Oh Canada…What Happened?

The following editorial shares an update about my internal debate with how to position portfolios given three assumptions:

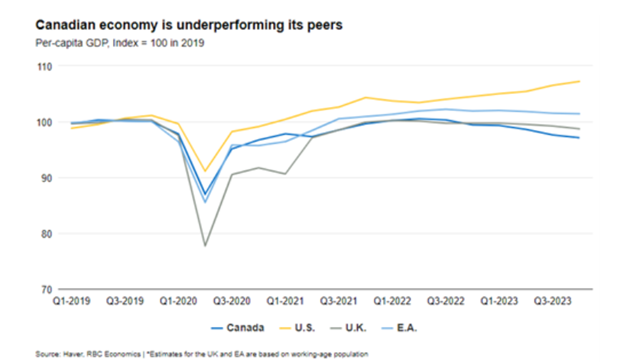

- Canada’s economy is lagging the rest of the developed world and is struggling to improve on that relative performance.

- With a lagging economy, the Canadian dollar should be a weak currency and that will exacerbate Canadian inflation.

- Canada is not the best place for growth investors to be exposed to. It is fine for income-oriented investments, but a poor choice for growth.

Where does this leave us as Canadian investors?

It brings me back to buckets #1, #2, and #3. Bucket number 1 is your fixed income investments. It is fine being highly Canadian concentrated.

Bucket #2 is the dividend income portion of your portfolio. Historically, it has been fine with a high Canadian content too. I must admit, I am questioning this more as I watch global corporations emerge from recession.

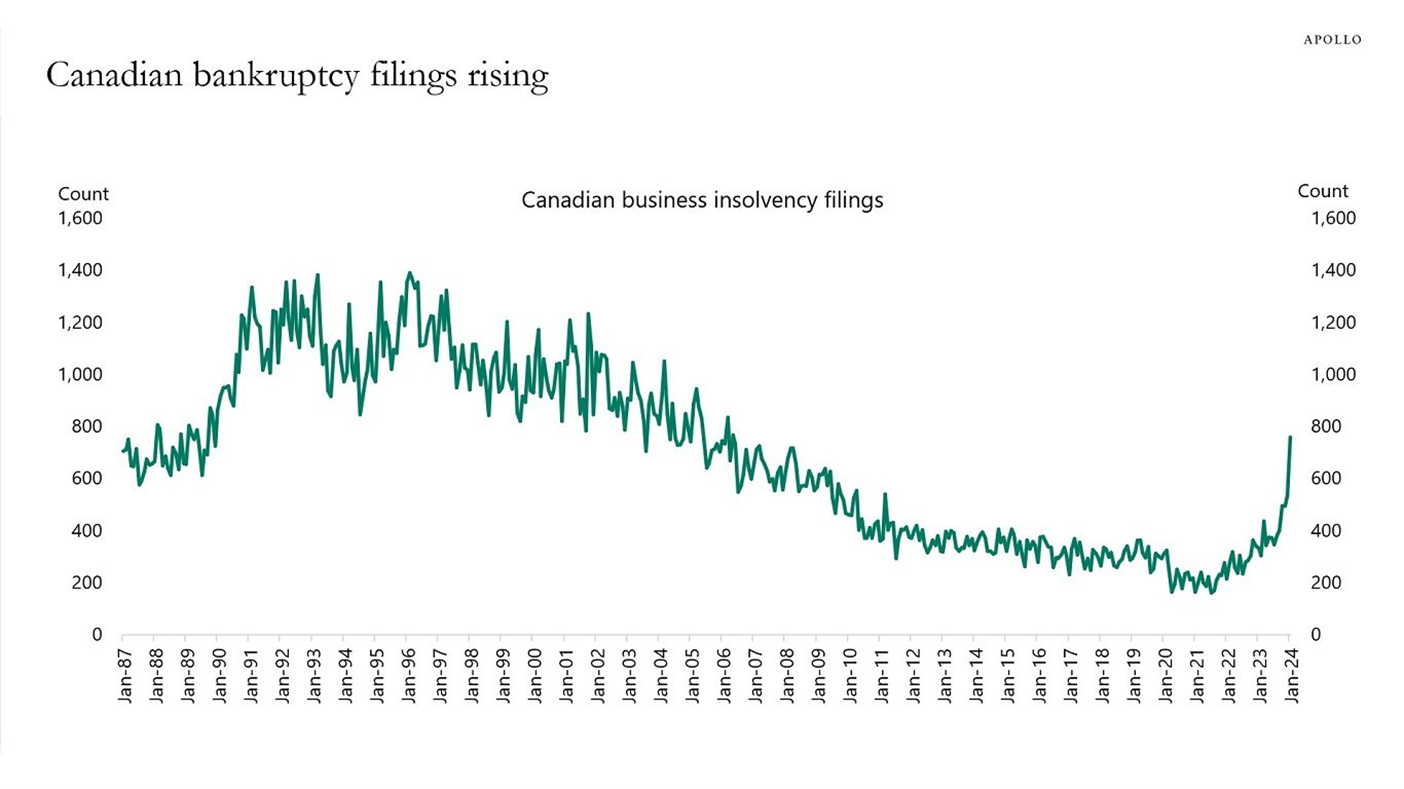

Check out the chart below for a startling picture.

Over the past couple months, I have shared about using a Bucket #3 that added risk to portfolios using the Hedgeye process.

Several factors have forced me to abandon this plan.

The main problem is the daily financial market volatility has made it so I cannot keep up to the frequency of the trades required! I only had six clients start on the system and I still couldn’t keep up.

How in the world could I scale it to 60 clients?

So, the question is, what do Canadian investors do about the assumptions made at the beginning of the editorial in terms of positioning their portfolios?

The solution is to add some professionally managed positions to the portfolios to compensate for Bucket #3 and some of Bucket #2.

More than any time in my career, Canadian investors are faced with the need to diversify globally. What countries would I look at?

Long term, India comes top of mind. China and Japan too. European exposure should be considered, as much of it emerges from a lingering recession. Investments in the UK also seem timely.

How can one advisor stay on top of all this? I don’t think one person can.

Remember, there is higher volatility in those markets too. We need someone right there managing our money in local time.

There are some amazing exchange traded funds (ETFs), mutual funds, and other investment pools that can help us with this transition.

Summary Statement:

I have said this before.

Since 2020 the financial markets have morphed into something very different from the 2009 – 2020 structure. (If you want to reread the details please click here).

The two changes that I want to highlight are:

- Central banks unwillingness to tackle stubborn inflation with tighter monetary policy. (Affirmed again this week with the US Fed).

- The use of options/derivatives having grown exponentially and how these products impact volatility in financial markets.

Canadian investors have an extra hurdle in terms of the Canadian dollar.

My hope was for Bucket #3 to be a solution to help with these challenges, but I cannot manually manage these positions.

Adding more professionally managed, internationally exposed investment products is the best solution I can come up with.

I am searching for some ideas in these areas now. Please stay tuned.