Broad Themes Revisited

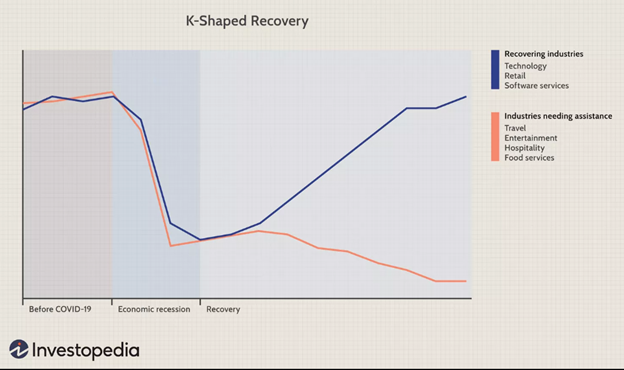

K-Shaped Recovery Intensifies

If you have not heard the term “K-Shaped Recover” it refers to the differing performance of the different deciles of the economy. In English, it means the rich get richer, the middle class gets squeezed and, the poor get poorer.

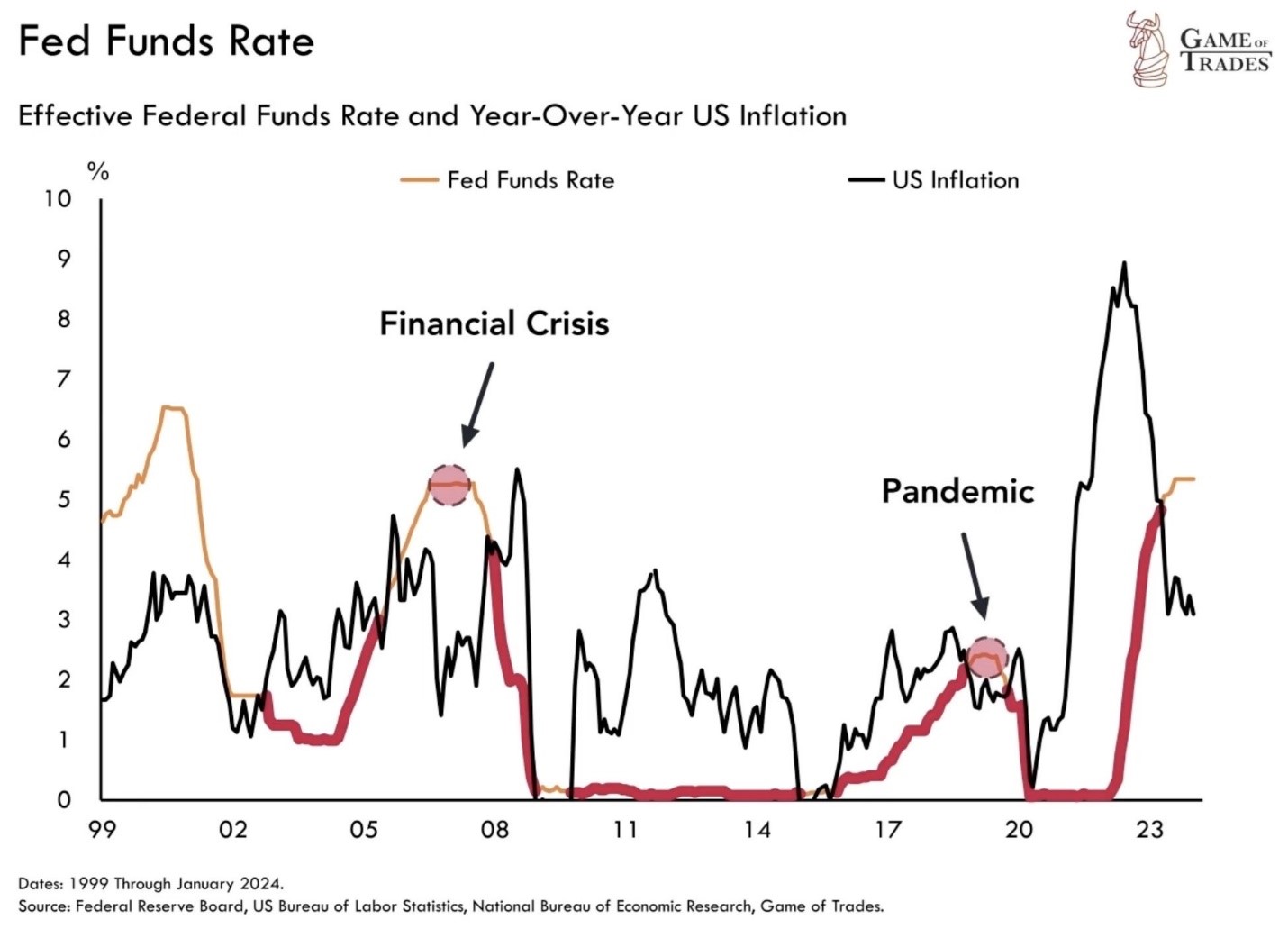

The fuel behind the economic realities of today is the hang over from the COVID era money printing around the world. So many of the old correlations used by people like me are outdated in today’s financial world. It has been a time of adaptation.

The last two editorials were short-term trading oriented and, therefore, not applicable to many of you. But for even those not interested in Bucket #3 and the AI driven strategies to invest, at least you now know that your long-term investments are being impacted by the changes in financial markets.

This week we move on to the polar opposite perspective: The very long-term.

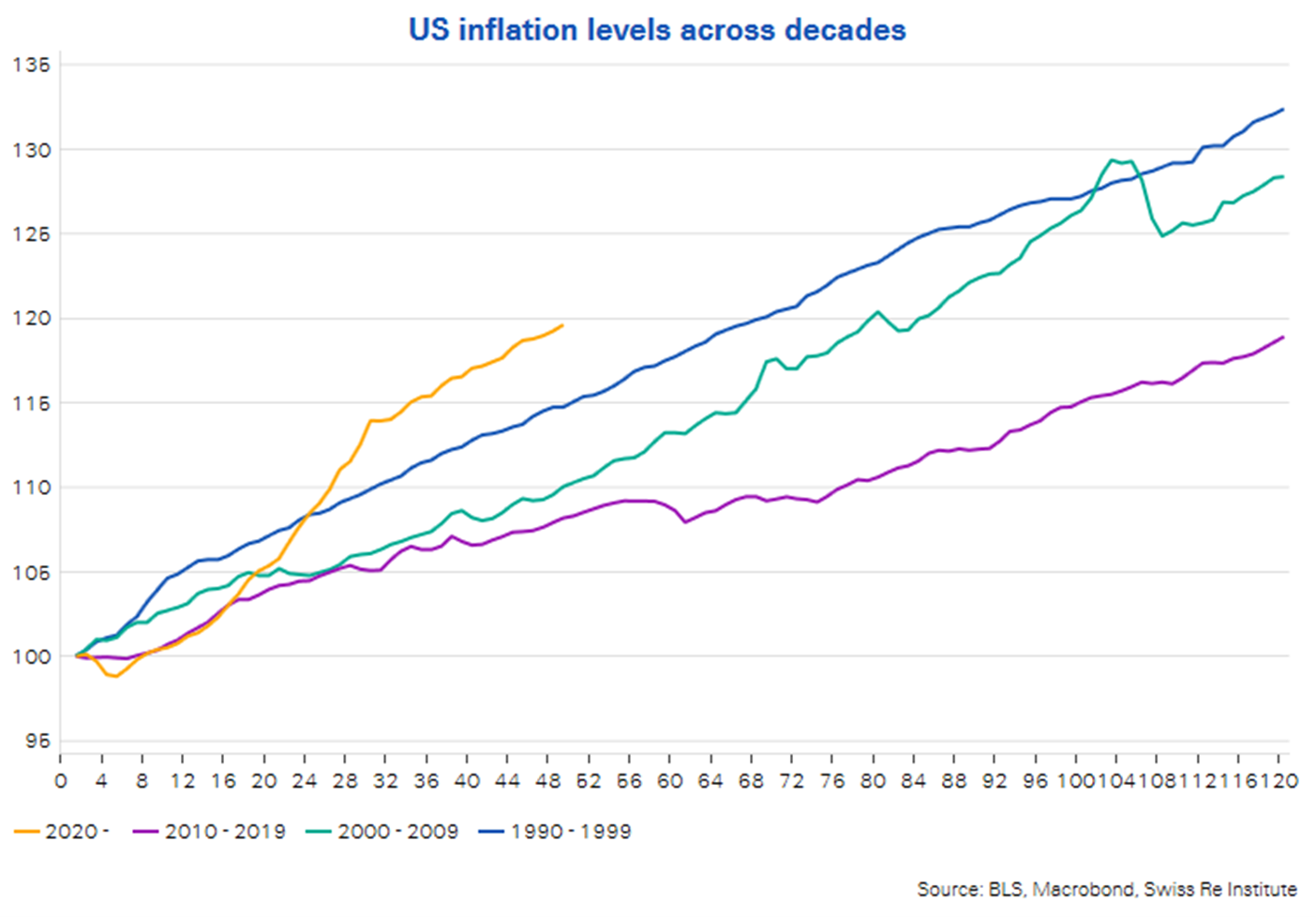

The first chart show below shows inflation in the US in cumulative form over decades.

This chart is the perfect place to start. If the global central banks start cutting interest rates into this type of inflation profile, the result would likely be intensifying inflation rates.

The middle class and the poor are already hamstrung by present inflation levels. The question: Is there any political will to regain control of the growth in debt and, thereby, rein in inflation?

My guess is there is not the will to fight the inflation battle. There are elections to be won, and triggering a recession in either Canada or the US is not on the politician’s bingo cards in 2024.

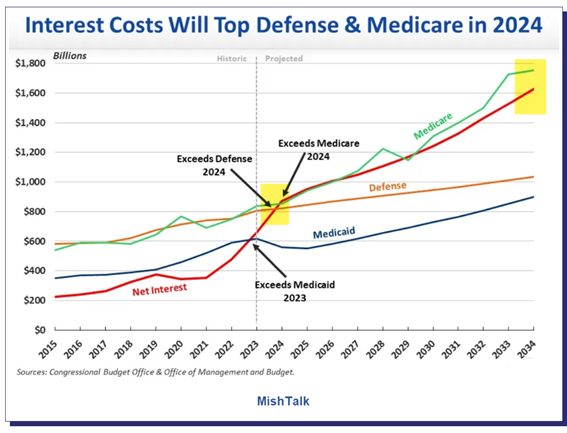

Speaking of debt…just how crazy are the debt growth rates at the present time?

The chart below demonstrates how quickly higher interest rates have impacted the US budget.

Focus in on the red “net interest” line from 2015 to 2021. The flatness of that line is why politicians and central bankers thought they were having and eating their cake for all those years. But in 2022 financial gravity kicked in and the rest of the chart speaks for itself.

Nick, what are you trying to share in this note? What is a person supposed to do about these issues?

Let’s look at the glass half full first…

If you have money in money market funds, GICs or short term bonds you are now making a cash flow from your money that is reasonable and above the inflation rate.

We have said before, if a person had $1,000,000 in 2021 sitting in money market funds, they were earning about $8000 per year. In 2024, that number is $46,000. A significant difference!

The old saying about “T.I.N.A” (There Is No Alternative) to taking risk in stocks or real estate is not correct today. Money market is an alternative that pays.

Secondly, dividend yields on quality holdings are above 5% as well. You can tuck some of these types of investments away and comfortably collect an income.

Alright, now let’s look at the glass half empty…

Inflation is our enemy in the long term and our leaders have no intention to rein it in.

As said earlier, if you have enough money, inflation is not nearly as devastating as it is to those with less. Those starting out in life and those in retirement are more negatively impacted by inflation than those in their working years who can demand higher wages.

Solutions to “stagflationary” environments have never been easy to come by. One only needs to think about the 1970s to see the challenges.

Solutions also tend to have risk attached.

What you choose to do about the long-term trends mentioned in this editorial depends upon several variables.

Inflation is a much larger enemy to the 65 year old retiree than the 85 year old. It is also less worrisome to the wealthy individual as compared to the middle class family.

If you have any anecdotal inflationary stories to share, I’d be interested to hear them. Let me start…

My wife and I got our home insurance renewal notice yesterday. For the same policy with the same company, our premium went from $2488 to $3744.

That seems inflationary to me! Feel free to chime in!