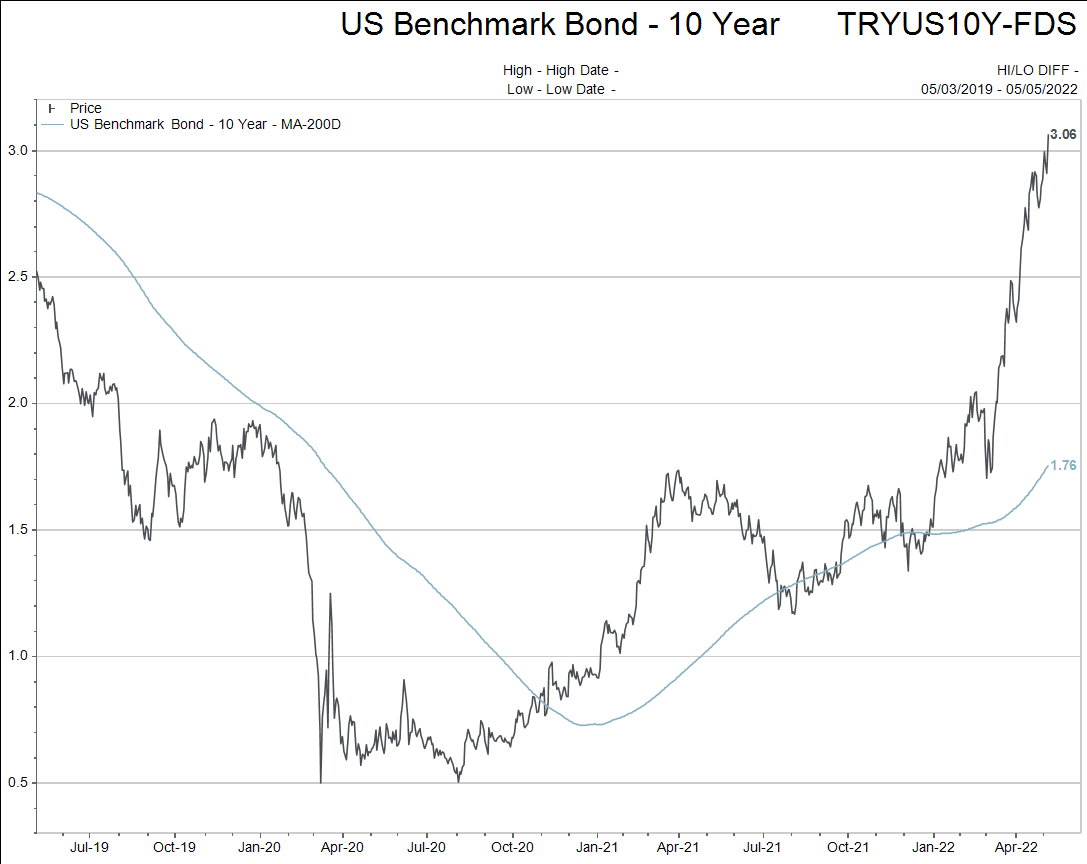

- Bond yields

This is not a complicated concept. Interest rates need to stop rising for asset prices to gain a solid footing again.

- Central Banks must signal they are near the end of their interest rate tightening cycle. – The cycle is just beginning. The earliest I can see a signal from either the Bank of Canada or the US Federal Reserve in terms of a pause in interest rate hikes is in the July meetings.

Hopefully this short comment gives you some food for thought for the weekend.