***If you tried the new RBC Wealth Management Online more than a week ago and have not used it since, please try it again. RBC has been listening to your feedback and working hard to make it better…thank you***

Second Wave, Vaccine, and the US Election

Every four months, I traditionally write a “tri-annual letter” that was a summary of the past and a short look out at the next trimester.

It has been longer than four months since my last letter like this.

There has not been much medium-term visibility to write about, and traditional market correlations are totally broken outside of a few short term directional momentum indicators.

This letter is going to be my stab at something of an outlook letter leading into the November 3rd, US election.

COVID-19 Second Wave –

Some are saying the first wave never ended…some call it the second wave. No matter the name, infections are spreading in many parts of the world and states in the US at the highest rate since the pandemic began.

There have been re-emergences in China and other countries where relaxing of social distancing protocols quickly correlating with rising infection rates.

Thankfully, Canada and specifically British Columbia have flattened the curve…so far.

I won’t rehash the statistics here. From an investment perspective I only have one thought to leave you with:

The US is not going to impose lockdown conditions again no matter how bad the second wave gets. Small areas may lockdown, but there will be no national lockdown.

Therefore, the economic question of normalization is going to come down to people feeling safe going about their old lifestyles. My guess is that a significant proportion of society lives a muted lockdown lifestyle even though the economy is fully operational.

If we assume that one third of people choose to live in muted lockdown, the economy is going to have a difficult time recovering to levels anywhere near pre-COVID levels.

Add to that idea, the fact that corporations are using the COVID recession to ramp up technology based service models, which cut back on business travel and office space requirements, and you have some massive economic change to work through as an investor.

This will present a constant headwind for stock prices. It will become even more evident when governments stop handing out money for people to not work (if they stop handing out money…that is another story).

Vaccine

I am in the camp that there will be a vaccine announced and likely marketed before November 2020.

There will be continual corporate announcements and “Trump Tweets” making sure we know the vaccine is just around the corner. The vaccine news will be supportive for stock markets on given days creating sharp rallies of up to 5%.

But from the research I have done and the conversations I have had with people with a lot more knowledge about these things than I have, here are a few of the conclusions I offer for thought:

- Coronavirus vaccine has never been created that is a “one and done” solution. As with the regular flu, each year a vaccine is required to be given and it is a guess as to its effectiveness against infection. Some of the reports are looking at the CV-19 “virus shield” duration of only two to four months with 75% successful immunization rates.

- Annual vaccine production stands at about one billion doses a year. If three to 4 billion people require vaccination, two or three times a year, the world is woefully short of production capability. Assuming another one billion production capability could be brought online by 2021, the world is still challenged in becoming “immunized.”

- Treatment solutions, where sick people are healed of CV-19 (or at least not dead from it) might be the biggest breakthrough of all if it were to happen.

- Coronavirus mutation is another wildcard. The re-emergence in Beijing appears to be a mutated strain of COVID-19. That puts vaccine plans back at square one.

So the good news, there will likely be a vaccine this year from what I can see. The bad news is it will only be about 75% effective and have a relatively short “shielding duration.” The treatment solution is the outcome in the middle that might actually be the best.

Taken together, those facts will limit the amount of economic normalization that will happen. If we add in the vaccine production bottleneck and mutation wildcard, the economic future appears murky as to EVERYBODY feeling confident about returning to “normal.”

The global protest rallies and the political connotations as to “wearing masks” and “rights infringements,” in the US specifically, are adding a dimension of potentially accelerating the CV-19 second wave.

The question is, “How and how many individuals change their behavior given growing evidence of a second wave?”

The US Election

It is time to start adding commentary around the potential outcomes of either party winning the US presidency.

As time ticks forward, we will talk about this topic a lot more.

For now a couple of thoughts:

- No matter who wins the election, the global US and global central banks will keep their balance sheets at bloated levels.

- If President Trump is re-elected, I imagine Jay Powell will remain at the US Fed helm and continue on as he is going. The interesting twist that could happen is that Trump might replace Powell with Judy Shelton. If that were to happen it might be BEARISH for stock markets as she has a tendency to lean towards a “gold standard” type monetary policy.

- If the Democrats win I expect an even more overt version of Modern Monetary Theory (MMT) to be adapted and a Fed Chair chosen that shares this vision. As an aside, I like to call MMT the “magic money tree” rather than modern monetary theory because that is a closer to the truth description. MMT implications would likely be BULLISH for asset prices long term, but the fear of raising corporate tax rates will be a negative for stock markets with a Dem victory short term.

- Violence around either outcome in November. The US is a divided country. The risk of greater violent uprising is real this November.

Regardless of the election outcome, interest rates appear to be locked down at these low levels for a long time.

If the CV-19 risks to the economy mentioned above take hold and vaccine or treatment solutions are delayed, I expect interest rates would end up “negative” in support of stock and real estate markets.

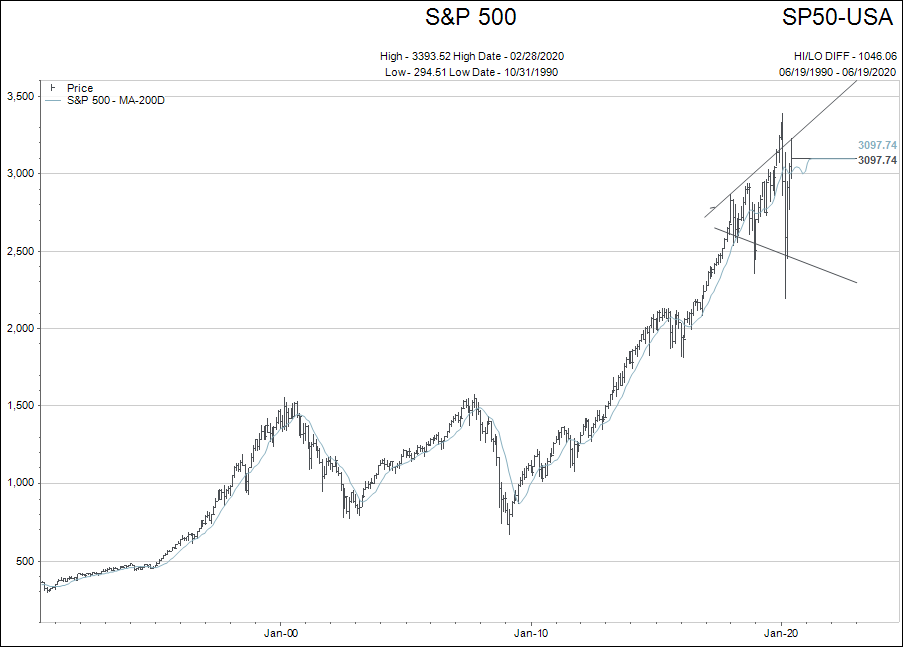

Technically, my expectation for the stock markets is now a “Megaphone.”

The 30 year chart of the S&P 500 index above shows the megaphone drawn on the graphic. It is really not much of a “prediction” in that it allows for the broad stock market to move between a high of 4,175 and a low of 2,250 this year and still be valid.

The megaphone is better described as being created as a function of a broken financial system.

Valuations, cash flows, profits and the likes, don’t really matter at this point in time. Central bank liquidity holds the day.

As the central bank liquidity “taps” slow down some, as they are right now, asset prices stagger a bit. If they stagger too much…boom…the magic money tree taps turn right back on.

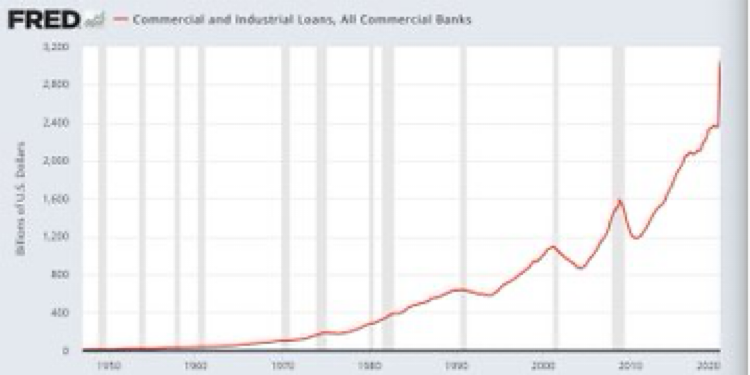

Below is a long term image of how drastic the US central bank response has been since March 2020.

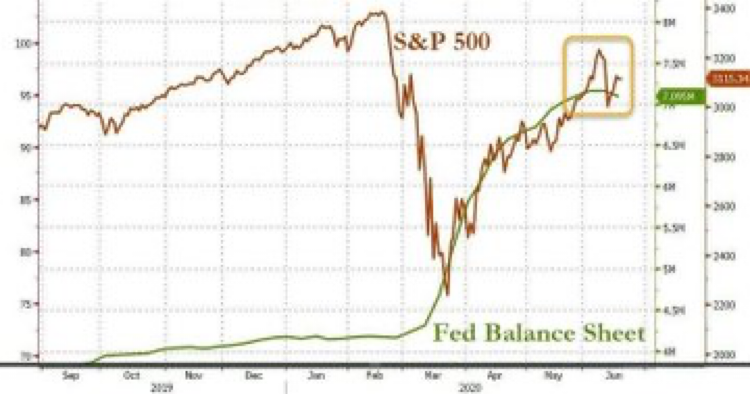

The next image shortens the time frame and depicts how strong the correlation to the central bank balance sheet expansion the stock market rally has been.

If you are BEARISH of the stock market, you want to keep a close eye on this relationship for opportunities to profit from falling stocks. Be careful if you are BEARISH. What I mean by that is don’t bet against the rising stock market until it shows weakness. It is ok to be in cash (neutral), but not short.

If you are BULLISH, don’t worry too much about this chart because the central banks can turn the taps of liquidity back on in a flash to reverse the problem of falling stock prices. “The Force is with you” for the time being.

There is a sly smile on my lips as I write these words. Maybe even a bit of sarcastic tone to my voice.

If keeping asset prices afloat and creating prosperity were really this easy, it likely would have happened long before our time on planet earth.

There is an endgame to this madness. I really believe that to be true, but I don’t believe the world is at that point.

Therefore, the megaphone prediction of a volatile stock market that oscillates between “zombie-like” fundamentals and “juiced up” central bank balance sheets is the world we need to know for now.

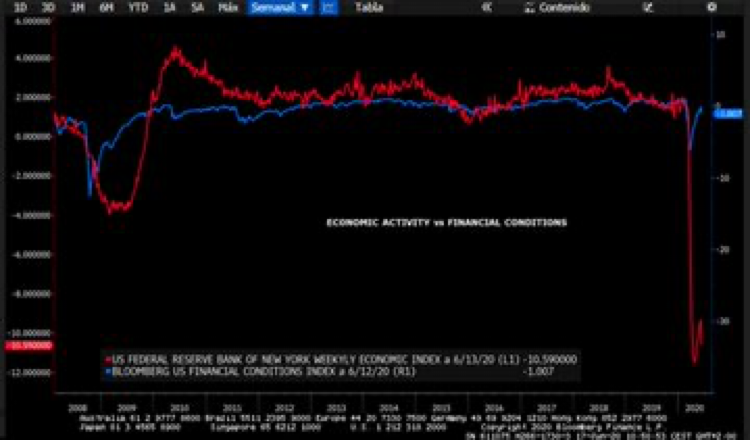

As a closing image, let me show you “the economy” relative to “the liquidity that drives stock market” in one picture.

The central banks acted very quickly and with much more force in March 2020 relative to 2008.

Do you want to know why?

Because they could…

And that is all you really need to know.

Buy the dips is alive and well. Use good discipline in how you approach your levels of exposure. A volatile market is a market with opportunities to profit. But you have to accept large price swings in what you buy and sell.

Shoot me an email if you'd like me to call, or have questions about what's discussed above.