The following bullet points were summarized from an editorial written by Bruce Mehlman (Mehlman Castagnetti Rosen &Thomas).

What I am looking for, is a key moment where the American and Canadian public really start to change their behaviour in response to much higher numbers of cases of COVID-19.

The low number of total tests done in the US and Canada is the only reason we do not see more cases. The mathematical multiplier is somewhere between 10x and 38x more in reality.

Medically, this does not make COVID-19 a pandemic or reason to panic. Financially, I believe, people are going to start to seriously change their behaviour once they come to understand the mathematical reality.

I think the Mehlman bullets fit with my expectation.

Key Points:

-

In addition to emergency response spending, look for billions in tax cuts, grants and transfer payments if virus containment measures push the economy toward recession.

-

Coronavirus will accelerate de-globalization and encourage even more export controls. Policy-makers will worry about over-reliance on China for critical goods.

-

New policies may try to promote telehealth services and remote work, and discourage large gatherings.

-

Just as 9/11 begat the TSA, this disease could generate new proposals impacting borders, airlines, cruise ships and public events.

-

The fact that uninsured/underinsured people are now a hazard to everyone may affect health care policy debates.

-

The 2020 election may become a referendum on President Trump’s crisis management.

-

Public health measures could reshape how political campaigns are waged and financed. Public rallies may become scarce.

-

Any troubled businesses that lay off workers could come under attack from both Trump tweets and House Democrats.

-

State governors (11 are up for reelection this year) will need to work with the President regardless of party, a potential challenge for some.

Bottom Line: Politicians learned long ago to never let a crisis go to waste. All these changes are possible, if not likely, even if coronavirus proves less severe than many think.

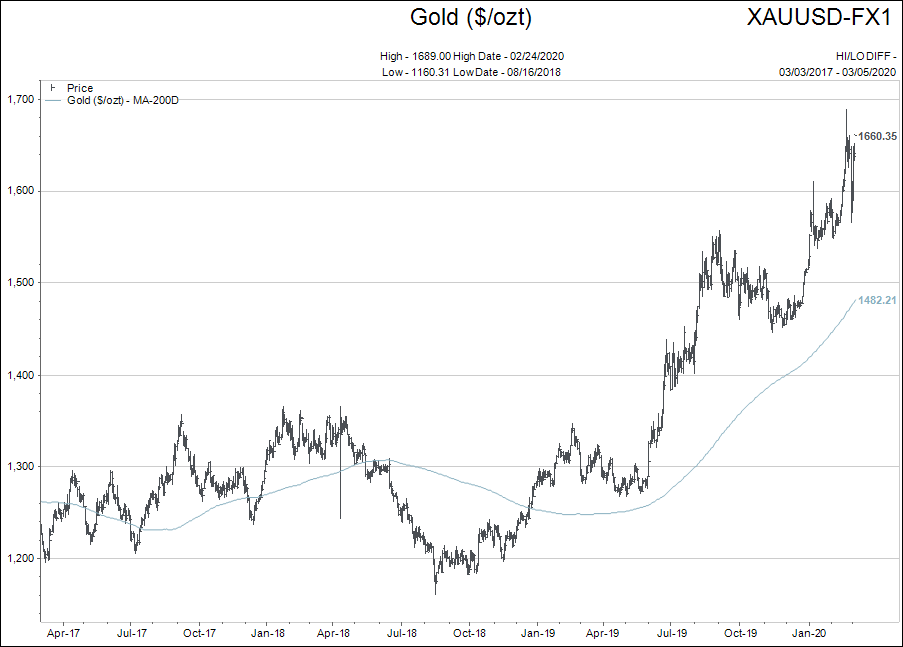

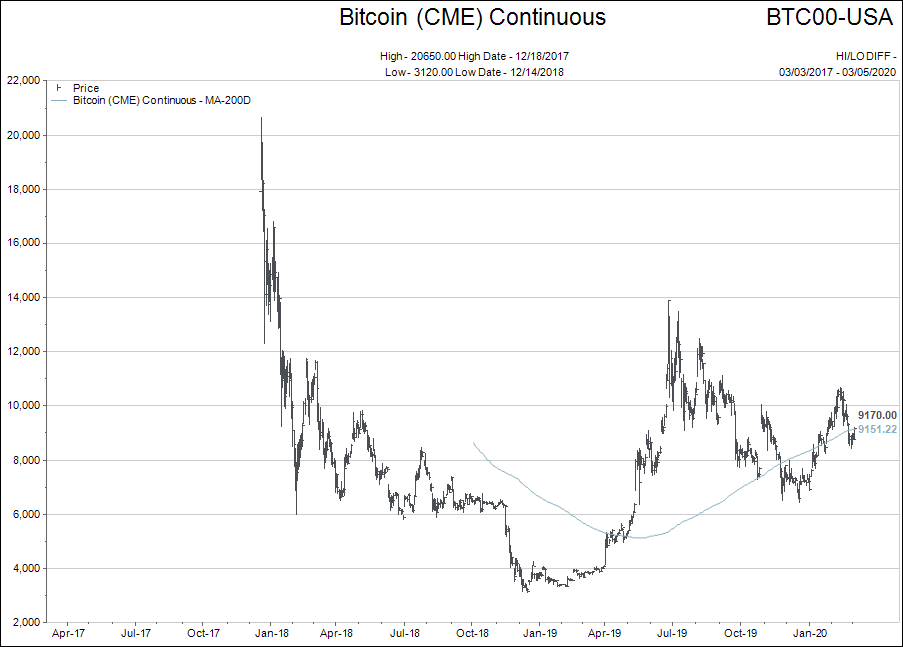

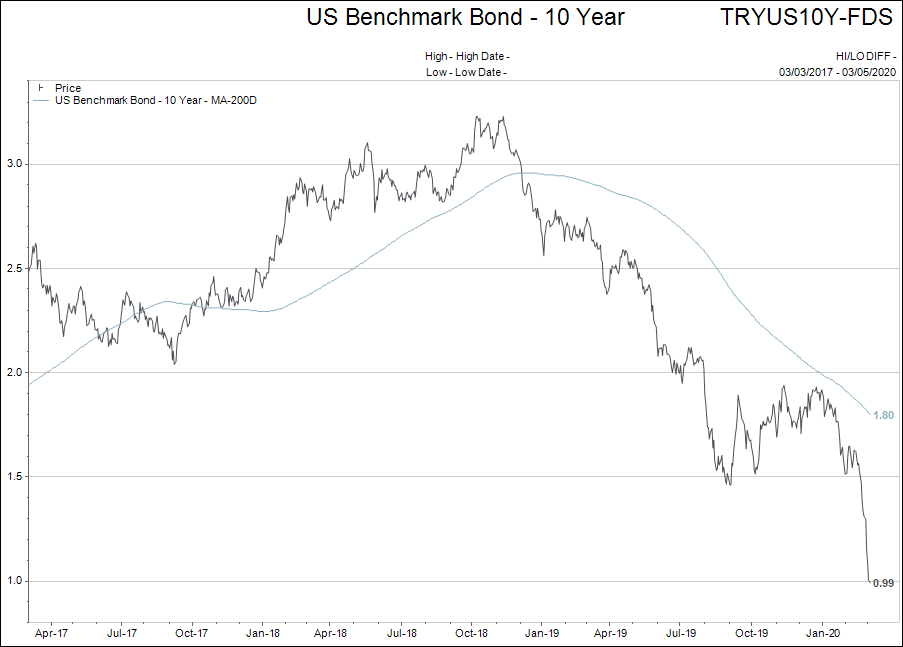

As put forward in my last communication, I continue to watch Gold, Bitcoin and Bond yields as to my clue as to when the stock markets are trying to find a bottom.

As long as Gold and Bitcoin go higher, and Bond yields go lower, my expectation is that stock markets will struggle to hold their current levels.

Record low interest rates do support stock valuations at higher levels. Especially income oriented investments. As quality stocks go down in price…they are becoming better long term values.

The next month is going to be challenging. Financial markets will likely stay volatile; bond yields will stay very low, and public opinion about COVID-19 is going to shift to where people are going to begin to change their behaviour on scale.

Summary:

I am looking for a place in the coming four to six weeks to take money out of bond investments that have returned 6% - 14% in the past number of weeks, and add to dividend paying stocks that will (hopefully) be lower priced than today.