Big Picture Economics…

And a Question for YOU!

Information overload appears to be setting in. There has been a lot of news since my last publication that, traditionally, would have had my phone blowing up with calls.

The reality, I had 16 incoming calls all week!

I might be being presumptuous in stating information overload is the cause. Maybe I am projecting my own feelings?

Anyway, if you have questions about the markets, please don’t hesitate to call.

Big Picture Economics:

Sometimes these publications contain charts and use terms that can be challenging for non-financial people to grasp. I had a chat with a young man who is studying accounting at university. He asked me “if it ever all makes total sense to me?”

The question made me smile.

No, it never makes total sense, yet sometimes I write like it does when I look back at past editorials. Humbly I submit, nobody ever really knows for sure!

So let’s outline the Big Picture today in a few short bullets:

- Earnings growth is slowing.

- Corporate profits have peaked.

- Central bank money printing is slowing.

- Inflation is high and peaking. (Assuming the central banks actually follow through on their interest rate increases).

If you remember one thing from today’s editorial the key factor in the first two facts stated above is to consider the rate of change more than the absolute number.

(This means that if earnings were growing at 4% a year ago and are presently growing at 9% that is THE positive factor for the stock markets. On the other hand, like right now, earnings are slowing from the 15%ish level a year ago down to what might be closer to 0.0% in May 2022).

The real kicker to all of the above is that the global central banks are trying to raise interest rates into a slowing economy.

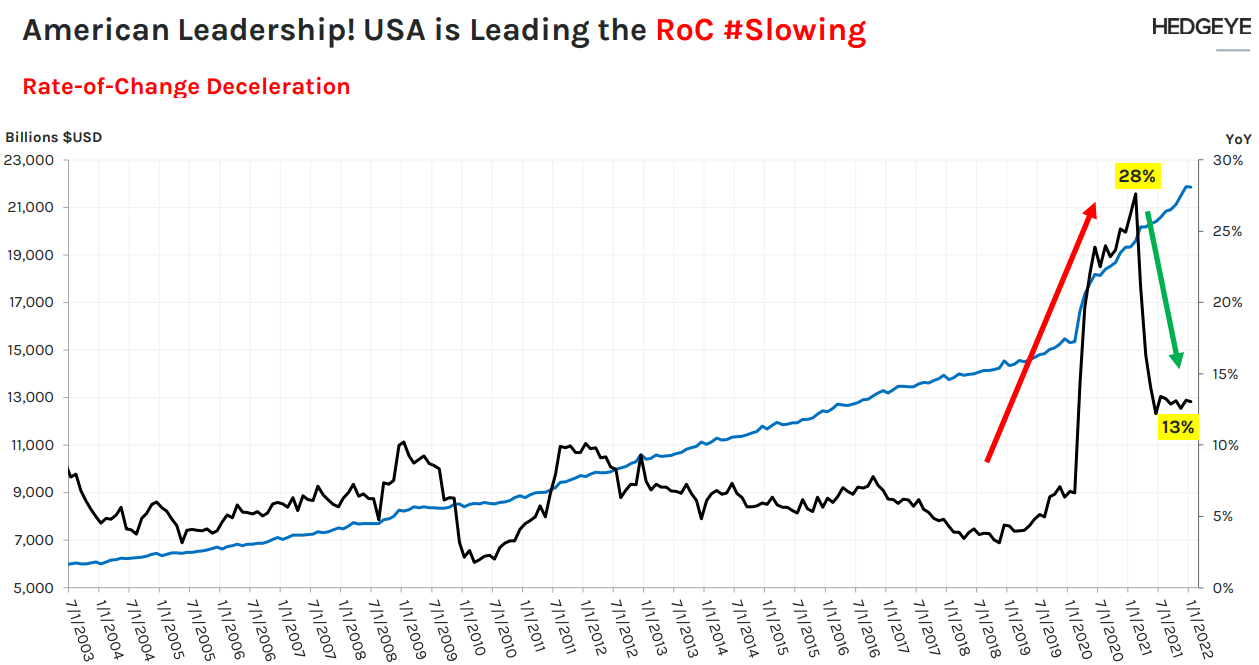

(Below is a graphic making the point about rate of change. The blue line is the total amount of central bank liquidity created that is still just peaking if you look real close at the $22 trillion US level. The black line shows the rate of change in the aggregate central banks’ balance sheets is down from 28% growth rate to 13%).

That is really all you have to see about the stock market right now…

As I look out until May 2022, these correlations do not improve much. Comparisons for all categories mentioned above will be tough on companies until the late spring.

To make things more interesting the Federal Reserve is forecast to raise interest rates 3 times during this time frame!

Expect lots of volatility and nibble away and investments you really want to own longer term. But it is not the time to buy aggressively yet!

A Question for You

What are you interested in learning about?

The next three months seem to be shaping up like I will be repeating the same message in different ways that I have stated in the editorial this week.

It is fine to restate a thesis if it is still in force but I really feel there might be some topics that we could cover that are outside the scope of the macro/market outlook.

Please feel free to email me some ideas you may have.