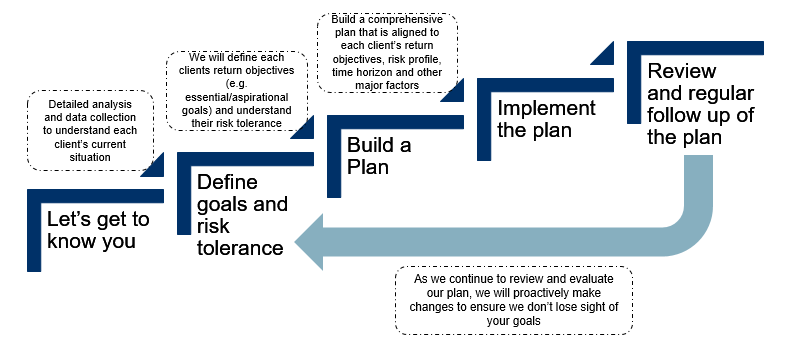

5 step process to manage your wealth

Our wealth management process is comprehensive and disciplined. We make the investment up front to under stand who you are, your values and upbringing. From there, we will work to define your goals and understand your views and level of comfort around risk and volatility. From there we will create a plan to meet your goals that will be aligned to your values and risk profile. We will revisit the plan on a regular basis to ensure we don't lose sight of your goals.

.

.

Step 1: Let’s get to know you

Our first and most important job is to listen to you, understand your background, values and views on money. At the same time, we want you to understand our views, beliefs and ultimately what defines our practice.

Step 2: Define goals and risk tolerance

Our next step is to understand your needs and goals for your future. We will take the time to understand your specific investment goals (essential and aspirational), such as saving for retirement, protecting your estate, financing a significant investment, and the timeframes available to achieve them. In addition, we will consider your return expectations, risk tolerance, time horizon, and other considerations.

Step 3: Build a plan

Once we have an in-depth understanding of your personal situation, we will create your investment plan. This provides the framework for managing your financial assets going forward. It clearly sets out your investment objectives, income needs, timeframes, asset mix guidelines, security selection criteria and review process. Your investment strategy helps keep your investment goals and preferences in clear focus. It also provides a benchmark for measuring the progress you're making towards achieving your goals.

Step 4: Implement the plan

Once you've approved your plan, we can set out to implement it with your personal portfolio.

In building a personalized investment portfolio for you, we select from a universe of international investments. This includes:

- Investments for growth, such as Canadian, U.S. and international stocks

- Investments for income, including government and corporate bonds

- Investments for wealth preservation, including guaranteed investments

We also have access to leading-edge investment strategy and research provided by the RBC Investment Strategy Committee, RBC Capital Markets and third-party, independent firms.

You will have a diversified portfolio that conforms to the guidelines and direction you set in advance. This process means you will receive specific, appropriate investment recommendations, and each recommendation will be clear and well thought-out.

Step 5: Review and regular follow up

The process doesn't end here—as time passes, and your situation changes, we will work with you to ensure that your plan remains current and that we don’t lose sight of your goals.