This is the third report of a four-part series on the 2024 U.S. general election. Part I and Part II are available for review

In the following update, we look at where the U.S. election race stands today and provide our thoughts on the interplay between each candidate’s tax and spending plans with U.S. debt levels and the Federal Reserve’s trajectory for rates in the medium-to-long term.

Tight race to the finish

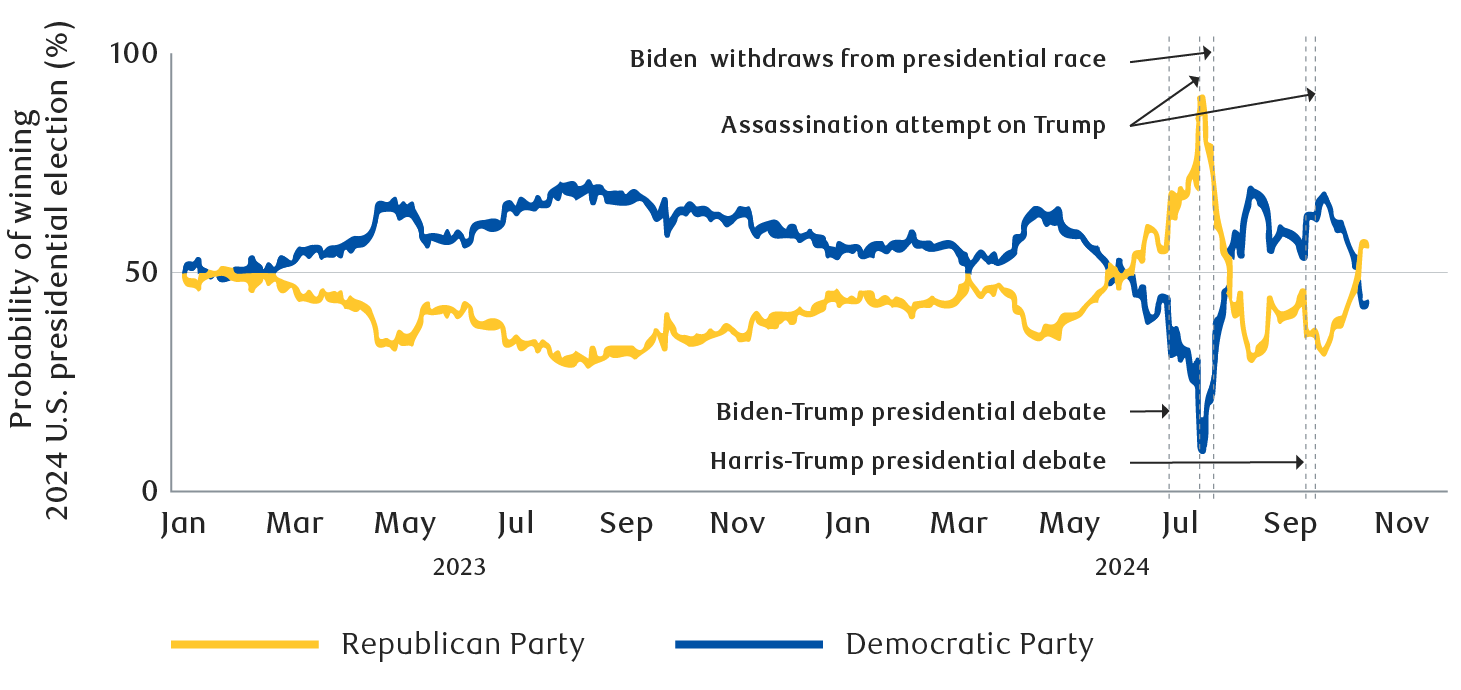

With just days to go, the presidential election is either candidate’s to lose. The early momentum that Vice President Kamala Harris enjoyed shortly after the announcement of her candidacy has largely dissipated.

It’s hard to pinpoint exactly why this is, but fundamentally we believe that Vice President Harris continues to struggle with her overall messaging to voters – particularly on issues such as inflation and the economy. In our view, the recent vice-presidential debate, while typically inconsequential to the outcome of the election, also did little to bolster Harris’ messaging or standing in the polls. Plus, there are some who argue that the ill-fated arrival of two hurricanes in the U.S. Gulf Coast and their handling by the current administration have hurt the incumbent party. Lastly, geopolitical risk remains front and centre in the minds of many voters, with certain factions viewing the Middle East conflict as the single most important issue for the upcoming election.

Still, the flurry of changes and developments over the course of the last few months has shown us that anything is possible. We would not be surprised to see elevated levels of market uncertainty leading into election day on Nov. 5. However, we would avoid knee-jerk reactions in portfolios due to such nerves. Our main focus for portfolios remains corporate earnings and GDP growth.

A few final pre-election thoughts on key topics

- More spending and a lot of debt:

In Part II, we discussed at length the broad platforms of each candidate, including spending plans that could reintroduce fiscal stimulus into the economy. How such programs are ultimately going to be paid for is far from clear and hardly commensurate with the level of spending. But such is the nature of politics. Politicians are typically loath to lean into fiscal austerity on the campaign trail, as it’s simply not politically expedient.

It is hard to know what the U.S. economy will look like over the course of the next several months. But should the (largely consensus) soft-landing scenario play out (i.e. a slowdown in U.S. GDP growth rather than a full-blown recession), and inflation remain above the Fed’s long-term target, the necessity of such fiscal stimulus is questionable at best. Indeed, such policies would have the overall impact of potentially driving inflation higher at a time when voters have disproportionately underscored this issue as a key concern. This would not only complicate the path for the Fed going forward (more on this momentarily), but it would do little to address the ballooning U.S. government debt.

The U.S. government ended its 2024 fiscal year on Sept. 30 with a deficit of US$1.833 trillion, up 8% from fiscal 2023 and the third highest on record. Government debt closed out the latest fiscal year at more than $35 trillion. Both the fiscal deficit and the national debt have ballooned under both the Trump and Biden administrations.

Regardless of who secures the presidency, they will face significant hurdles related to record debt levels, large structural deficits and rising interest payments. Neither candidate has addressed this challenge explicitly, perhaps because they each know that their tax and spending plans would drive further increases in deficits and debt, according to a thorough analysis by the Committee for a Responsible Federal Budget (CRFB), non-partisan think tank. Harris has made broad references to debt and deficits in her campaign policy book, though mainly to argue that her policies would be relatively more favourable than Trump’s.

According to the CRFB’s analysis, debt levels would increase by $3.5 trillion and $7.5 trillion between 2026 and 2035 under the Harris and Trump tax and spending plans, respectively. Both candidates have proposed a different approach to how such spending will be paid for. Harris has proposed tax hikes on the wealthy and corporations, while Trump has promised to pay for those tax breaks by raising tariffs on imports. On balance, economists assess Harris’ plan as marginally more “affordable,” and Trump’s as less “affordable” and more inflationary.

- A quick note on the U.S. elections and the U.S. Federal Reserve

At its September Federal Open Market Committee-(FOMC) rate-setting meeting, the Fed kicked off its much-anticipated rate-cutting cycle with a bang heard around the world: a 50-basis-points reduction to its trendsetting fed funds rate instead of the anticipated 25 basis points. While an economic soft landing seems achievable for now, the Fed is hardly able to take a victory lap given that the labour market has begun to slow (though is far from soft) and inflation remains above the Fed’s 2% target (but has moved considerably lower from its peak in the second half of 2022).

With respect to the path for interest rate cuts by the Fed, officials have penciled in a target range of 4.25%-4.5% for its benchmark federal funds rate by the end of this year, which indicates two quarter-point rate cuts or one half-point cut. For 2025, they are expecting to cut the benchmark rate four more times, bringing it to a range of 3.25%-3.5%.

There have been some questions raised around how the elections may or may not impact the Fed’s rate cutting cycle going forward. Our view leans to the latter. We expect the Fed, as an independent entity, to remain election-agnostic and data-dependent.

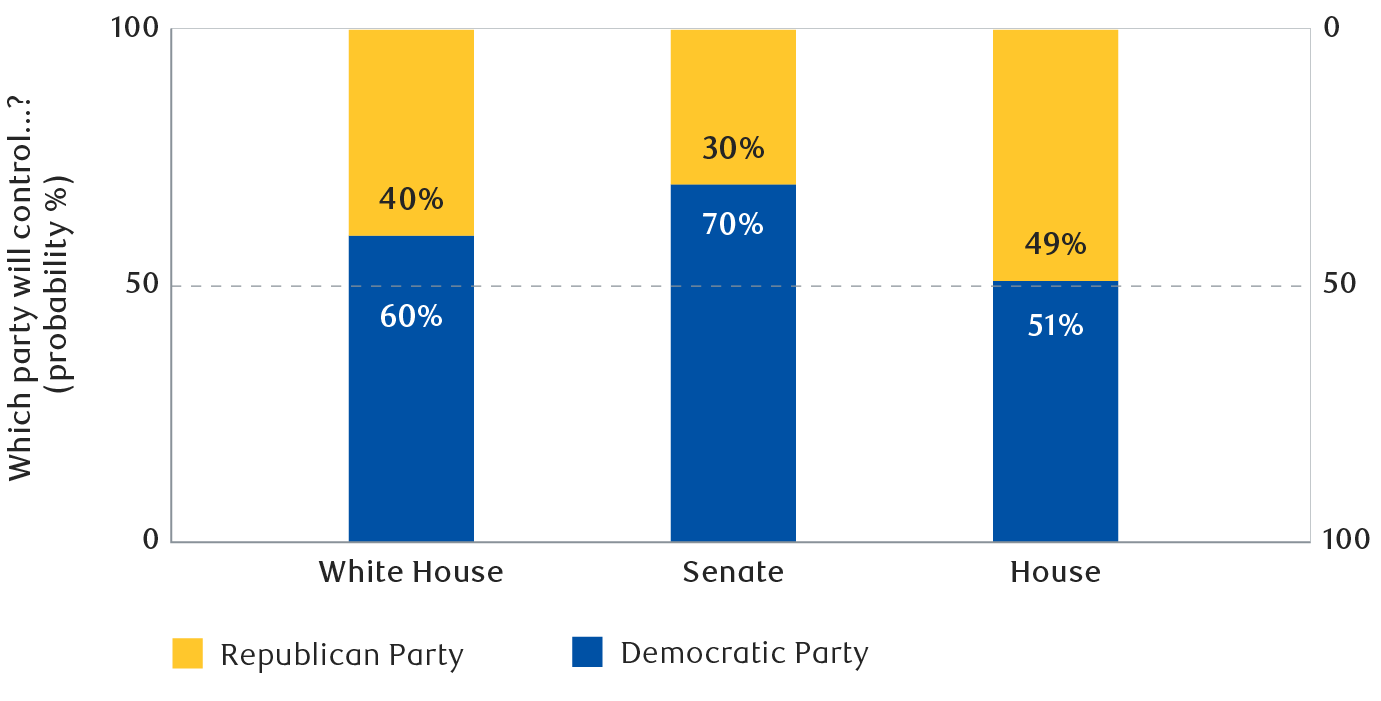

That said, we believe there are a couple of scenarios – albeit unlikely – which may compel the Fed to reconsider its current rate-cut projections. The scenarios we are contemplating are those in which either party secures the presidency along with a broad Congressional sweep (i.e. winning control of both the House and the Senate). With fewer checks and balances in place, elected lawmakers could feel emboldened to translate campaign rhetoric into legislation. We believe such scenarios could very well drive inflation expectations higher. This is particularly true under a Trump administration and a Republican Party majority in Congress, to the extent that there is follow-through on higher tariffs across the board coupled with an extension of the Tax Cuts and Jobs Act (as discussed in Part II).

The data-dependent Fed would be hard-pressed not to reflect on such developments, which may bring into question its current outlook for interest rates. We could see a return of the “higher-for-longer” rate narrative, or even the potential for rate hikes to resume. Should the Fed seek to limit the reignition of inflationary pressures, the current consensus for an economic soft landing could give way to a reinvigorated discussion around the rising risk of recession, putting risk assets under pressure.

Cheques & balances

The scenarios mentioned are hardly a foregone conclusion. While we believe that such scenarios are unlikely, should they transpire we suspect there may be some dissenting voices within each party (particularly from fiscal hawks), coupled with bipartisanship, that could stem the passage of such sweeping legislation.

Presidential campaign spending promises often don’t translate into legislation in the absence of Congress’ support. At the time of writing, according to YouGov, which models every 2024 U.S. Senate election and U.S. House election in each congressional district, the Republicans maintain a slim edge to control the Senate, and Democrats are a slim favourite to win the House. Each outcome would be a reversal of the current Congress. Put differently? Continued gridlock.

To the extent that government remains divided, compromises on spending will undoubtedly have to be made. So fiscal plans by both candidates, alongside subsequent estimates for increases in government debt laid out above, may ultimately prove generous or overstated.

Still, this is a small mercy considering already elevated levels of government debt in the U.S., and we have little hope that the fiscal deficit will shrink meaningfully anytime soon. This phenomenon of “buy now, pay later” will ultimately manifest in a compromise of economic prosperity in the medium-to-long-term. Rising government debt levels will weigh on long-term economic growth, and crowd out much needed private investment that enhances the nation’s capital stock and drives greater labour productivity. While fiscal stimulus provides a boost to consumption in the near-term, it is typically accompanied by higher inflation and higher rates in the medium-to-long-term, eroding consumer’s purchasing power.

No room for complacency in portfolios

As it pertains to investors’ portfolios, the uncertainty regarding the election outcome in the short-to-medium term,and the impact of expanding U.S. government debt levels in the medium-to-long-term, underscore the necessity of well-diversified portfolios across asset classes (i.e., equities, fixed income and alternative investments), geographies and style (i.e., growth versus value). The current consensus soft-landing call for the U.S. economy is hardly grounds for complacency, nor is it a fait accompli. Eric Lascelles, Chief Economist at RBC Global Asset Management, recently scaled back the likelihood of a U.S. recession over the next year to 25% from 30%. Yet even at a 25% probability, the risk of recession is hardly negligible, and is still higher than the baseline 10-15% risk associated with the average year.

While the outsized returns from the U.S. large-cap equites have been a boon to many portfolios, investors should remain wary of an over-concentration in this asset class at the expense of others, particularly considering current above-average valuations. We continue to see pockets of fixed income, alternative investments, and dividend growth or value-oriented equity strategies as areas in the market that can provide some level of ballast to portfolios, while also offering decent risk-adjusted returns.

Our Investment Counsellors, many of whom have lived through several market and U.S. election cycles, have the experience and perspective to look beyond the noise. This level-headedness is reflected in the well-diversified portfolios that they have constructed for our clients, which are based on robust investment frameworks and geared toward long-term horizons, all of which should help withstand transitory bouts of volatility. We continue to believe that staying the course is the best “vote” to cast in the coming months and beyond.

This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc. (RBC DS)*, RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC), RBC Global Asset Management Inc. (RBC GAM), Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their affiliates, RBC Direct Investing Inc. (RBC DI) *, RBC Wealth Management Financial Services Inc. (RBC WMFS) and Royal Mutual Funds Inc. (RMFI). *Member-Canadian Investor Protection Fund. Each of the Companies, their affiliates and the Royal Bank of Canada are separate corporate entities which are affiliated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and mutual fund representatives of RMFI, Investment Counsellors who are employees of RBC PH&N IC, Senior Trust Advisors and Trust Officers who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC DS. In Quebec, financial planning services are provided by RMFI or RBC WMFS and each is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RMFI or RBC DS. Estate and trust services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If specific products or services are not offered by one of the Companies or RMFI, clients may request a referral to another RBC partner. Insurance products are offered through RBC Wealth Management Financial Services Inc., a subsidiary of RBC Dominion Securities Inc. When providing life insurance products in all provinces except Quebec, Investment Advisors are acting as Insurance Representatives of RBC Wealth Management Financial Services Inc. In Quebec, Investment Advisors are acting as Financial Security Advisors of RBC Wealth Management Financial Services Inc. RBC Wealth Management Financial Services Inc. is licensed as a financial services firm in the province of Quebec. The strategies, advice and technical content in this publication are provided for the general guidance and benefit of our clients, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a qualified legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, RBC WMFS, RBC DI, Royal Bank of Canada or any of its affiliates or any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. ®/TM Registered trademarks of Royal Bank of Canada. Used under licence. © 2024 Royal Bank of Canada. All rights reserved.