Despite its terrifying toll, the COVID-19 pandemic has, from an investor perspective, validated some key insights about successful investing.

Insight #1: Crisis = Danger and opportunity

The Chinese symbol for “crisis” is made up of two symbols: one for “danger” and the other for “opportunity.” While the pandemic created a great deal of danger – leading some investors to panic and change course from their investment plans – those who stuck to their plans were largely rewarded for their perseverance.

From their peak in mid-February 2020, to their nadir in late March 2020, equity markets saw a shocking drop as a result of the unknown nature and potential impact of COVID-19.1 This was followed by the damaging economic impact of social distancing rules and lockdowns. But as governments and central banks around the world swung into action to avert disaster, pumping trillions of dollars of fiscal and monetary stimulus into their economies and financial markets, equity indices soared, ending the shortest bear market in history – and launching a new bull market in record time.

As history shows, markets move forward after a crisis, so sticking to one’s investment plan tends to lead to better long-term outcomes, rewarding investors for their patience.

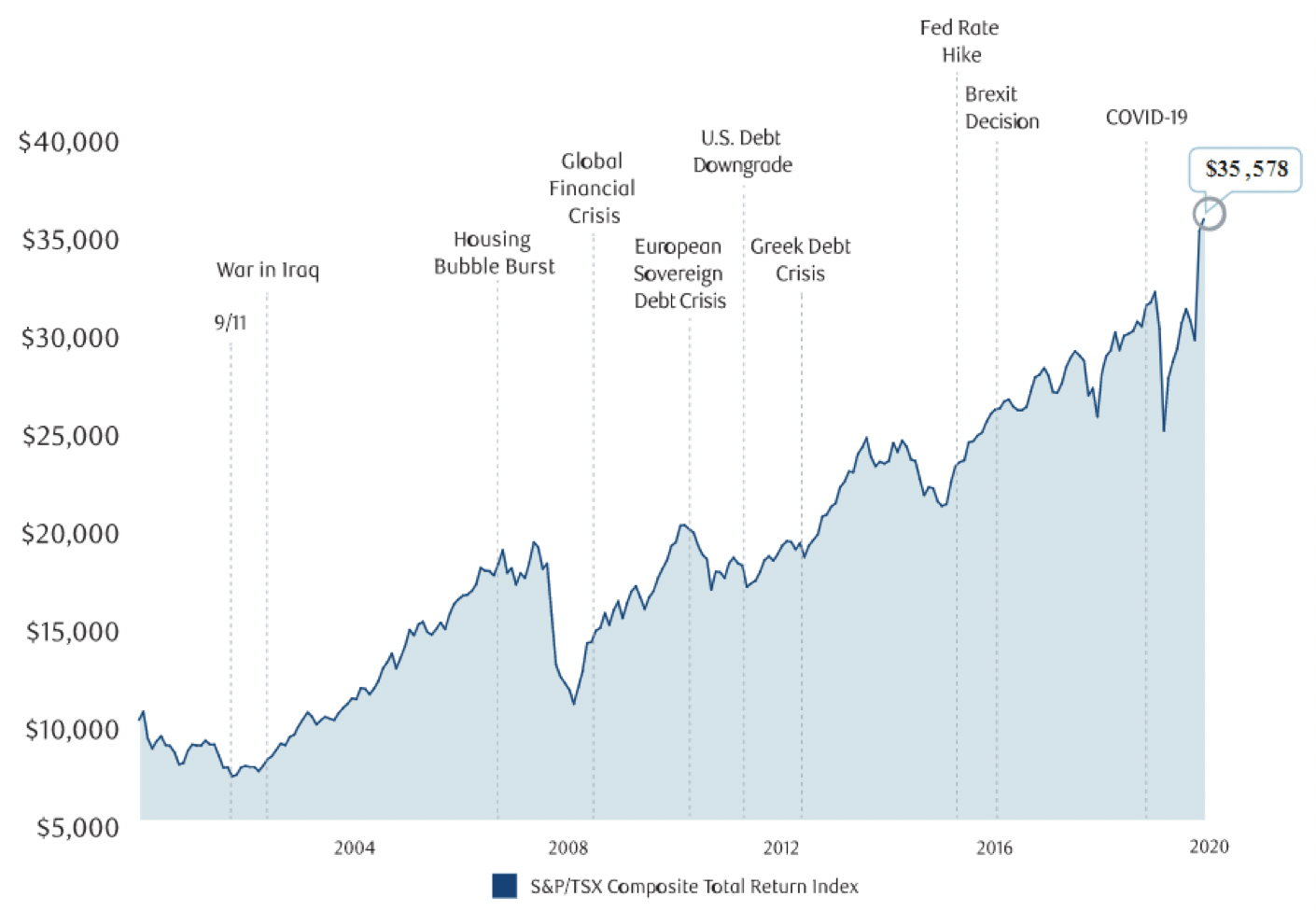

Opportunity in crisis: A 20-year perspective

The growth of $10,000 since January 2001. An investment cannot be made directly in an index. Graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. Performance data as of December 31, 2020. Source: RBC Global Asset Management Inc.

Insight #2: It’s not timing the market, but time in the market that matters

This well-known axiom about investing has proven once again to be wise advice, as the last year showed that getting out of the markets during periods of volatility can be more detrimental than staying in and persevering.

For example, if an investor purchased a theoretical unit of the S&P 500 Index on February 1, 2020, and then held on for a full year even through the worst of the “COVID Crash” in March, their return as of January 31, 2021, would have been 17%.2 Conversely, an investor might have avoided the market downturn by selling out, but missed the subsequent bounce back.

Insight #3: Stay diversified

The market’s pandemic performance reinforced another important insight: diversifying your investments remains critically important. Different investments perform differently at different times and under different economic and market conditions. Sometimes, it’s driven by factors specific to an investment, but also by industry or sector group, or even by geographic location. Going into 2020, few would have predicted that Emerging Market equities would lead with 16.6% returns, even beating U.S. equities. When the market downturn reached its bottom on March 23, 2020, it would have felt good to be in cash investments – but by December 31, 2020, that position would have returned only 0.6% on the year.3

Insight #4: The best plan is the plan that is right for you

Crises are often an excellent time to determine how well structured your portfolio is to withstand an unforeseen event such as the pandemic, but also to see how it performs in the wake of such an event. It also provides investors with the opportunity to assess their risk tolerance and risk capacity, and to ensure their portfolio and their investment plan is right for them. No one solution fits every investor, so taking the time to discuss your goals and risk profile with your Investment Counsellor is always time well spent.

Footnotes

1“Equity markets” returns as used here are of the S&P 500 Index in local currency.

2Return of the S&P 500 Index is a total return in local ($US) currency from February 1, 2020, to January 31, 2021. This is a theoretical return, as an investment cannot be made directly in an index. This return does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. Source: RBC Global Asset Management.

3Asset class diversification, RBC Global Asset Management.(February, 2021).

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2021. All rights reserved.