Everybody Has an Opinion

There are so many financial market opinions and forecasts floating around out there today, it is enough to make one’s head spin.

The good news: I’m sure you can find one to confirm your personal biases and keep you smiling.

The bad news: You might get locked into YOUR view and it might paralyze you from making good choices.

Below I am going to present three opinions/forecasts written by long-term quality financial analysts. Their names are not important, I could have chosen many others for each category. Rest assured, all three of these people are reputable and have had their share of great and bad calls.

The BULL:

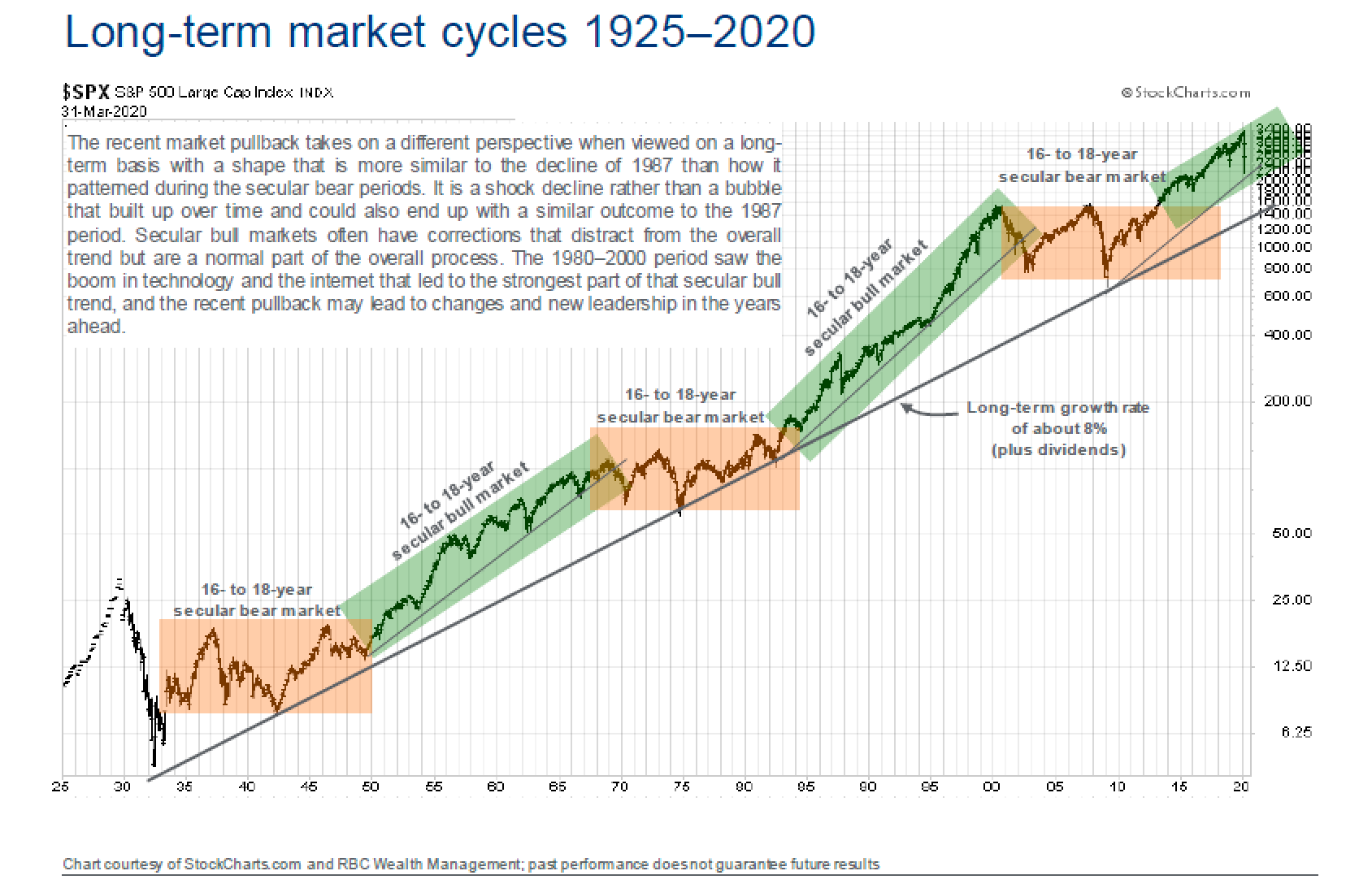

This analyst believes we are in a new 16 – 18 year BULL market that began as the S&P500 broke the old highs of 2001 and 2007 in 2012. This means the S&P500 should keep going higher until somewhere between 2028 and 2034.

If my personal bias is BULLISH then I can look at this long term chart, forget about the volatility in the financial markets, and continue with my dollar cost averaging approach to buying investments.

The MODERATE:

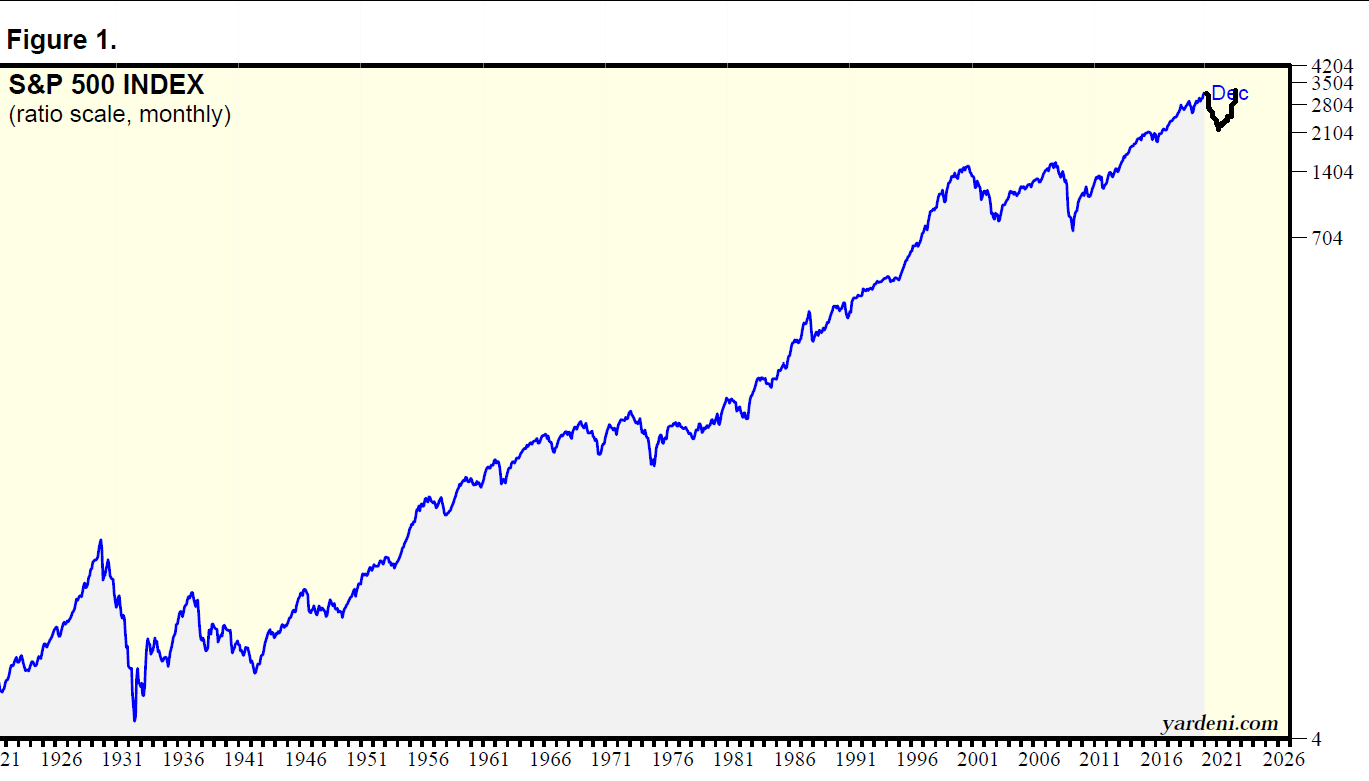

This analyst missed the decline from the top as he was BULLISH in February and sold nothing going into the downturn.

On March 25th, two days after the bottom trades so far in this BEAR market, he called a bounce back to S&P500 level of 2950 and a 2021 target of 3500 (shown in black on chart).

Nothing too drastic with either of those two calls.

This forecast requires a person to ignore the 3% daily moves in the financial markets and just focus on that 2950 “finish line” in December.

Again, if you are wired to focus on a relatively short term finish line this type of forecast will attract your attention.

The BEAR:

This type of forecast can be paralyzing. An 80% decline from the top of the stock market.

If you believe this is going to happen there is virtually no way to invest your money. Even cash is going to be challenge…who would you trust to hold your cash if this type of decline was going to happen?

So there you have three forecasts made in the past 10 days. All very different and, honestly, all are complete guesses!

I can guarantee you that two of these forecasts are going to be wrong!

Let’s be clear about one point here.

None of these forecasts are ACTIONABLE in the short term. They are all designed to sooth our “confirmation bias” and “worldview.” You will be attracted to those analysts who write as you believe the world to be.

This is where my goal is to separate what I do from forecasting.

As an advisor, it is imperative to have a market view and a worldview. It is really important to stay open to all opinions while formulating those views.

But the key is breaking that long-term view into bite-sized chunks that will allow me to change direction as per what is going on in real time.

If a person is successful at employing this bite-sized chunks process, they will be able to stay comfortable in the MODERATE view, while remaining nimble enough to manage either of the two extreme BULL or BEAR views.

You should make small mistakes that cost you money. That is part of the process. That is why they call it “investment management”, not “investment placement.”

Try not to get locked into your opinions…it will help you be a better investor.

As the old proverb states: How do you eat an elephant? One bite at a time.

May we live in interesting times…

Oil and Gold

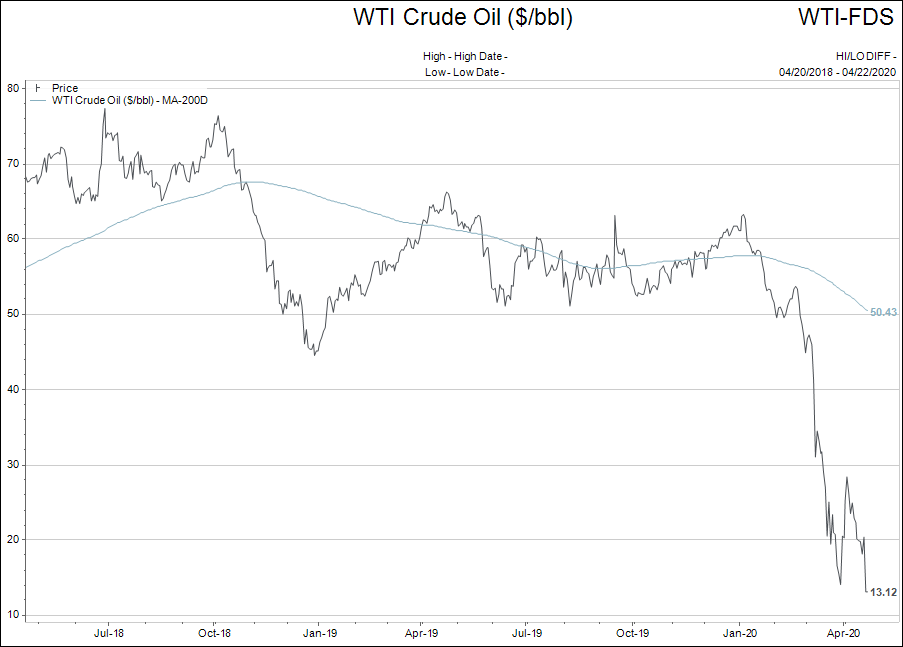

Who ever thought we would see negative oil prices?

My previous editorial was about “financilization,” and if we ever needed confirmation of how insane the money world has become, I believe negative oil prices would have to a good candidate.

If you didn’t hear about the negative oil story…that’s ok because it is only a sideshow for what is important. The chart below smooths out all the insanity of the last week.

Many of you have been calling to buy oil related investments.

The reason I show you this chart is to make the point there is no sign of bottom for this sector yet. You are back to “trying to catch a falling knife.”

A level of fundamental supply and demand balance is required to make a decent decision about ownership in this sector. Until the reopening of the global economy is started and the level of “return to normal” can be surmised, it is best to stay patient in this sector.

Please let oil related investments settle out and try to let this chart heal a little bit before buying.

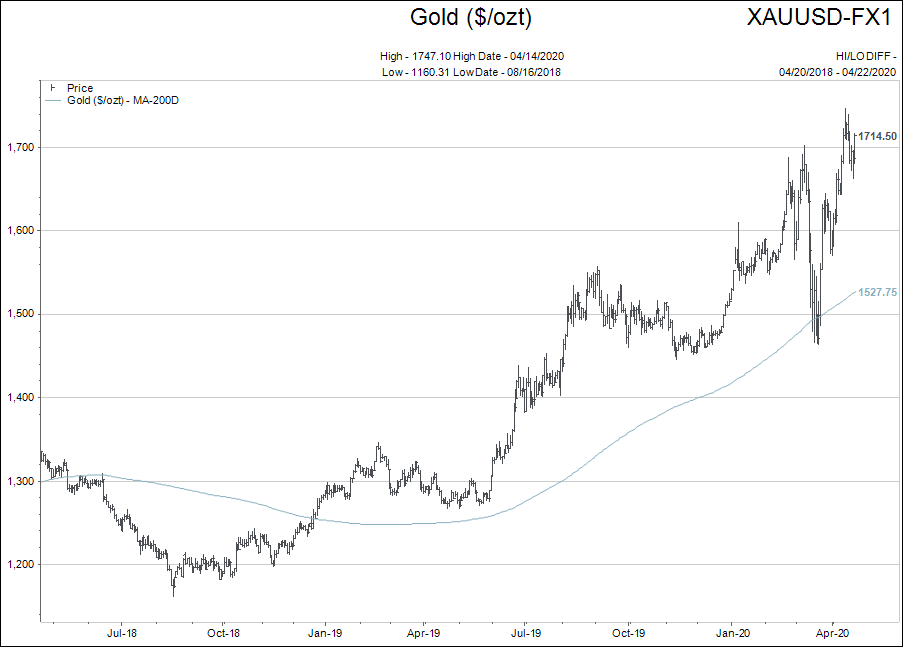

Gold on the other hand is in the exact opposite technical condition. It is trending in a well-established, “higher-highs” type formation.

Ironically, many gold related investments are still not back to all time high prices again.

There is an important facet to BULL markets I’d like to run through with you.

BULL markets have phases.

Think about the stock BULL market that ended in February of this year. It was common knowledge that stocks were in a BULL market. Same goes for real estate in Canada.

Remember, common knowledge is something that “everyone knows that everyone knows.”

When BULL markets are common knowledge, they are “safe” to be invested in until the trend changes.

Stocks have close to, but not decidedly yet, broken trend. Real estate looks to be facing a test in Canada in coming months.

But what about Gold? How many people believe it is in a BULL market? Would you say it is “common knowledge?”

Probably not even close to common knowledge…yet.

Let me share with you the first sign I have seen of the Gold BULL market becoming common knowledge.

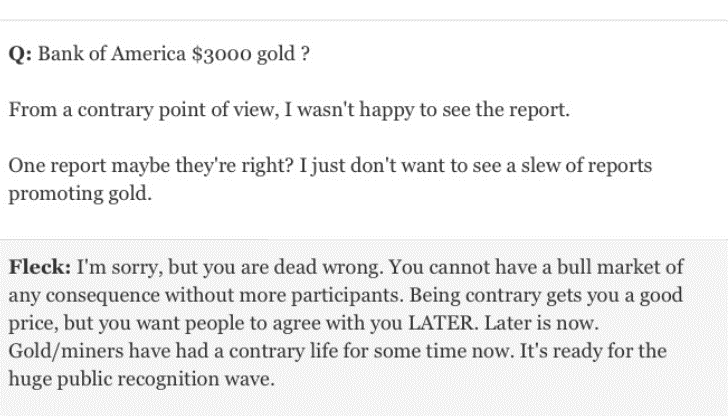

The question below was sent by a reader to Bill Fleckenstein who is a well-known stock BEAR and Gold BULL. The “Bank of America $3000 gold” refers to a research report written by a non-gold based research committee.

I think the Fleck Answer is critical to understanding where the Gold BULL market stands.

If Fleck is right, this is where mainstream investors should take notice of gold.

Hopefully there are some ideas in this comment that will help you sort through some of the emotions that volatile times bring to investors in the dead of night.

Feel free to email questions if you have them.